Nvidia Once Again Takes Center Stage - It's that time of the reporting season again, when all eyes turn to Nvidia, which reports after the close on Wednesday. While most investors look for clues about the state of the AI capex cycle, it's equally important to pay attention to commentary around China. In recent quarters, Nvidia has been transparent about the dollar value of missed sales due to restrictions. The 15% sales commission effectively imposed by the U.S. government on Chinese sales will pressure margins, but 85% of something is better than 100% of nothing.

However, there's talk of halting production of certain chips intended for China altogether. Is this a sign of weakening demand following Chinese government directives discouraging local companies from using Nvidia products, or is something else? Either way, we are approaching a point where the growth in AI-related capital expenditure may begin to decelerate. Companies now face increasing pressure to demonstrate how their AI investments translate into real returns.

Notably, free cash flow is no longer growing for the MAG 7, excluding Nvidia, reinforcing our belief that AI capex spending will likely slow from here. Remember: Nvidia now represents roughly 4% of total net income for the S&P 500, giving it the power to influence the index's overall profit trajectory meaningfully.

Rate Cut For September Now Very One-Sided – Powell delivered what the market wanted on Friday, with equities rallying and September rate cut odds rebounding to levels last seen two weeks ago. While a cut now feels increasingly likely, we're cautious about how one-sided this view has become. Over the weekend, nearly every article and media commentary we came across framed a September cut as a done deal.

Market sentiment echoed the same, with rate-sensitive small caps rallying sharply. That said, we want to temper expectations. There are still key data points ahead with another employment report and additional inflation readings before the Fed meets in September. When consensus thinking is overwhelmingly one-sided, it raises a flag for us.

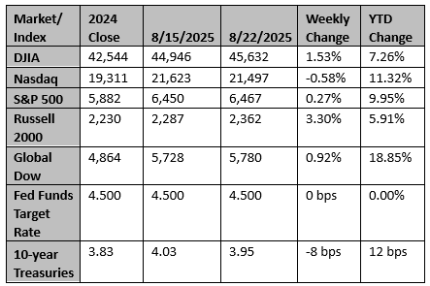

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

World's central bankers fear being caught in Fed's storm

Global central bankers gathered at a U.S. mountain resort over the weekend are starting to fear that the political storm surrounding the Federal Reserve may engulf them too.

Reuters

Nervous Swiss ready Trump sweetened offer for tariff pain relief

Switzerland soon hopes to finalise a new business offer for Washington to ease its tariff burden, which will likely include more defence spending and greater access for U.S. energy interests, two people familiar with the matter said.

Reuters