Each year, we bring you our friend, the CEO and CFO of Crossmark Investments, and his annual predictions that will affect the market. The following is a recap of his predictions:

Summary

The U.S stock market experienced a better-than-expected third year in a row of double-digit percentage gains. Earnings growth was quite good as AI-related businesses exceeded expectations. A 20% tariff-related decline led to a 40% recovery in the S&P 500. By year-end, investors are hopeful for yet another good year in 2026, despite valuation levels.

As things currently stand, we will achieve seven correct predictions for 2025, in line with our long-term average. Here is a brief rundown of the 2025 predictions.

1 . Economic growth slows as the unemployment rate rises past 4.5%. Real economic growth did slow by nearly a full percentage point on the back of tariff uncertainties and some slowdown in consumer spending on the back of lower and some middle-income consumers. With the government shutdown, the last 2025 unemployment report will be released Dec. 16. Consensus is in the 4.4%-4.6% range. We are expecting 4.5% or 4.6%, so credit will be taken for the prediction, recognizing our final write-up could count only half of this prediction correct. (✔ - Correct)

2 . Inflation remains sticky, fails to reach the Fed's 2% target, and causes Fed funds rate to fall less than expected again. Inflation certainly remained sticky and actually showed almost no signs of improvement (in part due tariffs). The Fed's 2% target remains elusive. At the start of the year, the Fed funds future curve suggested 2.5 Fed cuts for 2025. Last week, the Fed lowered rates for the third time, causing us to fail on that half of the prediction. (Half correct)

3 . Treasury 10-year yields trade primarily between 4% and 5% as credit spreads widen. While the 10-year Treasury yield dipped below 4% several times, it spent more than 95% of the year between 4% and 5%. Clearly, rates were higher early in the year and lower during the second half. Like Prediction #1, the second half of the prediction (spreads widen) is on a razor's edge, but we are on the right side of the prediction as we write. Our final write-up will make the adjustment if necessary. (✔ - Correct)

4 . Earnings fail to achieve consensus a) 14% growth and b) every sector has up earnings. While earnings growth has been strong, the consensus forecast for the full year is now +10%, short of the +14% expected on Jan. 1. Modest cost pressures have been the source of the shortfall. Unlike the beginning of year, the consensus forecasted that all sectors will show up earnings. Energy, consumer staples, and possibly real estate are now expected to show declined full-year earnings. (✔ - Correct)

5 . Equity volatility rises (VIX average approaches 20 for only the third year in 14). The VIX in 2025 will average between 19 and 20, the highest we have seen since 2022. Tariffs, the government shutdown, geopolitics, and economic and Fed uncertainties contributed to the volatility, with the highest volatility recorded in March/April/May. (April average 32.0.) High volatility is likely to continue somewhat in 2026. (✔ - Correct)

6 . Stocks experience a 10% correction as stocks fail to keep up with earnings (i.e., P/Es contract). As we know, the market corrected 20% rather abruptly in March-April due to the concerns around tariffs. (And the rebound since has been breathtaking.) The second half of this prediction is still possible, but at this writing, we are on the wrong side as the stock markets multiple has increased modestly. (Half correct)

7 . Equal-weighted portfolios beat cap-weighted portfolios (average manager beats index), and value beats growth. The first half of this prediction we got very wrong. Equal-weighted portfolios have noticeably lagged cap-weighted portfolios due to significant gains by many mega-cap stocks. At this writing, value stocks are lagging growth stocks by about 300 basis points (bps) year-to-date. (X - Incorrect)

8 . Financials, energy, and consumer staples outperform healthcare, technology, and industrials. After a great start to the year on this one, the strong performance of technology stocks and the nice recovery in health care rendered this one incorrect. Financials started the year very well, but lagged a bit in the second half. (X - Incorrect)

9 . Congress passes the Trump tax-cut extension, reduces regulation, but tariffs and deportation are less than expected. This prediction in some ways has four parts. The tax-cut extension (and much more) was passed ("One Big Beautiful Bill") with much hoopla. Regulatory reduction, while not getting a lot of attention, has been plentiful with more to come in 2026. Tariffs (while getting a lot of headlines), look to be about 12% of imported goods, as measured against the so-called Liberation Day plan of 21%. Certainly immigration was curtailed significantly, but deportation fell short of the Administration's goal. (✔ - Correct)

10 . DOGE efforts make progress but fall woefully short of $2 trillion per year of savings. With hindsight, this prediction was like "shooting fish in a barrel." Elon Musk's stated goal was out of the realm of possibility. Needless to say, progress was made by "only" a couple hundred billion - nowhere near $2 trillion. As we have stated many times, the ONLY way to begin to solve the increasingly acute debt and deficit problem is to tackle the entitlement programs, which comes with political suicide! (✔ - Correct)

In Summary

Looking ahead to 2026, investors are expecting yet another year of double-digit earnings and stock market gains. Our guess is that earnings will be good, but once again fail to achieve consensus expectations and that valuation levels may fall some (finally!). In all, a tougher year to make money. No matter what transpires, the investment landscape will undoubtedly be exciting and challenging.

The next issue of Doll's Deliberations will be released Dec. 31 at market close and will outline our 2026 predictions.

Source: Bob Doll CEO/CFO, Crossmark Investments

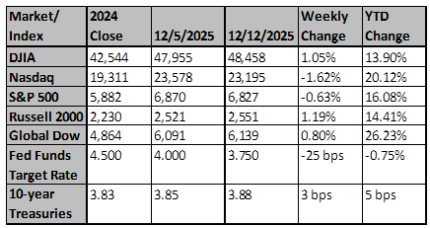

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

China's economy stalls in November as calls grow for reform

Factory output growth slowed to a 15-month low, while retail sales posted their worst performance since the country abruptly ended its draconian "zero-COVID" curbs, highlighting the urgent need for new growth drivers heading into 2026.

Reuters

Meta tolerates rampant ad fraud from China to safeguard billions in revenue

A Reuters investigation reveals the owner of Facebook, Instagram and Whatsapp decided to accept high levels of fraudulent advertisements from China. Internal company documents show Meta wanted to minimize "revenue impact" caused by cracking down on the scams.

Reuters