Summary

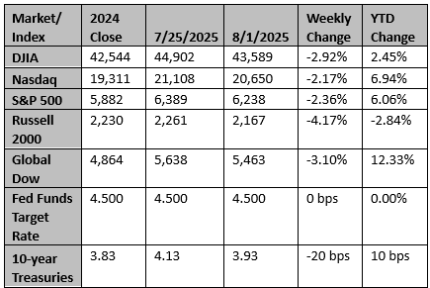

After reaching new record highs, stocks fell last week (S&P 500 -2.34%). Breadth was notably negative as equal-weighted averages underperformed cap-weighted averages. The pullback related to growth concerns following a disappointing July non-farm payrolls report and sharp downward revisions to prior months. Advancing sectors were utilities (1.56%) and communication services (0.01%); biggest decliners were materials (-5.40%) and consumer discretionary (-4.54%).

Key Takeaways

- U.S. nonfarm payrolls rose a disappointing 73,000 in July, and there were sharp downward revisions of 258,000 to May/June. (May/June/July job growth was the lowest three-month period in five years.) In light of these results, the probability of a Fed cut in September has increased.

- In his presser, Fed Chair Powell noted several times that the unemployment rate has been steady, yet inflation is above target, implying the Fed is focused on the risk of higher inflation more than the risk of weaker growth.

- Year-over-year readings of inflation (2.3%) and the unemployment rate of 4.2% seem good. However, FOMC participants expected both of these numbers to worsen in the months ahead, with unemployment averaging 4.5% in the fourth quarter and year-over-year inflation rising to 3.0%.

- 2Q GDP flash was 3.0%, but real final sales were up a more paltry 1.2%. (Net trade as a result of tariffs boosted growth by 5.0%).

- So far, the impact of tariffs on overall earnings has been less severe than initially anticipated. The effective tariff rate seems to be shifting from around 10% to around 15%. This remains a manageable number for most corporations.

- While trade deals may give the initial impression of emerging stability, risks remain: Will the details to be negotiated cause some deals to fall apart? Will each (the U.S. and the relevant trading partner) stick with the details? And what economic headwinds (e.g., inventory builds, margin hits) will the deals create?

- With half the S&P 500 having reported 2Q25 earnings, more than 80% have exceeded expected earnings and more than 60% have exceeded expected revenues. The average earnings beat has been about 6%, a strong result.

- July was the third straight month of equity market increases and the first month in a year where no day saw the S&P 500 up or down 1% or more.

- Through July 31, the path of least resistance for stocks has been higher on the resilient macro backdrop, the steady removal of tariff uncertainties, elevated buying by retail and quants, earnings beats, the AI growth theme, expected Fed rate cuts, and a pickup in deal activity.

- While it's not believed that we are in a full-blown bubble, asset prices are at or near all-time highs in many areas. Stocks are priced for perfection and the market's failure to power higher in the face of strong 2Q EPS results leaves us wanting to take some profits over the near-term into weaker seasonality.

Source: Bob Doll, CEO Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Switzerland says it's ready to make Trump 'more attractive offer' on trade

Switzerland is ready to make a "more attractive offer" in trade talks with Washington, its government said on Monday, following a crisis meeting aimed at averting a 39% U.S. import tariff on Swiss goods that threatens to hammer its export-driven economy.

Reuters

Wall Street rebounds as Fed rate cut bets intensify on weaker payrolls

Wall Street's main indexes bounced back on Monday after a sharp pullback in the previous session, buoyed by growing expectations of deeper Federal Reserve interest rate cuts following an unexpectedly weak jobs report.

Reuters