Each year, the Per Jacobsson Foundation hosts and publishes a lecture on Monetary Policy. In 1979, Arthur Burns—then the Chair of the Federal Reserve—delivered a lecture in Belgrade titled “The Anguish of Central Banking.” In it, he reflected candidly on the challenges the Fed faced during the inflationary 1970s.

Burns noted that, in practice, monetary policy often had to adjust to fiscal decisions made by elected officials. When the government expanded benefits or spending, the expectation was that the Federal Reserve would support those actions through accommodative monetary policy. As Burns put it, resisting these moves could be seen as undermining the will of Congress, to which the Fed is ultimately accountable.

In effect, Burns acknowledged that the Federal Reserve’s independence was constrained by political realities—particularly when supporting broader government policy goals.

Fast-forward to more recent times, and the question of Fed independence continues to generate debate. During the 2008–09 financial crisis and again during the COVID-19 pandemic, the Federal Reserve engaged in large-scale quantitative easing to help stabilize markets and support economic recovery—steps that aligned closely with significant increases in federal spending.

Some argue that these actions illustrate a limited form of independence, as the Fed’s policies effectively helped finance government initiatives. For instance, if the Fed had remained more detached, it might not have expanded the money supply to the extent it did, requiring the government to rely more heavily on traditional borrowing at market rates.

Today, the Fed is confronting a different policy landscape. While some policy proposals, such as the use of tariffs, have been implemented by elected leaders with broad public support, the Fed has expressed concern about the inflationary risks of such measures. This has influenced its decisions on interest rates, prompting discussion about whether the Fed is consistent in how it interprets and applies its mandate.

It’s worth noting that tariffs tend to raise the relative prices of specific goods rather than trigger broad-based inflation, which is typically driven by sustained increases in the money supply. Recent data support the view that overall inflation remains moderate. Since the beginning of the year, consumer prices have risen at a 1.8% annualized rate, while producer prices have increased just 0.2%—suggesting that monetary policy is currently tight.

Because monetary policy operates with a lag, and inflation appears to stabilize, some analysts argue that this may be a reasonable time for the Fed to consider easing interest rates.

However, others point to past decisions—such as the Fed maintaining rates below the level of inflation in late 2021—as evidence of inconsistency. At that time, inflation was rising, yet rates remained low. By contrast, today’s lower inflation and relatively high real interest rates exist.

This context has led to renewed discussion about true central bank independence. For some, independence doesn’t just mean avoiding political pressure and maintaining a consistent, principled approach to monetary policy regardless of prevailing political or economic narratives.

As for leadership, while there are differing opinions about Chair Jerome Powell’s tenure, many believe that replacing the Fed Chair so close to the end of a term—his current term ends in May 2026—could introduce unnecessary uncertainty. Potential consequences include legal challenges, internal resistance within the Fed, or broader market volatility if investors perceive a threat to the institution’s autonomy.

In summary, a central bank that is independent and consistent in applying its policy framework is widely seen as beneficial for the economy and markets. While the Fed has navigated immense challenges in recent years, ongoing discussions suggest there’s room to clarify and reinforce the principles guiding its independence.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist at First Trust

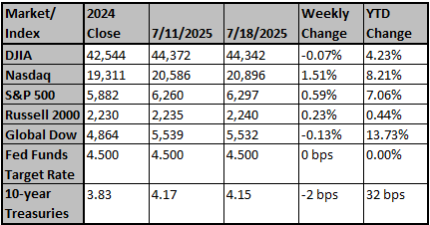

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

EU to ramp up retaliation plans as US tariff deal prospects dim

The European Union is exploring a broader set of possible counter-measures against the United States as prospects for an acceptable trade agreement with Washington fade, according to EU diplomats.

Reuters

Nasdaq, S&P hit record levels as megacaps rise ahead of tech earnings

The S&P 500 and the Nasdaq reached new record highs on Monday, bolstered by gains in megacaps as investors geared up for the week's major tech earnings, while the prospects of fresh trade deals also boosted sentiment.

Reuters