To the extent to which forecasts on the financial markets have largely been reduced to our collective reactions to utterances of policymakers who may or may not know any more than the rest of us, we’ve decided to keep things simple – presenting our base case as well as some facts we believe you should know:

Base Case:

- Recession odds are 45% in 2025 due to increased uncertainty regarding global trade and concomitant impact on capital spending/deal-making

- Unemployment claims (low), corporate credit spreads (still relatively tight), and corporate profits (rising) all suggest positive economic growth now

- Our research partner Strategas earnings estimates are lower than the Streets, but still expecting growth of +4% in 2025 ($255). 4.5% 10-yr. US Treasury yields redline for risk

- Inflation could be “sticky” due to deficits, pent-up wage demands, deglobalization, and immigration

- The Fed likely to ease but perhaps not as much as investors hope for → penchant for shorter duration equities that generate cash above debt payments paramount

- Major themes are: (1) deglobalization; (2) cash flow “aristocrats;” (3) A.I., and, (4) industrial power revolution

- Tighter trade policy puts more pressure on Administration to ease fiscally and regulatorily

- Artificial intelligence, crypto mining, Electronic Vehicles, higher global standards of living, and a desire to bring manufacturing back home all greatly increase the need for electricity and grid modernization. It also makes a reliance on fossil fuels greater in the short term

- Favor Large Cap Value over Growth. Favor Financials, Energy, Utilities, & Industrials sectors

- High-quality small companies vs. broader Russell 2000 exposure to small cap companies. Underweight Fixed Income with cash allocated to Gold

POTENTIAL BULLISH CATALYSTS FOR STOCKS

- The announcement of a trade deal with current major trading partner (Japan, India, Europe, China) – agricultural goods & LNG exports will be key

- The Fed is likely to start easing in June

- Signs of major progress on a new fiscal package that preserves a large part of the Tax Cuts and Jobs Act (current tax plan)

- Companies too uncertain to lay off staff or cancel already approved capital spending

- A tweak in the SLR (Supplementary Leverage Ratio) that relieves any upward pressure on Treasury yields

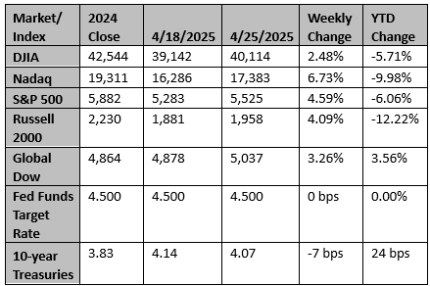

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Asia shares edge up; dollar at mercy of US trade whims

Asian share markets and the dollar made a cautious start on Monday as confusion over U.S. trade policy showed little sign of easing, in a week packed with major economic data and mega-tech earnings.

Reuters

China holds off on new stimulus, shows composure in US trade war

China has advanced this year's stimulus plans but is holding off on fresh measures as it tries to maintain composure, betting on Washington blinking first in a protracted trade war.

Reuters