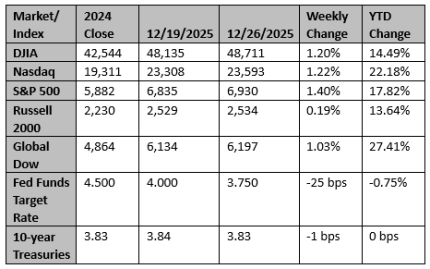

U.S. equity markets began the holiday‑shortened trading week on a firm footing. Broad gains in major indexes and the start of the Santa Claus rally marked this week. Following modest volatility in trading earlier in December, sentiment improved significantly as investors bet on year-end flows. As shown, the CNN Fear-Greed Index has moved materially higher from its readings earlier in the month.

The Santa Claus rally window officially began on Christmas Eve. That rally is traditionally defined as the final five trading days of December, plus the first two of January. This seasonal effect has occurred in roughly three‑quarters of years since the 1950s, with positive average returns of 1.4%. However, that did not happen in the last two years, but there have never been three consecutive years without a positive return.

Despite a strong seasonal start, trading remained light throughout Christmas week. On Friday, markets dipped slightly in thin post-holiday trading, with the S&P 500 retreating marginally. That pullback reflected the typical lack of liquidity during this period.

The Santa Claus Rally spilled over into gold and silver, which hit record levels, driven by expectations of lower interest rates and persistent market uncertainty. But the pace and shape of these rallies are unusual. Parabolic breakouts often occur when price momentum accelerates rapidly, driven by speculative capital and short‑term positioning, rather than by gradual accumulation based on long‑term fundamentals. Recent reports indicate that speculative traders are adding aggressive net long positions in silver futures, amplifying momentum beyond typical levels.

Fundamental support for precious metals remains. Physical demand, supply constraints, and geopolitical tensions underlie current price levels. However, the intensity of the recent rally suggests that speculative forces are also at play alongside fundamentals. Investors should prepare for higher volatility and understand that a speculative peak often precedes a corrective phase, not a straight continuation of the parabolic trend.

Overall, the start of the Santa Claus rally and record index levels reflect persistent confidence among investors, even as market leadership shifts and year‑end thin trading raise the potential for volatility. Strategic positioning now hinges not only on seasonal history but also on evolving monetary policy expectations and corporate earnings outlooks as the new year approaches.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Tariffs, China, and the dollar: What Wall Street got wrong in 2025

This was one of the most topsy-turvy years in living memory for financial markets, as U.S. President Donald Trump tore up the economic playbook that has shaped the multilateral, globalized world for decades.

Reuters

US economy to ride tax cut tailwind but faces risks

A see-saw year for the U.S. economy in 2025 looks set to give way to a stronger 2026 thanks to tailwinds from President Donald Trump's tax cuts, less uncertainty around tariffs, the ongoing artificial intelligence boom and a late-year run of interest-rate reductions from the Federal Reserve.

Reuters