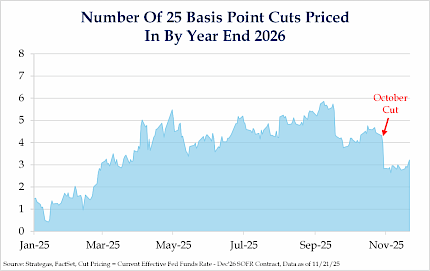

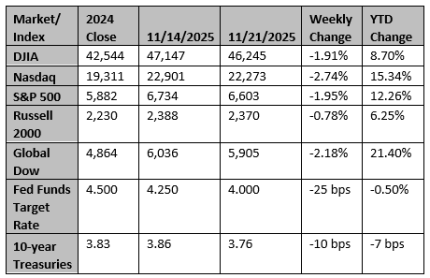

Nvidia Delivery Wasn’t Enough, Fed Cuts By Year 2026 Ticking Higher

Nvidia’s earnings report didn’t raise any red flags; in fact, it was expected to help ease concerns about the broader A.I. capex cycle. The market’s reversal last week seemed driven by factors beyond A.I. alone. It’s also worth noting that Fed rate-cut odds have started to tick higher again. Despite the ongoing commentary from Fed officials about lingering inflation risks, there are not many signs of seeing that inflation is re-accelerating.

Market-based measures remain stable, and it’s clear the labor market has softened. Given this backdrop, not cutting rates in December would be a missed opportunity given that the Fed has the cover it needs to move. Looking ahead, the potential for another government shutdown in January would add yet another layer of uncertainty.

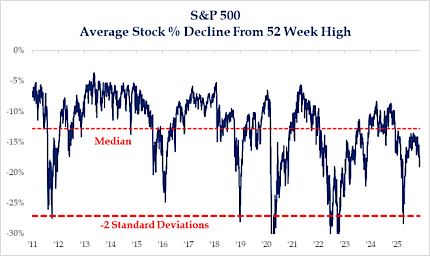

Average Stock Decline Still Only Sits At -19%, Too Soon To Call The All Clear

One of our favorite indicators to watch during equity market pullbacks is the average stock’s decline from its 52-week high. For the S&P 500, the median level at any given time is around –13%. With today’s reading closer to –19%, we are still far from anything that would be considered extreme, making it difficult to give an all-clear signal on the market’s downturn. This suggests we may still be in the early stages of the correction and a cautious approach remains warranted.

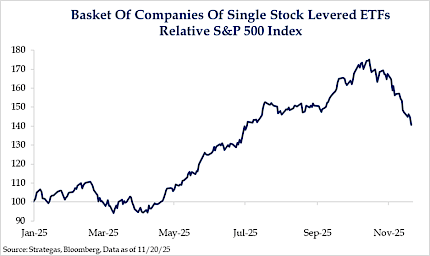

Hard To Catch A Falling Knife, Levered & Crypto Related Stocks Weighing Here

We recently built this basket to track companies most exposed to leverage, and attempting to buy them today would be the definition of catching a falling knife. The 130-plus companies in this group have underperformed the broader market by more than -20%, with little indication that the trend is stabilizing. Many of the names in the basket are those that saw strong performance earlier this year or were closely tied to the cryptocurrency boom. It raises an important question: just how far the ripple effects of the cryptocurrency downturn may extend.

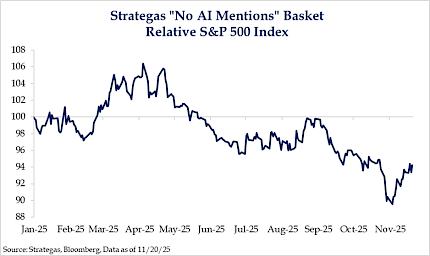

Outperformance Of Companies Least Tied To “A.I.” Fizzling Out

This basket of companies that haven’t mentioned “A.I.” in earnings transcripts over the past two years had been showing strong outperformance in the two weeks leading up to Nvidia’s results. However, over the past few days, that momentum appears to have stalled. If this trend continues, it suggests the current market correction may be less about the A.I. capex cycle and more indicative of emerging concerns in private credit or deleveraging within the crypto space.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Companies tone down price hike talk as tariff fog clears

Fewer global companies signaled price hikes in the third quarter, pointing to a change in tack.

Reuters

From two weeks to two hours: how AI might reboot Britain's economy

When accountants at mid-tier firm Moore Kingston Smith began using artificial intelligence to speed up their work, profit margins jumped.

Reuters