What is M2: M2 is a measure of the money supply that includes M1 (currency, demand deposits, and other liquid deposits like checking accounts) plus savings deposits, money market accounts, and certificates of deposit (CDs) with maturities of less than $100,000. It represents a broader measure of money available in an economy for spending and investment.

If a tree fell in the woods, but the data said it didn’t, does it really mean anything?

Despite what appeared to be relatively solid data, many polls throughout the 2024 election cycle showed more than half of all voters rated the economy as “poor.” That left the prior administration often frustrated that official statistics painted a picture of strength, while public sentiment did not reflect the same optimism.

Now it looks like we know why. The Labor Department estimated that it will need to revise down the amount of payroll growth between April 2024 and March 2025 by a total of 911,000. This doesn’t mean payrolls outright declined during that year; it means that, contrary to earlier reports of 147,000 jobs per month, jobs actually grew by only about 71,000 per month in the year ending March 2025.

These revisions are relatively small compared to total employment (about 0.6% of the 160 million total), and adjustments of this size have happened before. But this is now the third consecutive year of downward revisions, which is unusual outside of recessions or other major economic shocks.

This suggests the economy was weaker last year than previously thought. At present, the official GDP reports say the economy grew 2.0% in the year ending in March. However, reducing job growth from 147,000 per month to 71,000 could translate into a noticeable downward revision to real GDP growth when the Commerce Department issues its annual update in late September.

After revisions, the data show that government jobs plus government-influenced positions in healthcare and social assistance made up more than 100% of net job creation over that period, while private sector jobs outside these categories actually declined. That helps explain why many households didn't feel the benefits of a "strong" economic reports.

From an economist's perspective, this also clears up a mystery. After surging in the first two years of COVID, the M2 money supply fell from early 2022 through late 2023, yet official data showed no major slowdown. No recession, no sharp deceleration.

But what if the slowdown was missed in real time and is only now being reflected in revisions? And what if the economic effects of declining M2 were temporarily offset in 2024 by a combination of (1) an unprecedented surge in immigration and (2) a large increase in the federal budget deficit?

If so, the risk of a recession in the next year or so may be higher than many investors expect. Immigration policy has shifted dramatically, with a move away from rapid inflows toward something closer to net zero. Meanwhile, the Congressional Budget Office projects this year’s budget deficit will be smaller relative to GDP than last year’s, while reductions in some government-related jobs are already showing up.

In the long run, a leaner government footprint could support stronger private sector growth and broader prosperity. But in the very near term, reduced fiscal support and slower hiring could create headwinds as workers and businesses adjust to the new environment.

For now, this likely means the Federal Reserve is almost certainly going to cut rates on Wednesday—probably by a quarter percentage point—and will be inclined to cut rates further in the fourth quarter, likely by another half a point.

Some investors will see this as a reason to tilt even more toward risky assets. However, we are more concerned about the downside risk these policy measures are designed to protect us from than the measures being taken themselves. If a firetruck shows up at a house, that’s not a reason for civilians to run into the building, even if the data says there is no fire.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist

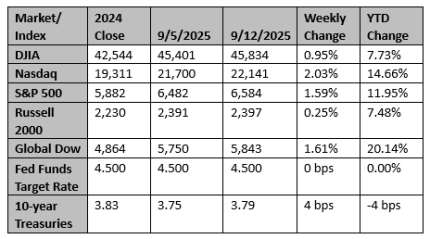

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

US, China reach framework deal on TikTok; Trump and Xi to speak on Friday

The United States and China reached a framework agreement to switch short-video app TikTok to U.S.-controlled ownership that will be confirmed in a call between President Donald Trump and Chinese President Xi Jinping on Friday, U.S. officials said.

Reuters

India and US to hold trade talks, raising hopes for reset

India and the United States will hold trade talks on Tuesday, New Delhi said, raising hopes for a breakthrough weeks after President Donald Trump imposed punitive tariffs on the South Asian nation for buying Russian oil.

Reuters