The Fed meets on Wednesday to discuss the direction of monetary policy. With the futures market pricing the odds of “no change in rates” at 97.2%, no one should expect a rate cut at this meeting…or, we think, anytime soon.

Some, including the Trump Administration, might complain about steady short-term interest rates and say Fed Chief Jerome Powell is playing politics. The claim about playing politics may be accurate, but for now, Powell has the data on his side. The economy looks solid, and inflation remains stubbornly higher than the Fed’s 2% target.

Real GDP grew at a rapid 4.4% annual rate in the third quarter, the fastest quarterly pace in two years. We like to follow other key measures of economic activity, and although they didn’t grow as rapidly, they don’t signal a problem with economic growth, either.

“Core GDP,” which includes consumer spending, business fixed investment, and home building, while excluding the more volatile categories like government purchases, inventories, and trade, grew at a respectable 2.9% annual rate in Q3. In the meantime, Real Gross Domestic Income, an alternative to Real GDP that is just as accurate over time, rose at a 2.4% rate in Q3. Not great, but not bad either. (Remember, the Federal Reserve thinks the long-term growth rate of the economy should average 1.8%, so even 2.4% is faster than that long-term average.)

More impressively, fourth-quarter economic growth could come in even faster. At present, the Atlanta Fed’s GDP Now model suggests the economy grew at a 5.4% annual rate in the fourth quarter. Yes, much of this is related to a very favorable international trade report for October, which might reverse in November (new data to be released Thursday). But even if we exclude that by looking at Core GDP for Q4, the economy appears to have grown at about a 2.7% rate. Not bad.

The Fed is also looking at the labor market. While not as strong as the overall economy, the reports there are not showing clear stress, either. The unemployment rate finished 2025 at 4.4%, up from 4.1% a year ago, but private-sector payroll growth continues despite a significant drop in net immigration into the US. Yes, growth in private-sector payrolls has been narrow, mostly confined to health care and social assistance, but we don’t think the Fed is focused on this issue for now. More importantly, the household survey, which contacts people directly rather than surveying employers, shows jobs up 2.4 million in the past twelve months.

Nor is inflation signaling a need for rate cuts. The Consumer Price Index rose 2.7% in 2025 (December/ December), with core prices, which exclude food and energy, up 2.6%. And, just released with the GDP data, the GDP Deflator was up at a 3.8% annual rate in the third quarter.

There are reasons to believe inflation may decline in the next several months. One key reason is that the M2 measure of the money supply is up only 4.3% in the past year, slower than the pre-COVID trend of about 6.0% per year, which coincided with an average annual CPI inflation rate of less than 2.0%. As Milton Friedman taught us decades ago, inflation is always and everywhere a monetary phenomenon.

In addition, the way the government calculates the CPI may also lead to a drop in measured inflation. Zillow’s observed rent index tends to lead the CPI’s measure by about one year, and Zillow’s measure of rent decelerated in 2025, suggesting the CPI’s measure of rents will decelerate this year. That’s a big deal because shelter rent accounts for about 35% of the overall CPI. This is also consistent with stricter enforcement of immigration law, right or wrong, putting downward pressure on rents nationwide.

Put it all together , and we have a Fed that, until Powell departs in May, is not only politically inclined to reject rate cuts but also, at least for the time being, has the economic data to back up its case. If the Trump team really wants an easier monetary policy, it could drain the Treasury General Account, which currently holds almost $900 billion at the Fed. By spending that money rather than hoarding it and issuing more debt, it could quickly boost M2 by about 4%.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist First Trust

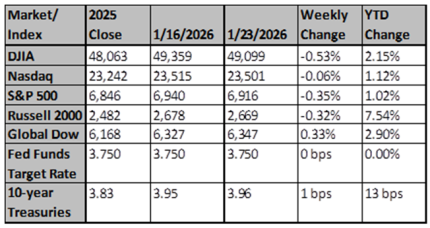

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed meeting likely to be overshadowed by threats to central bank's independence

The Federal Reserve is expected to hold interest rates steady this week at a meeting overshadowed by a Trump administration criminal investigation of U.S. central bank chief Jerome Powell, an evolving effort to fire Fed Governor Lisa Cook, and the coming nomination of a successor to take over for Powell in May.

Reuters

Drugmakers turn to AI to speed trials, regulatory submissions

Artificial intelligence has yet to deliver on the most challenging aspect of drug development -- finding new molecules that lead to major medical advances -- but it is already streamlining less glamorous parts of the process, industry executives say.

Reuters