Each year, we bring you our friend, the CEO and CFO of Crossmark Investments, and his annual predictions that will affect the market. The following is a recap of his predictions: Summary The U.S stock market experienced a better-than-expected third year in a row of double-digit percentage gains. Earnings growth was quite good as AI-related businesses exceeded expectations. A 20% tariff-related decline led to a 40% recovery in the S&P 500. By year-end, investors are hopeful for yet anot… View More

Authors

Post 11 to 20 of 607

Earnings Growth Outlook Improving, Hard To Be Too Negative Heading Into 2026 With 3Q reporting nearing an end and the fourth quarter coming into focus, we’re seeing an interesting trend: earnings estimates are once again being revised higher—much like what we saw in the third quarter. This pattern is unusual, especially at this stage of the year. The 4Q earnings estimate now stands at 8.2%, up from 7.7% on October 1. Revenue expectations are also strong, with forecasts calling for 7.0% gro… View More

In today’s Investment Strategy Note, we discuss the undeniably strong profit trends, begin to consider the narrative heading into 2026, and address the two near-term risks we continue to observe. Profit Growth Continues To Trend Higher With the third quarter reporting season nearly wrapped up, the fundamental backdrop for equities remains supportive as we move toward 2026. As of the end of November, the subsequent twelve-month earnings growth stands at 12.5%, the highest level since Janu… View More

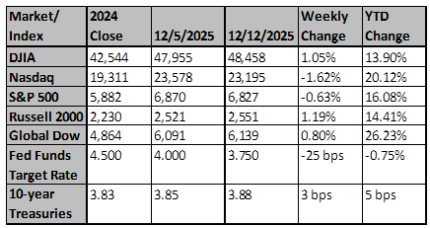

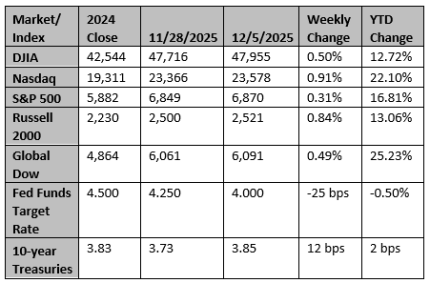

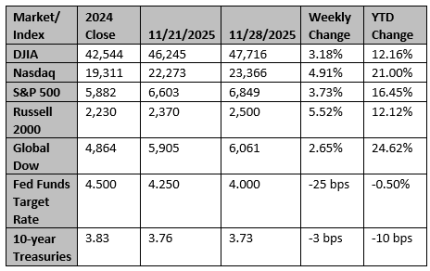

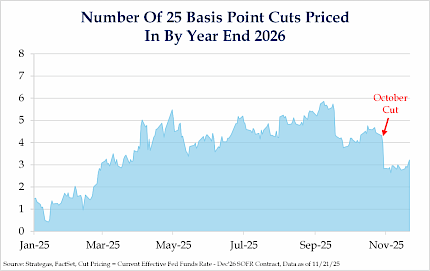

Nvidia Delivery Wasn’t Enough, Fed Cuts By Year 2026 Ticking Higher Nvidia’s earnings report didn’t raise any red flags; in fact, it was expected to help ease concerns about the broader A.I. capex cycle. The market’s reversal last week seemed driven by factors beyond A.I. alone. It’s also worth noting that Fed rate-cut odds have started to tick higher again. Despite the ongoing commentary from Fed officials about lingering inflation risks, there are not many signs of seeing that infla… View More

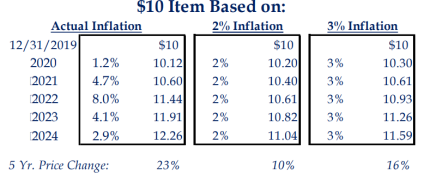

A relatively new term was bandied about during and after the off-year elections held two weeks ago that the chattering classes deemed critical in determining the outcome – “affordability”. The thesaurus function built into the Word program in which this essay found no synonyms for affordability. Still, taking a stab at it and say that it is a euphemism for inflation. It’s hard to know, of course, but it seems reasonable to assume that the cost of everyday items has become an increasingly… View More

It was, and remains, fashionable in some quarters abroad and even here at home, to question the concept of American exceptionalism after the 2024 election. Naturally, some of those feelings were driven more by the man who won the contest rather than a dispassionate understanding of what has made America so special and unique since its founding. European intellectuals often see America’s patriotism and success as attributable to luck or some cosmic accident that would be impossible to reproduce… View More

AI Spending Concerns Addressed: Increased Funding Needed Recent concerns regarding a potential slowdown or halt in the AI capital expenditure (capex) cycle have largely been alleviated, at least for the upcoming quarter. Many of the largest spenders have either projected higher capex for next year or indicated an increase in spending. However, it is important to note that not all spending appears equal; Meta’s recent sell-off serves as a prime example. Companies will need to demonstrate tangi… View More

Strong 3Q Reporting Season So Far, 2026 Overall Expectations Little Changed With 29% of companies reporting this earnings season, overall results have been strong. About 87% of companies have beaten earnings estimates, and 82% have exceeded revenue expectations. Financials have shown the most significant improvement in earnings growth forecasts, rising to 21% from 12% at the start of the quarter. Materials have also strengthened, with growth estimates increasing to 19% from 14%. For the overall… View More

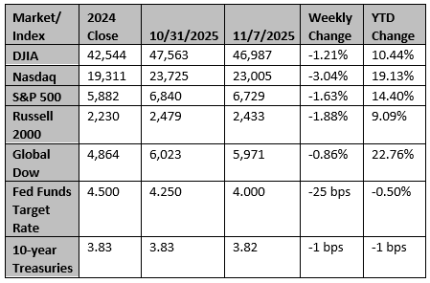

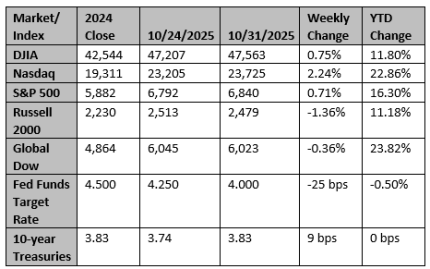

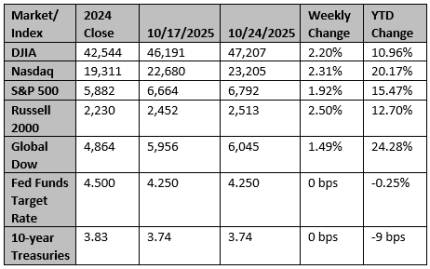

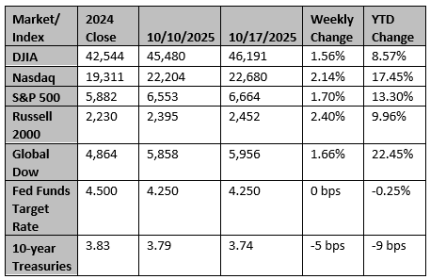

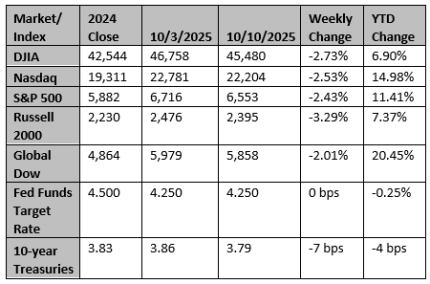

Summary Stocks rebounded in a volatile week (S&P 500 +1.71%) following the rout two Fridays ago. 3Q25 earnings started strong, led by big banks. Volatility resulted largely from U.S.-China trade rhetoric. Best sectors were communication services (+3.64%) and real estate (+3.46%); biggest laggard was financials (+0.03%). The High-Risk Bull Market Continues The October Fed Beige Book points to slowing growth as uncertainty continues to weigh on activity. The September ISM Services In… View More

Over the past two and a half decades, the federal government has buried taxpayers under a mountain of debt, now approaching $38 trillion. During this time, the key problem has been spending, not a lack of tax revenue. Over the past 25 years, taxes have remained relatively stable as a share of GDP, while spending has continued to rise. It's estimated that spending was 23.2% of GDP in the year ending September 30 (Fiscal Year 2025) versus 17.7% in 2000. In other words, the reason there is a debt … View More