Summary

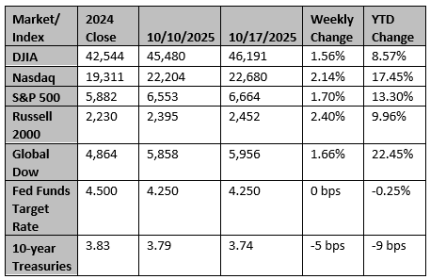

Stocks rebounded in a volatile week (S&P 500 +1.71%) following the rout two Fridays ago. 3Q25 earnings started strong, led by big banks. Volatility resulted largely from U.S.-China trade rhetoric. Best sectors were communication services (+3.64%) and real estate (+3.46%); biggest laggard was financials (+0.03%).

The High-Risk Bull Market Continues

- The October Fed Beige Book points to slowing growth as uncertainty continues to weigh on activity.

- The September ISM Services Index fell to 50.0, missing estimates and signaling broad-based weakness consistent with slowing U.S. growth.

- The U.S. labor market has cooled significantly since May, with a spike in policy uncertainty and immigration-related activities clearly taking a toll on job creation.

- The additional uncertainty in the labor market caused by the government shutdown and the absence of labor reports increases the likelihood of an October Fed cut.

- In last week's speech, Fed Chair Powell observed that the Fed is navigating the "tension between our employment and inflation goals, with 'no risk-free path' forward."

- The minutes from September FOMC meeting strengthen our conviction that the market's forward rate expectations are overly dovish.

- The September bankruptcies of auto parts supplier First Brands and car dealership Tricolor remain isolated events for now, but if additional more widespread credit problems emerge, banks are likely to tighten lending standards, hurting economic growth.

- We continue to overweight high-quality bonds (e.g., Treasurys) and believe credit spreads have been too tight to warrant holding significant positions in corporate and high yield bonds.

- It is possible (maybe likely) that bulls have too much faith in healthy households' ability to carry the overall economy.

- The CPI experienced by low-income households is likely higher than overall CPI, which is likely pressuring their spending lower to maintain liquidity.

- Many studies show that the private sector is healthy, and the government sector is radically unhealthy.

- It has been 16 years since the last true U.S. recession ended in 2009 (not counting the self-imposed pause due to the COVID pandemic).

- The consensus earnings growth rate for Q3 has increased from 8.0% to 8.8% since July 1, marking the fifth time since 2003 that growth estimates have been revised higher heading into earnings season.

Source: Bob Doll CIO/CEO Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed still poised to cut rates, but worries mount over US data vacuum

The Federal Reserve will go into a policy meeting next week with its view of the economy obscured by a U.S. government shutdown that has suspended the release of key data, a less-than-ideal situation for policymakers divided over which risks deserve the most attention.

Reuters

China's economy slows as trade war, weak demand highlight structural risks

China's economic growth slowed to the weakest pace in a year in the third quarter as fragile domestic demand left it heavily reliant on the humming of its exporting factories, stoking concerns about deepening structural imbalances.

Reuters