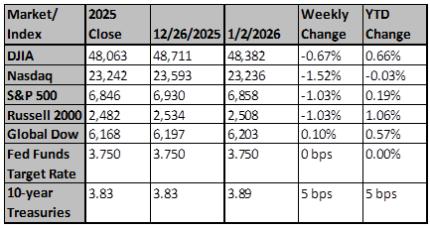

In today’s note, we discuss our initial thoughts as 2026 begins, noting that double-digit return years are not uncommon, and we explore how the fundamental broadening of the S&P is being pushed out further in 2026.

Returns Exceeding 15% For A Fourth Consecutive Year Not Unheard Of

Since 1926, there have been four instances in which the S&P 500 posted returns greater than 15% for three consecutive years. In only one of those cases did the market experience a negative return in the following year. That instance occurred in 2022, following the strong returns from 2019 to 2021, despite the global disruption caused by the pandemic. In contrast, 1945, 1952, and 1998 all delivered returns exceeding 15% after the prior three years had also surpassed that threshold.

As 2026 begins, we continue to remind ourselves that the major underpinnings of the bull market remain intact. Corporate profits are still showing double-digit growth. Employment data, particularly initial jobless claims, suggest that the labor market is holding up. Financial conditions remain supportive, with credit spreads for both high-yield and investment-grade debt staying contained. Until we see meaningful shifts in these areas, we remain optimistic. A broadening of returns is widely expected, but a very out-of-consensus outcome for the year would be if the Technology sector once again led the market.

Market expectations for earnings to broaden is getting pushed out further into 2026

To start the year, earnings growth expectations for 2026 remain relatively robust, with the market anticipating S&P 500 EPS growth of roughly 15%. However, the narrative around broadening fundamentals appears to be losing some momentum. The growth rate for the remaining 493 stocks was initially expected to surpass the MAG 7 in the second quarter of this year, but that milestone has now been pushed out to the fourth quarter.

Technology is once again projected to deliver the strongest earnings growth, at nearly 30%, followed by materials at approximately 21%. The key difference, however, is scale: technology accounts for almost half of the total earnings growth in dollar terms, while materials contribute only marginally. As a result, overall growth remains vulnerable to downward revisions in the technology sector. That said, it doesn’t appear that we have reached the end of this cycle. While the slowdown in growth of AI-related spending is widely acknowledged, it has had little impact on current earnings outlooks.

Observations From Holiday Travels and Conversations

The biggest takeaway from the past two weeks is that consumers continue to spend. Airports were crowded, ski resorts were full of families, traffic along the I-95 corridor was in full force, and even local restaurants were turning customers away during non-prime hours. Services and experiences continue to attract strong demand.

It's continued to believe in the idea of a consumer spending wave, at least in the first half of 2026, and it appears we are already in the midst of it. Credit card data has finally turned higher, which may indicate that spending is beginning to flow through more clearly. That said, we remain focused on higher-end consumers, who are in a much stronger position than those on the lower end of the income spectrum. Affordability will remain a front-and-center issue this year.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Breakingviews - Gain and pain will battle for leading role in 2026

In 2025, tech optimism overpowered tariff gloom to keep economies growing and markets buoyant. In the coming 12 months, state stimulus and corporate exuberance will again clash with political dysfunction and financial gravity. The stage is set for a turbulent showdown.

Reuters

Bank of Japan chief vows to keep raising interest rates

Bank of Japan Governor Kazuo Ueda said on Monday the central bank will continue to raise interest rates if economic and price developments move in line with its forecasts.

Reuters