Now that the “One Big Beautiful Bill” has passed, we will highlight some of the major components of the legislation. Extension of $400bn of Expiring Tax Provisions. If Congress did not act by the end of this year, middle-class families would face a $400bn tax increase in 2026. Both political parties had been working on a plan to extend many of these tax provisions. The new tax law permanently extends these tax cuts, meaning the only way to change the tax rates is by a future act of Co… View More

Authors

Post 1 to 10 of 574

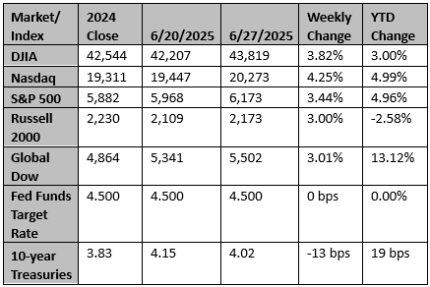

Well, it took just 55 trading days for the S&P to roundtrip from the 4/8 closing low to Friday’s 6/27 cycle high, even beating the 1998 analogue by a few days as the fastest example in 75 years following at least a -15% drawdown (using closing lows / closing highs for consistency). The velocity of the move was a surprise, but it’s again a reminder that when the S&P 20-day highs expand through 50% (as they did in early-May) spend more time thinking about what could go right than wron… View More

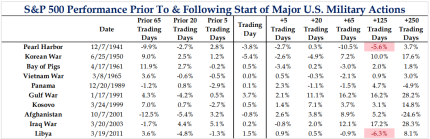

America’s military strikes on Iran’s nuclear facilities on Saturday evening will, no doubt, be seen as a “hinge moment” in history. Experience teaches us as investors, however, to be careful in drawing too many conclusions at this stage about the implications of the event. (Who can forget US Treasury yields falling in response to the initial downgrade in 2011?) Perhaps this will usher in a new period of peace in the Middle East where this is either a regime change in Iran or Iran’s lea… View More

The United States consumes much of its GDP; China does not. The result is Yin and Yang. On net, China produces and the US consumes. Treasury Secretary Scott Bessent put it this way last week at a Senate hearing – “China has a singular opportunity to stabilize its economy by shifting away from excess production towards greater consumption.” That is the rallying cry for tariffs and trade negotiations. And while the US government seems to blame it all on China, it is also true that the US h… View More

Back during the Financial Panic of 2008, clickbait media kept screaming “Hyperinflation.” This theme was consistently pushed back against, and argued that inflation would not accelerate. Yes, Quantitative Easing and zero percent interest rates, which Ben Bernanke invented at the time, massively increased the size of the Fed’s balance sheet and boosted cash deposits and reserves at banks as the Fed printed money to buy debt – Treasury bonds, mortgages and other assets. So why didn’t th… View More

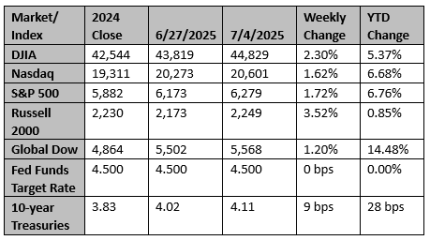

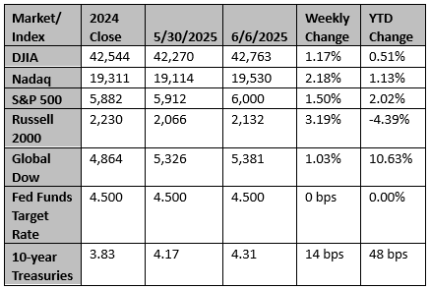

As the dust settles after a volatile first five months of the year, investors are biased to buy risk assets. Record or near-record highs are frequently recorded in various markets, including equities, credit, real estate, gold, etc. There is no shortage of investor liquidity. Summary Equities increased (S&P 500 1.90%) last week, offsetting some of the prior week's loss. Highlights included lots of tariff crosscurrents and NVIDIA'S earnings. Best Sectors were real estate (2.75%) and tec… View More

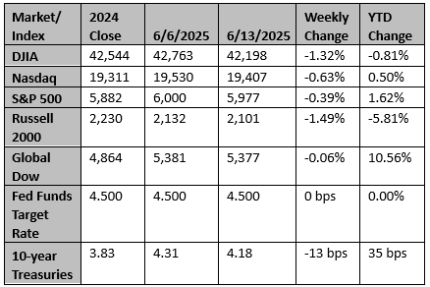

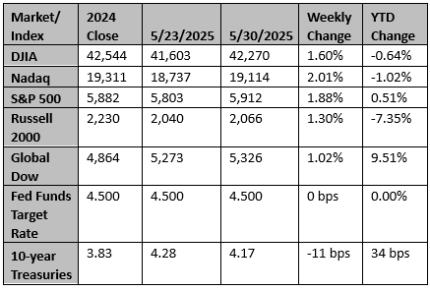

The big discussion last week among investors was about the deficit and the impact on bond yields of the One Big Beautiful Bill (OBBB). A long-tail Treasury auction threw gasoline on this debate, which was already combustible. It has been noted that once net interest costs exceed 14 percent of tax revenue, bond markets pay attention to US fiscal policy. Interest costs are currently at 18 percent of tax revenue. Adding to this pressure is that Treasury will need to flood the market with debt issu… View More

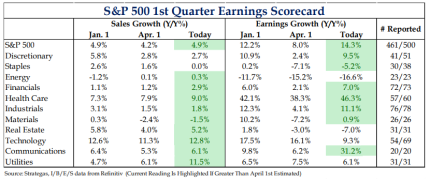

With the first quarter earnings season nearly complete, earnings growth surprised to the upside, coming in at approximately 14%, well above the 8% expected at the start of the season. Revenue growth also exceeded expectations, coming in just under 5%. Despite concerns about tariffs during the quarter, corporate profits continued to advance. This marks the third time in the past four quarters that earnings have grown double-digit, suggesting that corporations remain in solid shape overall, even … View More

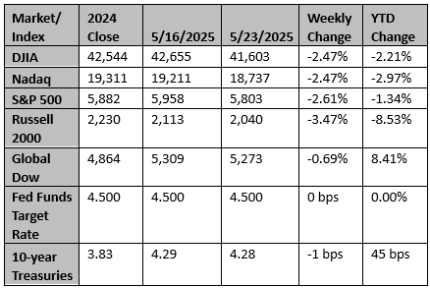

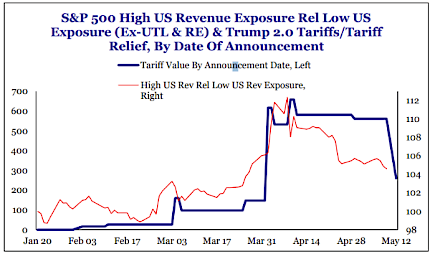

Good morning. We hope everyone had a great Mother’s Day. No rest in Washington this weekend with: (1) US-China trade talks leading to a 90-day reprieve of most tariffs ($300bn reduction annualized); (2) The first provisions of the tax bill released showing increases in the child tax credit, small business deduction, and estate tax exemption; (3) The middle-ground Medicaid changes taken in the first draft of the tax bill; (4) Trump readying his plan to impose large price controls on pharmaceut… View More

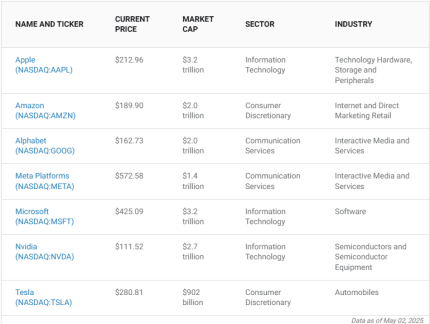

Many clients ask us why we manage our portfolios the way we do. Our management style is that of active managers, meaning we will overweight or underweight the companies represented by the S&P 500 index, considering certain fundamentals. These fundamentals include free cash flow, price-to-earnings ratio (PE Ratio), and increasing shareholder value like increases in dividends or stock buybacks that favor the shareholder. On the other hand, passive investing is investing in the indexes as they… View More