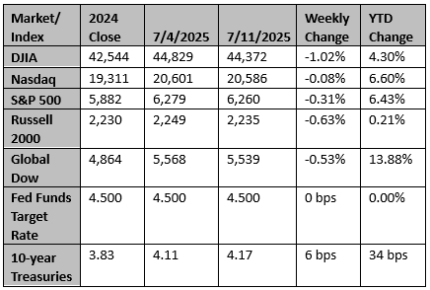

While stocks fell overall last week (S&P 500 -0.29%), both the S&P 500 and NASDAQ hit record highs. Macro news was relatively quiet. The focus is on this week's CPI report and the beginning of 2Q earnings reports. Tariff developments continue to confuse. Best Sectors were energy (2.48%), utilities (0.77%), and industrials (0.59%); worst sectors were financials (-1.90%), consumer staples (-1.77%), and communication services (-1.07%).

Key Takeaways

- June's employment report showed a tick down in the unemployment rate, which likely rules out a Fed rate cut until September.

- Reports indicate administration is considering nominating a Fed successor ahead of the end of Chairman Powell's term, a move aimed at undermining his authority. Such a nomination would inject policy uncertainty into markets and potentially further weaken the dollar.

- The near shutdown of immigration and deportation efforts have caused a shortage of workers in some places, and will aid in keeping the unemployment rate from rising significantly.

- President Trump orchestrated the passage of his legislation and has pivoted to trade deals and cease fires. It is thought that much of the good news is already priced in.

- It remains hopeful that President Trump knows that he needs to put an end to his trade wars before it does any serious economic damage.

- The recently passed "Big Beautiful Bill" is massive in terms of the number of issues it addresses. Among all of the crosscurrents, including deficit and debt acceleration, the expensing of capital projects should not be ignored as a potential economic stimulant.

- China now contributes 20% of global growth, down from nearly 50% in the 2010s.

- Consensus earnings growth estimates for Q2 are 5.8% with communications (32%) and technology (18%) best and energy (-25%) worst.

- The S&P 500 recently climbed to a new record high, but the median constituent remains about 10% below its 52-week high.

- The percentage of active managers outperforming year-to-date has gradually declined (and fallen to 48%) as the market rebounded from its April low and climbed to a new all-time high.

Source: Bob Doll CEO, Crossmark Global Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

EU warns of countermeasures over 'absolutely unacceptable' US tariff threat

Washington has threatened to impose hefty duties from August 1.

Reuters

China finally feels the pinch of its overcapacity

Beijing vows to rein in excessive competition and production as cheap Chinese goods stoke deflation at home and trade friction abroad. The policy shift is necessary to protect China's key industries and improve optics with its global partners but it will be painful.

Reuters