A relatively new term was bandied about during and after the off-year elections held two weeks ago that the chattering classes deemed critical in determining the outcome – “affordability”. The thesaurus function built into the Word program in which this essay found no synonyms for affordability. Still, taking a stab at it and say that it is a euphemism for inflation. It’s hard to know, of course, but it seems reasonable to assume that the cost of everyday items has become an increasingly significant political issue. However, what is surprising is the current administration’s reaction to the idea that inflation played a role in the outcome of the recent elections. In short, it was along the lines of “you are imagining it, the cost of living is more palatable than you realize.”

Now, if there is one thing you have learned in years of marriage, it is that telling people how they should feel is always a losing, sometimes tragically flawed rhetorical tactic. It is undoubtedly a disastrous political strategy as the Democratic Party learned in 2024 when it came to the issues of immigration and crime. People feel how they feel. Like it or not, inflation is an issue that the occupant of the White House gets credit for, whether he caused it or not. To the extent to which anyone cares what I think, better messaging may have said this – “We know the cumulative effects of inflation have been hard on Americans, but our policies are designed to boost productivity, which, in turn, will boost real wages.” I’m not smart enough to know how to put that on a bumper sticker, but I know that it is a good argument.

When it comes to future capital spending, the United States appears to be without peer. That should, over time, mitigate the effects of runaway government spending and still-bloated central bank assets. (As a reminder, the Fed’s balance sheet stood at a mere $900 billion in 2009 and stands at $6 trillion today.) What appears to be a widely accepted fiction is that the Fed’s vaunted 2% inflation target can be easily reached. It is worth noting that the average inflation rate in the United States has been 3.6% since 1950, and inflation was running above 8% as recently as three years ago.

While investors and economic policy makers tend to think of financial trends in first derivative terms, it should be remembered that your average consumer always thinks of things in terms of the price level – i.e., the nominal price of goods and services versus their own expectations. This is why it becomes so easy to dismiss the “affordability” concerns of the average person by Wall Street types, academics, and people inside the Beltway.

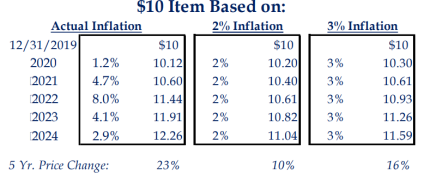

This is also why the issue of inflation can be so silently dangerous. Unless you can find a way to boost the real wages of workers, it can become very easy to think you don’t have a problem when, in fact, you do. Like the rate of interest, inflation compounds over time, and what seems to be a slight difference can ultimately become quite substantial. To take a straightforward example, let’s look at the price of a $10 item over the last five years based on actual inflation and make-believe scenarios of 2% and 3% average inflation.

Based on this simple example, it is not hard to imagine why inflation was a political issue in 2024 and “affordability” was a political issue in 2025. Once the toothpaste is out of the tube, it’s tough to get it back in. At present, it appears that we are in a footrace between the impact of tariffs on inflation and the effects of technological advancements on the general price level. Given the nature of the man, it is easy to see anything related to President Trump in binary terms. In this sense, people have written mainly off the economic impact of tariffs on inflation simply because the S&P is up 15% YTD.

However, make no mistake, tariffs increase prices in the short term. The fundamental policy question is whether the cost is worth it compared to the increased revenues to the Treasury, an improvement in the general terms of trade for the United States, and a plan to rebuild a middle class in this country that was weakened under the rubric of “free trade” over the past 25 years.

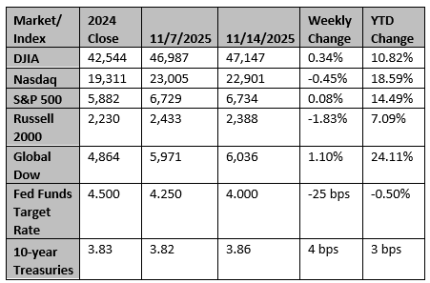

In this regard, it may not be surprising that the market has already priced out quite a bit of Fed easing. Worldwide populist movements would suggest that true fiscal sobriety is a long shot. In this regard, the Fed may not be able to reduce as much as investors might think.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

China could give the US a disinflationary hand

As policymakers in the United States fret about getting inflation back down to target, they may inadvertently get a helping hand from an unlikely source.

Reuters

Canada's inflation in October eases to 2.2% on lower gasoline, food prices

Canada's annual inflation rate in October eased to 2.2% as gasoline prices dropped, food prices eased and mortgage interest costs came down below the 3% mark, data showed on Monday.

Reuters