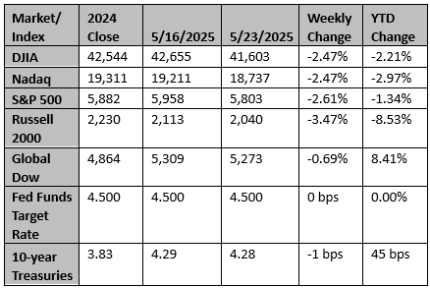

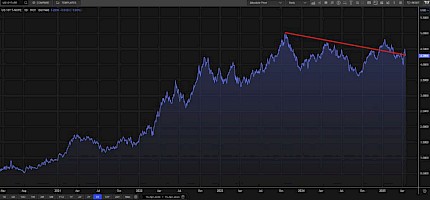

The big discussion last week among investors was about the deficit and the impact on bond yields of the One Big Beautiful Bill (OBBB). A long-tail Treasury auction threw gasoline on this debate, which was already combustible. It has been noted that once net interest costs exceed 14 percent of tax revenue, bond markets pay attention to US fiscal policy. Interest costs are currently at 18 percent of tax revenue. Adding to this pressure is that Treasury will need to flood the market with debt issu… View More

Authors

Post 41 to 50 of 608

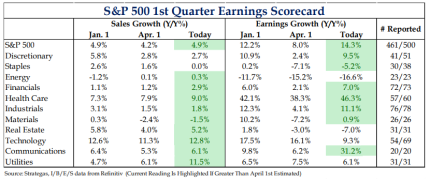

With the first quarter earnings season nearly complete, earnings growth surprised to the upside, coming in at approximately 14%, well above the 8% expected at the start of the season. Revenue growth also exceeded expectations, coming in just under 5%. Despite concerns about tariffs during the quarter, corporate profits continued to advance. This marks the third time in the past four quarters that earnings have grown double-digit, suggesting that corporations remain in solid shape overall, even … View More

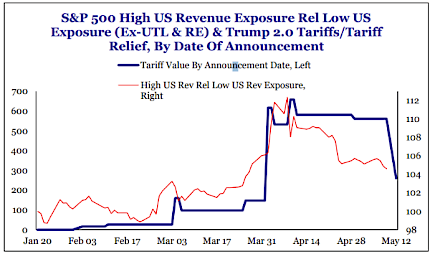

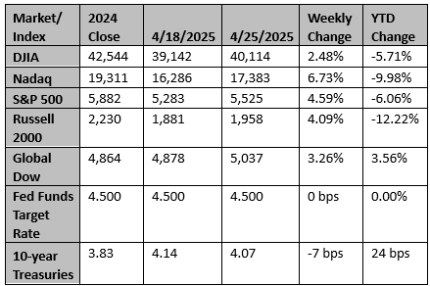

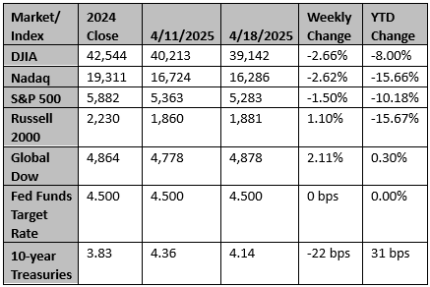

Good morning. We hope everyone had a great Mother’s Day. No rest in Washington this weekend with: (1) US-China trade talks leading to a 90-day reprieve of most tariffs ($300bn reduction annualized); (2) The first provisions of the tax bill released showing increases in the child tax credit, small business deduction, and estate tax exemption; (3) The middle-ground Medicaid changes taken in the first draft of the tax bill; (4) Trump readying his plan to impose large price controls on pharmaceut… View More

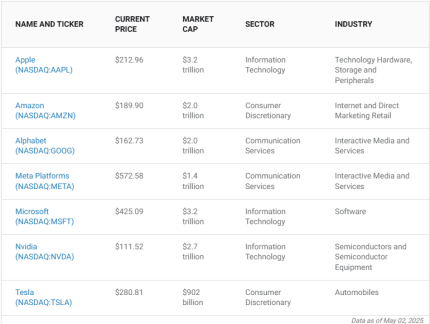

Many clients ask us why we manage our portfolios the way we do. Our management style is that of active managers, meaning we will overweight or underweight the companies represented by the S&P 500 index, considering certain fundamentals. These fundamentals include free cash flow, price-to-earnings ratio (PE Ratio), and increasing shareholder value like increases in dividends or stock buybacks that favor the shareholder. On the other hand, passive investing is investing in the indexes as they… View More

To the extent to which forecasts on the financial markets have largely been reduced to our collective reactions to utterances of policymakers who may or may not know any more than the rest of us, we’ve decided to keep things simple – presenting our base case as well as some facts we believe you should know: Base Case: Recession odds are 45% in 2025 due to increased uncertainty regarding global trade and concomitant impact on capital spending/deal-making Unemployment claims (low), co… View More

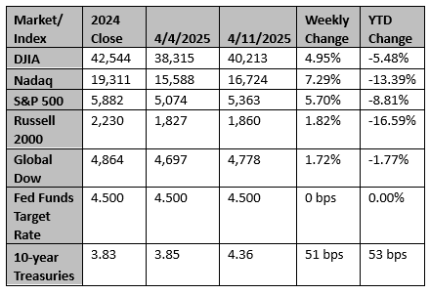

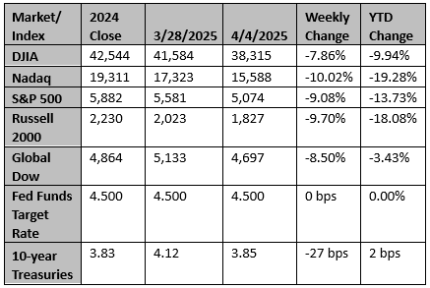

We’ve expected a recession for more than a year now. Simply put…the Era of Easy Everything is Over. Expanding deficits and easy money (that have lifted the economy since COVID) are no longer with us. At the same time, tariff negotiations have created an unbelievable amount of uncertainty. Add it all up and we expect 0.3% real GDP growth in the first quarter. Consumers and businesses were front-running tariffs in Q1, trying to get as many goods as possible into the country as soon as possibl… View More

Before the long weekend, we wanted to share additional thoughts on: Can the US avoid recession, and can the stock market deliver positive returns in 2025? Consumer Confidence If so much good news exists, why is the market down? What about China and the tariffs? Won’t that cause hyperinflation? Isn’t the US alienating its allies and trading partners? Won’t this open the door for China to step in? Because there is much to cover here, we’ve divided it into sections so you can ju… View More

Quantitative Easing was different during COVID than during the Financial Panic of 2008. During COVID, M2 growth soared, while it was held back during the Financial Panic by much tighter liquidity controls on banks. That’s why we were among the first and very few who predicted much higher inflation due to COVID policies. After that, we remained wary of loosening monetary policy too aggressively because we feared that, in spite of a drop in inflation, inflation remained above the Federal Reserv… View More

The Federal Reserve started raising short-term interest rates three years ago and the M2 measure of the money supply – what Milton Friedman said to focus on – soon started declining, hitting bottom in late 2023. One of the great mysteries of the past two years is why, given tighter money, economic growth didn’t slow down, much less hit a recession. One reason was that the federal government was engaging in the most reckless deficit spending in our lifetimes. Don’t get us wrong, we don�… View More

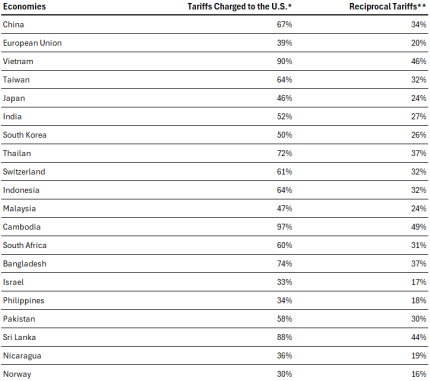

Trade partners lack options, prefer negotiation over retaliation China opens to talks, India and Vietnam prioritize negotiations EU considers retaliation, seeks new trade alliances U.S. trading partners have few good options in their trade war with President Donald Trump, other than to sue for peace. Hit by 10%-50% tariffs on their exports to the world's dominant economic superpower, most lack the firepower to hit back or the political will to slug it out, say government officials, econom… View More