Strong 3Q Reporting Season So Far, 2026 Overall Expectations Little Changed

With 29% of companies reporting this earnings season, overall results have been strong. About 87% of companies have beaten earnings estimates, and 82% have exceeded revenue expectations. Financials have shown the most significant improvement in earnings growth forecasts, rising to 21% from 12% at the start of the quarter. Materials have also strengthened, with growth estimates increasing to 19% from 14%. For the overall index, earnings growth has improved to 10.4%, up from 8.8% at the beginning of the season.

From a revenue standpoint, the overall index has risen to 6.7%, one percentage point higher than the start-of-quarter estimate. Looking ahead to next year, growth projections remain unchanged, with consensus expectations moving lower for financials but higher for materials.

The Most Consensus Call From Client Conversations

In recent conversations with clients, the consensus has been that the market is poised to rally into year-end. This expectation is supported by favorable seasonal trends and the likelihood that investors will chase performance as the year closes. With China trade negotiations moving positively, that outlook certainly feels justified.

However, this scenario depends on earnings and guidance from the AI hyperscalers holding up later this week. If they deliver, there may be little standing in the way of a strong year-end rally; if they don’t, an unwind in the trade will be pretty painful.

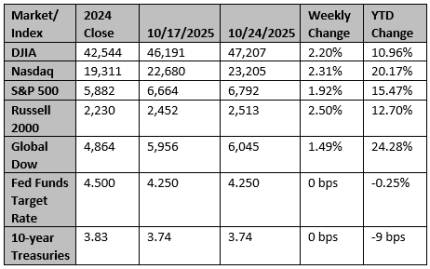

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Wall St futures hit record highs on US-China optimism; tech results in focus

U.S. stock index futures jumped to record highs on Monday as expectations of a trade deal between China and the United States fanned risk appetite in a week packed with Big Tech earnings and a potential interest-rate cut from the Federal Reserve.

Reuters

Countdown to Fed cut: Bond investors scale back on longer-dated Treasuries

Bond investors are re-examining their holdings of longer-dated Treasuries, with some reducing positions and others even going short relative to their benchmark, as the Federal Reserve prepares to cut interest rates by another quarter percentage point on Wednesday.

Reuters