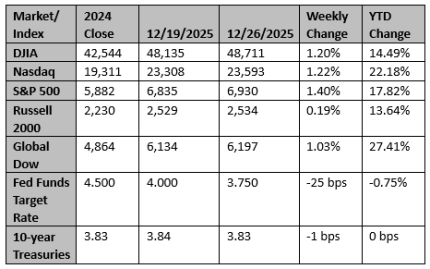

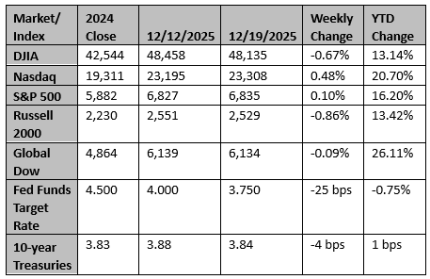

U.S. equity markets began the holiday‑shortened trading week on a firm footing. Broad gains in major indexes and the start of the Santa Claus rally marked this week. Following modest volatility in trading earlier in December, sentiment improved significantly as investors bet on year-end flows. As shown, the CNN Fear-Greed Index has moved materially higher from its readings earlier in the month. The Santa Claus rally window officially began on Christmas Eve. That rally is traditionally defined… View More

December 2025

Post 1 to 5 of 5

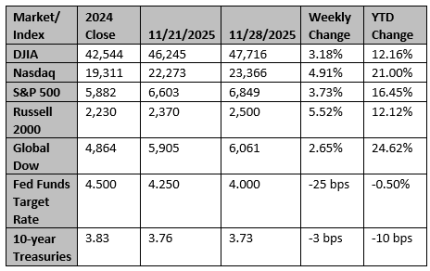

As 2025 draws to a close, markets are poised for a potential Santa Claus rally amid a year of solid gains. The S&P 500 is up over 15% year-to-date, on track for its third consecutive double-digit advance, driven by resilient economic growth, AI momentum, and Fed rate cuts. Despite a shaky December—with indices slightly lower so far this month due to profit-taking in tech and AI jitters—historical seasonality favors upside into year-end and early 2026. Small-caps and value sectors have s… View More

Each year, we bring you our friend, the CEO and CFO of Crossmark Investments, and his annual predictions that will affect the market. The following is a recap of his predictions: Summary The U.S stock market experienced a better-than-expected third year in a row of double-digit percentage gains. Earnings growth was quite good as AI-related businesses exceeded expectations. A 20% tariff-related decline led to a 40% recovery in the S&P 500. By year-end, investors are hopeful for yet anot… View More

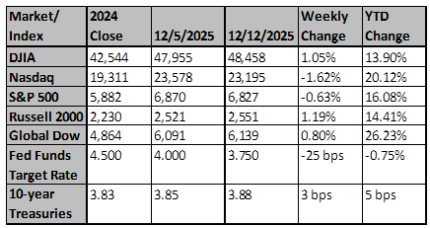

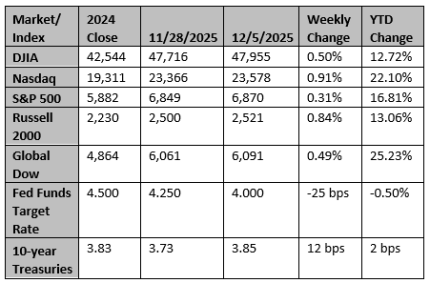

Earnings Growth Outlook Improving, Hard To Be Too Negative Heading Into 2026 With 3Q reporting nearing an end and the fourth quarter coming into focus, we’re seeing an interesting trend: earnings estimates are once again being revised higher—much like what we saw in the third quarter. This pattern is unusual, especially at this stage of the year. The 4Q earnings estimate now stands at 8.2%, up from 7.7% on October 1. Revenue expectations are also strong, with forecasts calling for 7.0% gro… View More

In today’s Investment Strategy Note, we discuss the undeniably strong profit trends, begin to consider the narrative heading into 2026, and address the two near-term risks we continue to observe. Profit Growth Continues To Trend Higher With the third quarter reporting season nearly wrapped up, the fundamental backdrop for equities remains supportive as we move toward 2026. As of the end of November, the subsequent twelve-month earnings growth stands at 12.5%, the highest level since Janu… View More