Strong Showing For Q2 After Lowered Expectations: Despite the lower expectations, Q2 is shaping up to exceed even the pre-liberation day growth expectations, with growth coming in at more than double the initial expectations of 12.9%. The spotlight remains on the most prominent companies, but we have seen strong performance. 9 of 11 GICS sectors exceeded July 1st expectations, and 8 out of 11 exceeded April 1st expectations.

Second-quarter EPS currently stands at $66.84, more than $1.30 above where it was on "liberation day." Despite the noise surrounding tariff announcements, market fundamentals have remained resilient. Revenue growth is coming in at 6.3%, outpacing the previous four quarters, even before President Trump's tariffs were introduced. Concerns over stalling sales have not materialized. Looking ahead, full-year 2025 EPS estimates are once again approaching $270, while growth projections for 2026 remain strong at around 13%.

Checking In On Five Themes We Were Watching For The 2Q Reporting Season – Deregulation – As we suspected, most of the deregulation commentary has come from the financial sector, and we continue to see this trend unfolding. While it will take time to filter through the economy fully, it is progressing in the background.

Capex & AI Investment – There's no change to the story here. The hyperscalers continue to invest heavily in both AI and data center buildouts. What may be noteworthy, however, is that we are likely reaching an inflection point where growth rates begin to decelerate, not due to a lack of demand, but simply because the dollar amounts invested have become so large.

Tariffs & Costs – Two distinct narratives appear to be taking shape. First, tariffs remain a key concern for management teams. They are likely to persist, contributing to some upward pressure on costs. However, the more these measures are delayed until later in the year, the less immediate the cost impact is felt. What was initially expected to be a blunt and swift implementation has instead evolved into a more drawn-out process.

Pricing Power – Companies have attempted to raise prices, but the impact on volumes remains uncertain. If minimal volume declines, these price increases could ultimately support stronger profitability.

Additionally, some increases appear consistent with historical pricing trends, while others are directly attributed to tariffs. Labor Market – There have been few announcements of layoffs or downsizing this earnings season, aligning with the continued low unemployment claims. Overall, the idea that profits remain the glue holding the economy together remains intact. As long as companies continue generating profits, they will likely maintain employment. In turn, as long as consumers remain employed, they will continue to spend.

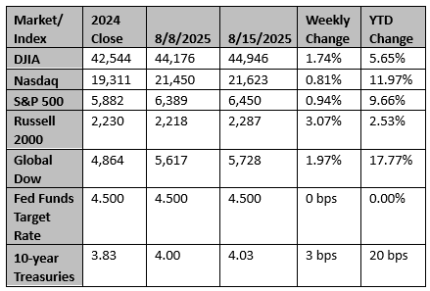

Source: Strategas Research

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Powell has used Jackson Hole to battle inflation and buoy jobs; he's now caught between both

Incoming information has confounded Fed Chair Jerome Powell's data-dependent strategy by pulling in both directions.

Reuters

US homebuilder sentiment dips back to lowest level since late 2022

A gauge of U.S. homebuilder sentiment fell unexpectedly in August, slipping back to its lowest level in more than two-and-a-half years, with more than a third of residential construction firms cutting prices and roughly two-thirds of them offering some form of incentive to lure buyers sidelined by still-high mortgage rates and economic uncertainty.

Reuters