U.S. real GDP was revised higher in 2Q, which helped keep NIPA corporate profits in positive territory (+1.7% q/q and +4.3% y/y). As profits are growing, the U.S. economy tends to avoid big trouble. Still, until U.S. economic growth becomes more broad-based (e.g., it includes housing, manufacturing, etc.), it seems critical that government policymakers keep U.S. financial conditions from tightening much.

There are some cracks, eg, U.S. home prices declining m/m in June (both the Case-Shiller and FHFA measures), pending home sales falling m/m in July, and the Conf Board reporting jobs were more challenging to get in August. Still, we’ve made it through another week with still-low initial jobless claims (229,000 last week), indicating no broad contagion in the U.S. labor market (ie, firings remain limited).

Real consumer spending increased +0.3% m/m in July, that’s solid. Other supports for the U.S. economy include surging tech capex spending, stable healthcare employment gains, gig jobs supporting the lower income cohorts, and wealth effects buoying upper income consumers.

We’ve seen inflation brewing in the middle of the economy (eg, the U.S. PPI). Other measures have been more moderate. The PCE deflator (the Fed’s preferred inflation gauge) was +0.2% m/m in July (2.6% y/y). Core PCE inflation was +0.3% m/m (2.9% y/y). A further move (inflation through the pipeline) is likely coming soon.

The base case is that Fed policymakers will watch the pop, and conclude inflation expectations are still anchored – for instance, if 5yr forward market-based expectations don’t move much. Then the door is open to easing. It is expected a -25bp at the September FOMC meeting.

Bottom line: Growth in the U.S. private sector has slowed. Some of this shift is related to reduced labor supply—i.e., it’s structural, not cyclical. But not all. There were notable shocks in 1H that slowed payroll gains (after revisions). Some parts of the economy are working, but it’s a narrow list (tech, healthcare, gig jobs).

We are set for several additional choppy months ahead. Some of the shocks due to political uncertainty are ongoing (eg, tariffs on/off). Looking ahead to 2026, the situation should improve. The recently passed U.S. tax bill should further boost corporate capex (core cap goods orders ex aircraft increased +1.1% m/m in July). Deregulation should also support activity. Fortunately, credit conditions still look benign. There remains time to correct the course, and part of this process is likely that the Fed will ease soon, as Governor Waller emphasized in a speech last week.

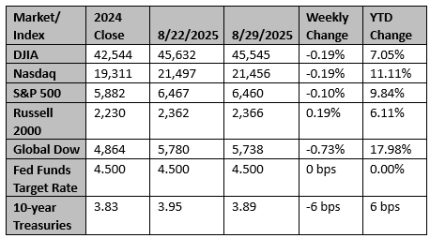

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed at a potential pivot point on jobs as storylines diverge

Job growth over the last three months has hit one of the weakest patches, outside the pandemic, since the U.S. economy was limping to recover from the 2007 to 2009 financial crisis and recession.

Reuters

US manufacturing mired in weakness; AI spending boom helps some factories

U.S. manufacturing contracted for a sixth straight month in August as factories continued to grapple with the impact of import tariffs, but an artificial intelligence spending boom is lending support to some segments of the industry.

Reuters