Now that the “One Big Beautiful Bill” has passed, we will highlight some of the major components of the legislation.

- Extension of $400bn of Expiring Tax Provisions. If Congress did not act by the end of this year, middle-class families would face a $400bn tax increase in 2026. Both political parties had been working on a plan to extend many of these tax provisions. The new tax law permanently extends these tax cuts, meaning the only way to change the tax rates is by a future act of Congress. Moreover, the legislation passed the tax provisions early to avoid any type of business and/or consumer uncertainty in the second half of the year.

- Passage of President Trump’s Campaign Promises: Trump campaigned on ending taxes on tips, eliminating taxes on Social Security, eliminating taxes on overtime, and ending taxes on auto interest payments. Some iteration of each of these four items was included in the package, which we estimate will provide $80bn of consumer aid in early 2026 in aggregate.

- Economic Growth Provisions to Sterilize the Negative Effects of Tariffs: The new tax law allows for: 1) 100% expensing of capital equipment purchases; 2) 100% expensing of R&D costs; 3) A more generous corporate interest deduction; and 4) Full expensing of factory building. The combination of these policies should create a building boom in the US. We estimate companies will save $100bn between now and September 30th and an additional $130bn over the course of FY 2026 (October 1, 2025 – September 30, 2026).

- Spending Cuts to Pay for a Portion of the Tax Bill: We are still awaiting the final Congressional Budget Office (CBO) cost estimate, but we estimate the spending cuts will come in between $1.3 and $1.6 trillion over the next 10 years. These include major changes to renewable energy spending, Medicaid, Food Stamps, and student loans. Notably, a large portion of the Medicaid cuts do not come into effect until 2028, ahead of a presidential election.

- Raising the Debt Ceiling by $5 Trillion: An all-Republican government was elected into office in January, and there was no major debt ceiling scare. The consistent threat of government shutdowns and both parties arguing over the debt ceiling has been a consistent theme for some time now. Though we would still like to see the government bring its spending down more, there wasn’t enough appetite in the government for that. Granted, the circumstances here were different than usual, with the expiration of $4 trillion in tax cuts on the table, making a debt ceiling increase easier to digest. Treasury will need to figure out how to finance a deficit of 6% of GDP.

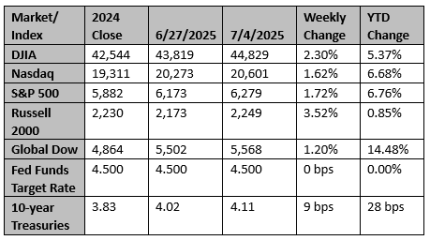

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

US signals trade announcements imminent as deadline looms

WASHINGTON/BRUSSELS (Reuters) -The United States will make several trade announcements in the next 48 hours, Treasury Secretary Scott Bessent said on Monday, adding that his inbox was full of last-ditch offers from countries to clinch a tariff deal before a July 9 deadline.

Reuters

US SEC's guidance is first step toward rules governing crypto ETFs

New U.S. Securities and Exchange Commission guidance on disclosure requirements for exchange-traded products tied to cryptocurrencies marked the first step toward approval of dozens of applications for ETFs linked to everything from Solana and XRP to President Donald Trump's eponymous meme coin.

Reuters