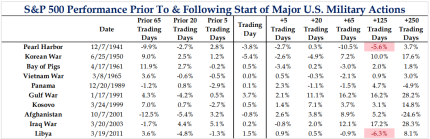

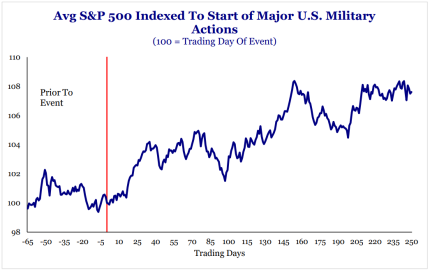

America’s military strikes on Iran’s nuclear facilities on Saturday evening will, no doubt, be seen as a “hinge moment” in history. Experience teaches us as investors, however, to be careful in drawing too many conclusions at this stage about the implications of the event. (Who can forget US Treasury yields falling in response to the initial downgrade in 2011?) Perhaps this will usher in a new period of peace in the Middle East where this is either a regime change in Iran or Iran’s leadership decides to pursue diplomatic rather than military solutions, to achieve its goals. If so, we could expect to see a relief rally of sorts in financial assets and a sell-off in commodities like crude oil and gold.

Given recent statements from Iran’s leadership, however, a more likely outcome it would seem would be a continuation of Iran’s conflict with Israel, and, taken at their word, the United States. This could take the form of conventional strikes against military targets or less conventional (terroristic) attacks against American civilian interests. While tragic and frightening, past American experiences with such events has taught us that such actions would have little if any meaningful long-term impact on the behemoth that is the U.S. economy.

A key short-term risk to the global economy would be any broadening of this conflict that would limit the ability to move oil through the Strait of Hormuz, a chokepoint for roughly 20% of the world’s oil consumption. There are signs that Iran is moving closer to doing so although a final decision has not been made at that time of this writing. To the extent to which China has influence on Iran and China’s economy is highly dependent upon a “dark fleet” of tankers transporting sanctioned oil through the Strait, this move would appear to be counterproductive. At least a short term closure cannot be ruled out, however, potentially ushering in a period of market instability.

At the margin, we would suspect that there will continue to be an underlying bid in energy and global defense stocks as well as safe-haven assets like gold and U.S. Treasurys. Stable or lower long-term yields should shield higher-valuation growth stocks from a significant fallout from recent events. But, any sense that America’s involvement in this conflict is about to broaden meaningfully - especially anything that would include “boots on the ground” - might have the biggest negative impact on yields, the dollar, and, in turn financial assets in the long-term.

America’s budgetary experiences with past conflicts in Vietnam (1955-1973) and the Iraq War (2003-2011) have taught us how expensive such conflicts can be. While such an outcome seems inconsistent with President Trump’s stated agenda to end overly-intrusive and long-term American intervention abroad, stranger things have happened.

Source: Jason Trennert, Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

US business activity moderates; price pressures building up

U.S. business activity slowed marginally in June, though prices increased further amid President Donald Trump's aggressive tariffs on imported goods, suggesting that an acceleration in inflation was likely in the second half of the year.

Reuters

German industrial lobby group cuts 2025 economic forecast as US tariffs weigh

The German economy is set to contract more than previously expected in 2025 as U.S. tariffs weigh on exports, the BDI industry association said on Monday, forecasting a 0.3% contraction in 2025.

Reuters