It was, and remains, fashionable in some quarters abroad and even here at home, to question the concept of American exceptionalism after the 2024 election. Naturally, some of those feelings were driven more by the man who won the contest rather than a dispassionate understanding of what has made America so special and unique since its founding. European intellectuals often see America’s patriotism and success as attributable to luck or some cosmic accident that would be impossible to reproduce.

But anyone looking to discount America’s economic success is liable to be sorely disappointed as we approach 2026. Three forces are going to coalesce that are likely to lead to a boom in economic activity and consumer spending in the U.S.– the tax cuts and supply-side effects of the One Big Beautiful Bill, America’s World Cup, soccer’s premier, unparalleled contest, and, finally, a celebration of the 250th anniversary of the signing of the Declaration of Independence.

Of these three forces, the most significant economic impact will naturally be driven by the tax cuts and supply-side incentives, which were written into law as part of the One Big Beautiful Bill. In one fell swoop, the OBBB makes permanent the lower tax rates established by the 2017 Tax Cut and Jobs Act, which eliminates taxes on tips and overtime, increases the standard deduction for single and married filers, introduced deductions for Seniors and those who pay interest on car loans, and raises the cap on the SALT deduction for those paying state and local taxes. To the extent that the IRS said that it will not adjust its withholding schedules for income and Social Security benefits before 2026, the tax refund season is expected to be especially heavy as we start the new year. Historically, the propensity for taxpayers to spend their tax refunds is high.

As necessary, the supply-side impacts of the OBBB may come just in time to boost what appears to be a softening labor market. The law increases the small business tax deduction, raises the thresholds, and makes permanent the Qualified Business Income deduction, while also allowing for 100% immediate expensing of new investments in factories and production facilities. The correlation between capital spending and employment is well-established, especially in the manufacturing sector. The nonpartisan Joint Committee on Taxation estimates that the research provisions will reduce taxes by $141 billion by 2034, with more than $87 billion in cuts in fiscal years 2025 and 2026 alone.

This bounty will be enhanced by the fact that it will host what is arguably the world’s premier sporting event – the World Cup – in 2026. A record 48 teams will participate in the tournament, which will take place in 11 cities across the U.S., as well as in 5 cities in Mexico and Canada. A joint study by FIFA, the soccer governing body, and the WTO estimates that an astounding 6.5 million people are expected to attend the FIFA World Cup 2026 globally, generating 185,000 full-time equivalent jobs, $30.5 billion in gross output, and $17.2 billion in GDP for the United States alone. The 39-day tournament will take place from June 11 to July 19, 2026, scheduled perfectly to encapsulate July 4, 2026, the 250th anniversary of the signing of the Declaration of Independence.

To the extent that there are innumerable events to celebrate America's sesquicentennial at the federal, state, and local levels, it isn't easy to measure how much national pride might impact economic activity. The New York City Economic Development Corporation estimates that the parade of tall ships in the Port of New York and New Jersey – Sail4th 250 – will generate $2.85 billion in economic activity for the New York area alone. The City of Philadelphia is expecting a financial boost of $1-2 billion. And on it goes. President Kennedy implored Americans never to forget that they were “heirs to that first revolution.” A reminder that the American experiment is exceptional may enable the country to mend a torn social fabric. Anyone old enough to remember the bicentennial knows that it was fun and inspiring. In that regard, the celebrations may be priceless.

The U.S. is currently considering a policy mix that it typically sees in response to a recession - stimulative fiscal policy, likely Fed easing, and regulatory relief– just as the labor market appears to be softening. Tax cuts are likely to boost consumer spending as we enter 2026. Although some argue that this will only provide a short-term boost to the American economy, the incentives for increased capital spending should provide the basis for long-term economic growth. A celebration of America’s semi-quincentennial, as the country hosts the world’s premier sporting event, will only enhance America’s coming economic boom. A self-proclaimed political elite may claim that such forces are merely a matter of luck. American patriots, however, are likely to conclude that “luck is the residue of design.”

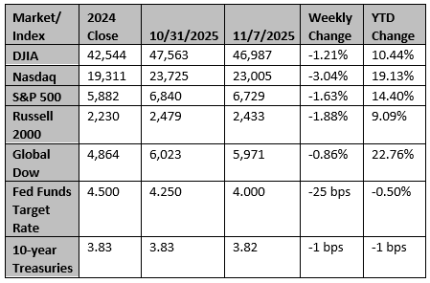

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

US stock futures rise on hopes of end to government shutdown

U.S. stock index futures advanced on Monday following signs of progress in Washington to end a record U.S. government shutdown that has stalled economic data releases and intensified concerns over the state of the economy.

Reuters

Fed's Daly says policymakers need to keep an open mind about further cuts

Slowing payroll growth in the U.S. is likely due more to weaker demand for workers than the drop in the labor force from tightened immigration policy, an important distinction in the U.S. Federal Reserve's debate about further interest rate cuts, San Francisco Fed President Mary Daly said on Monday.

Reuters