Over the past two and a half decades, the federal government has buried taxpayers under a mountain of debt, now approaching $38 trillion.

During this time, the key problem has been spending, not a lack of tax revenue. Over the past 25 years, taxes have remained relatively stable as a share of GDP, while spending has continued to rise. It's estimated that spending was 23.2% of GDP in the year ending September 30 (Fiscal Year 2025) versus 17.7% in 2000. In other words, the reason there is a debt problem is that there is a spending problem.

That’s the bad news, and it means policymakers still have a long way to go before we can claim our fiscal house is in order. But just because the overall budget picture remains bleak doesn’t mean we shouldn’t recognize improvements when they happen, and there is some progress.

The Congressional Budget Office recently estimated that the budget deficit for the year ending September 30 (FY 2025) came in at $1.809 trillion, slightly smaller than the $1.817 trillion of FY 2024. Although that’s only an improvement of $8 billion in dollar terms, there are reasons for at least some modest hope on the deficit.

First, it is projected that nominal GDP grew 4.8% in FY 2025, which means that even if the deficit remained roughly the same in dollar terms, it declined relative to GDP. After clocking in at 6.3% of GDP in FY 2024, it was 6.0% in FY 2025. That may seem like only a minor improvement, just 0.3 percentage points of GDP, but it’s a shift from the expansion of the deficit in the prior two years. It’s movement in the right direction.

Second, the decline in the deficit this past year would have been larger were it not for a calendar-related issue. In particular, two years ago (in 2023), October 1 fell on a Sunday, so $72 billion in federal payments (spending) that generally would have been made that day were made on Friday, September 29, 2023. That shift changed the budget math because September 29 was still in FY 2023. This artificially held down official spending in FY 2024, making the deficit appear smaller than it really was.

In addition, due to natural disasters in 2023, some taxpayers were allowed to postpone tax payments. This boosted revenue in FY 2024 by about $70 billion. In other words, the actual reduction in the deficit for FY 2025 was really closer to $150 billion, not $8 billion.

Third, although total federal spending was up $228 billion last year (after adjusting for the timing issue discussed above), the gain was due to factors largely outside the control of the new President and Congress, at least in the short term. Social Security, Medicare, and Medicaid spending were up $245 billion in FY 2025. Meanwhile, interest payments on the national debt were up $80 billion.

In addition, under the direction of the former President, the Environmental Protection Agency shoveled out $20 billion in extra payments in the waning days of his Administration, which was included in FY 2025. By contrast, other spending categories – outside those entitlements, interest, and unusual EPA payments – declined $117 billion. When was the last time you remember that happening?

Fourth, due to weather-related disasters, some revenue that usually would have occurred in FY 2025 is postponed into FY 2026. In other words, while the CBO says federal receipts were up 6% versus last year, the gain would have been more like 8% without disaster-related deadline changes.

Again, none of this means we are close to controlling the debt or deficit situation. A deficit of 6.0% of GDP is still unsustainable. Moreover, the Supreme Court may throw the whole budget situation for a loop if it declares recent tariffs illegal. Expect a ruling early next year.

The current shutdown and political brawl over emergency additions to Medicaid spending during COVID-19 are extremely important for maintaining this progress. Government spending has been on a one-way escalator, with each so-called crisis (2008 and then COVID-19) permanently lifting spending to a larger and larger share of GDP.

Somehow, the angst over budget deficits has disappeared. We remember when deficits were all anyone talked about. Remember ABC’s Sam Donaldson screaming at President Reagan about the size of the deficit?

Lately, the angst and screaming have been about cutting spending, not reducing the deficit. The good news is that progress is being made. It’s essential to recognize the progress of the budget when it happens, even if more needs to be done. So, here’s a thumbs up for the progress made in FY 2025, with fingers crossed that this progress is just the beginning.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist First Trust

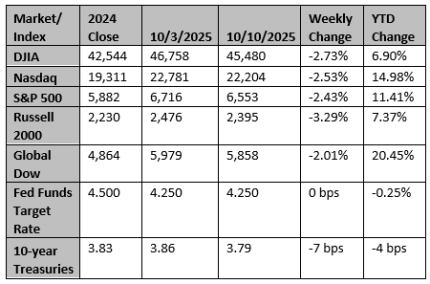

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

JPMorgan to invest up to $10 billion in US companies critical to national security

JPMorgan Chase on Monday unveiled a plan to hire more bankers and invest up to $10 billion in U.S. companies considered critical to U.S. national security and economic resilience.

Reuters

OpenAI taps Broadcom to build its first AI processor in latest chip deal

OpenAI has partnered with Broadcom to produce its first in-house artificial intelligence processors, the latest chip tie-up for the ChatGPT maker as it races to secure the computing power needed to meet surging demand for its services.

Reuters