With another week’s worth of data in the books, the U.S. economy looks ok. Inflation is not a problem. We continue to believe that any (eventual) inflation pop due to tariffs should be “transitory” with monetary policy restrictive. The consumer still has some momentum. Yes, there are some impaired U.S. sectors (eg, housing), but this is not new news. Manufacturing – which has been weak – may be starting to recover for the first time in over two years. There have been considerable shoc… View More

July 2025

Post 1 to 5 of 5

Each year, the Per Jacobsson Foundation hosts and publishes a lecture on Monetary Policy. In 1979, Arthur Burns—then the Chair of the Federal Reserve—delivered a lecture in Belgrade titled “The Anguish of Central Banking.” In it, he reflected candidly on the challenges the Fed faced during the inflationary 1970s. Burns noted that, in practice, monetary policy often had to adjust to fiscal decisions made by elected officials. When the government expanded benefits or spending, the expecta… View More

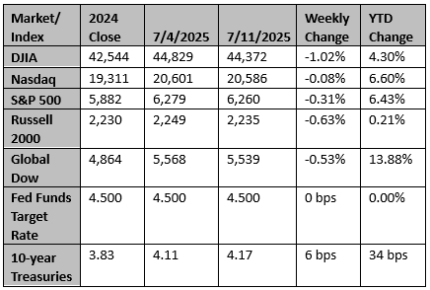

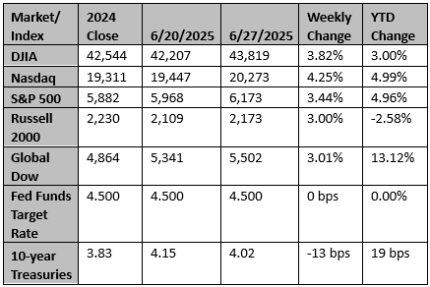

While stocks fell overall last week (S&P 500 -0.29%), both the S&P 500 and NASDAQ hit record highs. Macro news was relatively quiet. The focus is on this week's CPI report and the beginning of 2Q earnings reports. Tariff developments continue to confuse. Best Sectors were energy (2.48%), utilities (0.77%), and industrials (0.59%); worst sectors were financials (-1.90%), consumer staples (-1.77%), and communication services (-1.07%). Key Takeaways June's employment report showed a… View More

Now that the “One Big Beautiful Bill” has passed, we will highlight some of the major components of the legislation. Extension of $400bn of Expiring Tax Provisions. If Congress did not act by the end of this year, middle-class families would face a $400bn tax increase in 2026. Both political parties had been working on a plan to extend many of these tax provisions. The new tax law permanently extends these tax cuts, meaning the only way to change the tax rates is by a future act of Co… View More

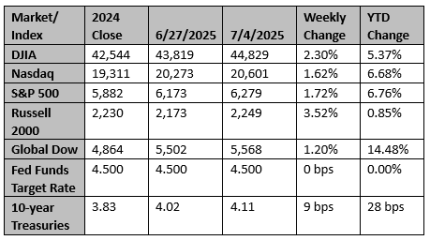

Well, it took just 55 trading days for the S&P to roundtrip from the 4/8 closing low to Friday’s 6/27 cycle high, even beating the 1998 analogue by a few days as the fastest example in 75 years following at least a -15% drawdown (using closing lows / closing highs for consistency). The velocity of the move was a surprise, but it’s again a reminder that when the S&P 20-day highs expand through 50% (as they did in early-May) spend more time thinking about what could go right than wron… View More