AI Spending Concerns Addressed: Increased Funding Needed

Recent concerns regarding a potential slowdown or halt in the AI capital expenditure (capex) cycle have largely been alleviated, at least for the upcoming quarter. Many of the largest spenders have either projected higher capex for next year or indicated an increase in spending. However, it is important to note that not all spending appears equal; Meta’s recent sell-off serves as a prime example. Companies will need to demonstrate tangible results for the markets to continue rewarding these investments.

Most significantly, it seems the technology sector is headed for a debt boom. Self-funding resources, such as cash on balance sheets and free cash flow, are unlikely to cover the scale of current spending initiatives. With credit spreads at near all-time lows and the expansion of the interest expense deduction to EBITDA in OBBB, capital markets are eager to offer debt to many of these companies.

Solid Earnings Reports; Focus Now on Consumer Trends

With 62% of the index reported, third-quarter earnings growth is nearly 14%, with 10 out of 11 sectors exceeding initial expectations for the quarter. The industrials sector is the only exception, having missed growth estimates thus far. This marks the fourth consecutive quarter of double-digit earnings growth for the overall index. Earnings are surpassing initial expectations by about 5%, notably without the typical pattern of downward revisions. On the revenue side, growth currently stands at approximately 7.5%, the highest level in the past two years and the sixth consecutive quarter of sales growth above 5%. The increase in sales is widespread, with all sectors outperforming their initial forecasts.

For the full year, earnings growth is projected to reach around 11.5%, with earnings per share (EPS) just below $270. The growth estimate for 2026 remains unchanged at about 14%, while the EPS forecast has slightly increased to $306. With most of the largest companies having already reported, attention will now turn to consumer-focused companies. A spending surge in 2026 continues to be a key theme for us, and for the market to broaden, we will need to see clear signs of strength and improvement from consumer-oriented businesses.

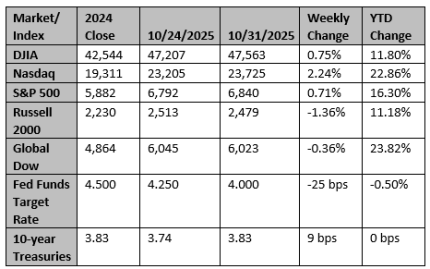

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

OpenAI turns to Amazon in $38 billion cloud services deal after restructuring

OpenAI has signed a seven-year, $38 billion deal to buy cloud services from Amazon.com , in its first big push to power its AI ambitions after a restructuring last week that gave the ChatGPT maker greater operational and financial freedom.

Reuters

Canadian manufacturing PMI rises to nine-month high in October

The downturn in Canada's manufacturing sector eased in October as output and new orders, which have been held back by trade uncertainty, declined at a slower pace, data showed on Monday.

Reuters