Over the weekend, Israel and the United States launched an attack on Iran. Retaliation from Iran followed with missiles targeted at US military assets in the region and Israel. The Houthis have announced the closure of the Bab el-Mandeb Strait in the Red Sea with the intention of targeting US and Israeli ships. As we have noted repeatedly, the US does not move this level of military assets into a region to bluff. The placement of the USS Gerald R. Ford aircraft carrier and F-22 Raptors in the r… View More

Authors

Post 1 to 10 of 608

The Trump Tariffs are dead - long live the Trump Tariffs? As we expected, the Supreme Court struck down most of the new tariffs President Trump had imposed since taking office thirteen months ago. While Congress granted the President “emergency” powers to regulate trade in a 1977 law, the Court ruled 6-3 that the statute does not explicitly authorize the use of tariffs under those powers. As a result, many of the recently imposed tariffs exceeded the authority Congress delegated to the exec… View More

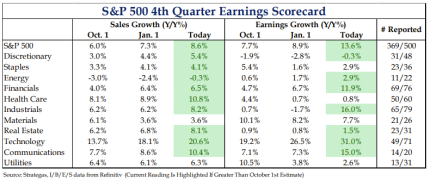

Q4 Earnings Reporting ~75% Complete & 4Q Growth Being Reported As Strong With roughly 75% of S&P 500 companies having reported earnings, results are coming in strong. Earnings growth is once again tracking in the double digits for a fifth consecutive quarter, an outcome that’s somewhat unusual at this stage of the economic cycle. The impact of AI-driven capex is clearly showing up in the numbers. The strongest growth rates are concentrated in the Technology, Communications, and Indust… View More

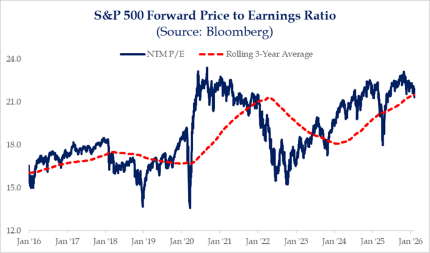

Market Multiple Has Fallen Below Its 3 Year Average For the first time since Liberation Day, the S&P 500’s multiple has fallen below its three-year average, a level that over the past several years, has typically been associated with a resumption of multiple expansion. One of the more surprising developments so far has been the strength of corporate earnings alongside continued stock selloffs. Notably, the prospect of increased capex spending, which was viewed positively last year, is no … View More

It could have been anything… we’re of course referring to Silver’s spectacular -40% decline over the last 72 hours, and the broader selling in Precious Metals. We’ve read countless attempts to come up with the reason “why” over the past few days –it was the Warsh nomination, the Yen is to blame, an options squeeze, etc. etc. etc. – but the reality is when a parabolic move grips the tape and emotion takes over, it can literally be anything that triggers a sudden shift to the preva… View More

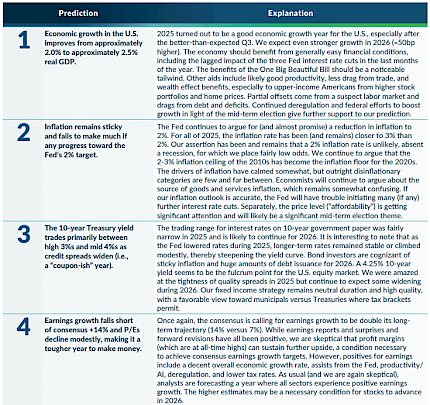

The Fed meets on Wednesday to discuss the direction of monetary policy. With the futures market pricing the odds of “no change in rates” at 97.2%, no one should expect a rate cut at this meeting…or, we think, anytime soon. Some, including the Trump Administration, might complain about steady short-term interest rates and say Fed Chief Jerome Powell is playing politics. The claim about playing politics may be accurate, but for now, Powell has the data on his side. The economy looks solid, … View More

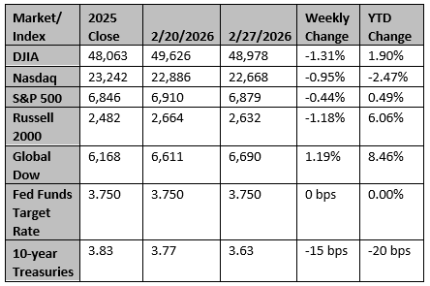

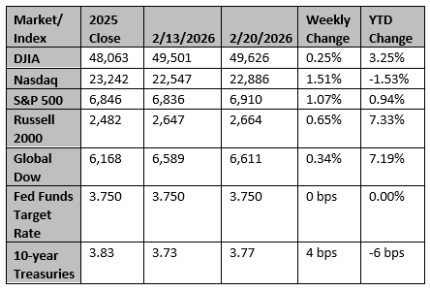

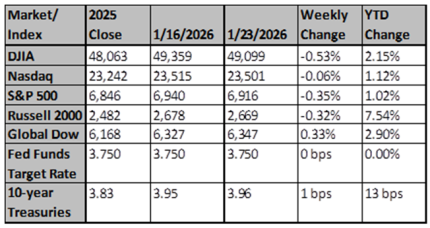

Love him or hate him, President Trump will likely be remembered as a consequential president. His historical shadow may overwhelm all but a few. Setting aside the current tensions in the North Sea, the Trump Administration’s market report card is quite good – stocks up, bond yields down, and mortgage rates and retail gasoline prices lower. The most significant blemish is the decline in the US Dollar. The broader economic picture has also shown relatively steady results, with real growth han… View More

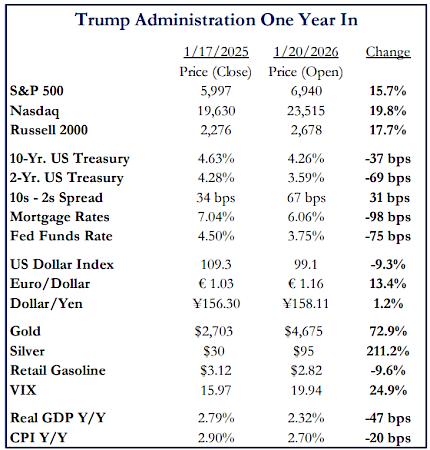

Each year, we like to bring you the top 10 predictions from our Friend Bob Doll, who is Chief Investment Officer and CEO of Crossmark Investments. We have been following Bob's predictions since he was the Chief Investment Officer at Merrill Lynch and BlackRock. He is right more than wrong, so this is a good guide for what the next year will look like for the economy and Markets. 10 Predictions For 2026 Theme: High-Risk Bull Market Source: Bob Doll CEO/CFO, Crossmark Investment… View More

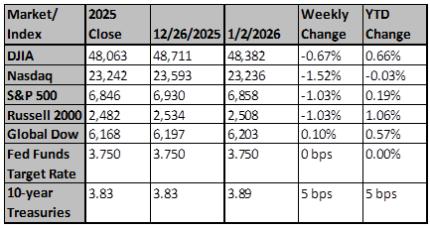

In today’s note, we discuss our initial thoughts as 2026 begins, noting that double-digit return years are not uncommon, and we explore how the fundamental broadening of the S&P is being pushed out further in 2026. Returns Exceeding 15% For A Fourth Consecutive Year Not Unheard Of Since 1926, there have been four instances in which the S&P 500 posted returns greater than 15% for three consecutive years. In only one of those cases did the market experience a negative return in the… View More

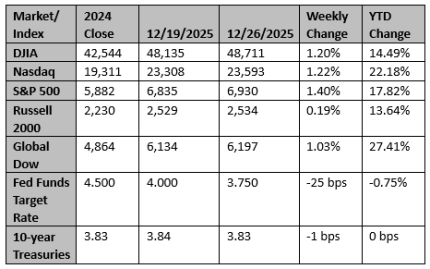

U.S. equity markets began the holiday‑shortened trading week on a firm footing. Broad gains in major indexes and the start of the Santa Claus rally marked this week. Following modest volatility in trading earlier in December, sentiment improved significantly as investors bet on year-end flows. As shown, the CNN Fear-Greed Index has moved materially higher from its readings earlier in the month. The Santa Claus rally window officially began on Christmas Eve. That rally is traditionally defined… View More