It could have been anything… we’re of course referring to Silver’s spectacular -40% decline over the last 72 hours, and the broader selling in Precious Metals. We’ve read countless attempts to come up with the reason “why” over the past few days –it was the Warsh nomination, the Yen is to blame, an options squeeze, etc. etc. etc. – but the reality is when a parabolic move grips the tape and emotion takes over, it can literally be anything that triggers a sudden shift to the prevailing wind. We’d be mindful of what else has parabolic characteristics at the moment – the memory stocks stand out, with MU some 150% above the 200-day. The 50-day is providing some near-term support for Silver and Gold in the last few hours, but when we can’t measure risk/reward, we try to refrain from playing until the dust settles.

4Q Earnings Growth Rates Improved Last Week, Earnings Remain Supportive

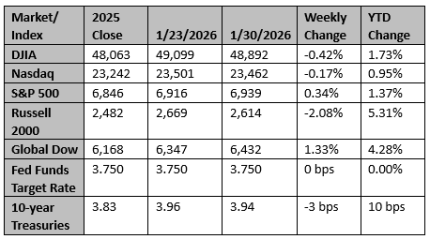

Despite headlines around the Fed chair nomination, the cooling of the metals trade, and shifting expectations for AI-driven debt issuance among large tech companies, while others may be pulling back spending, the earnings backdrop remains solid. Fourth-quarter earnings growth has ticked up to 10.9% with roughly one-third of companies reporting. Technology has been a standout, with its growth rate rising to 30% from 26%, while both Communication Services and Financials are now expected to deliver double-digit growth after previously being in the mid-single digits. The percentage of companies beating estimates is slightly below historical averages, though this could change quickly given another heavy week of earnings reports ahead.

Looking to 2026, the first quarter has seen some downward revisions, but growth is still expected to come in at 12.5%, with revisions also being seen in fourth-quarter expectations. This growth rate, however, remains in the mid-teens, down from the high teens. The Street continues to pencil in roughly 15% growth for full-year 2026, but our take is that overall, the bias appears to be toward slower rather than faster growth, reflecting investor hesitation to aggressively ramp AI spending following last year’s surge.

In Search Of The Next Market Narrative

No one enjoys a good story more than the market, but it’s starting to feel like the bookshelf is getting thin. The AI capex narrative that drove returns last year appears to have pulled forward demand, and at a minimum, growth is expected to slow. Unfortunately, that likely means the power generation story slows as well. Meanwhile, the long-awaited consumer spending wave remains slow to materialize. We are at the beginning of refund season, but new calls to boycott the World Cup in the U.S. add another wrinkle. Fans will almost certainly fill stadiums, yet the biggest winners may be streaming platforms and prediction markets. All of this leaves investors in limbo.

Slowing AI spending argues for fading tech, but if overall growth decelerates, investors typically chase what growth remains. ETF strategist, Todd Sohn, has been highlighting a forgotten corner of the market: low volatility. The challenge, of course, is that this space is home to many “boring” companies. Still, boring may be attractive right now, especially given that the average market drawdown is roughly 14% in any given year and tends to be even larger during midterm election years.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Slump in commodities rattles global markets

Commodities markets slumped, led by deep losses in gold, silver, oil and industrial metals, as a selloff unleashed by President Donald Trump's choice of Kevin Warsh for the next U.S. Fed chair sent precious metals tumbling for a second session.

Reuters

Euro zone factory activity contracts in January but output rebounds, PMI shows

Euro zone factory activity remained in contraction territory in January for the third straight month amid persistent weakness in new orders despite output returning to growth, a survey showed.

Reuters