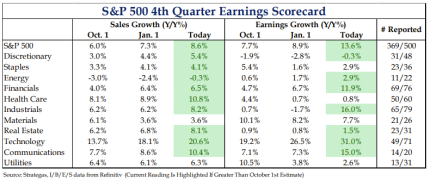

Q4 Earnings Reporting ~75% Complete & 4Q Growth Being Reported As Strong

With roughly 75% of S&P 500 companies having reported earnings, results are coming in strong. Earnings growth is once again tracking in the double digits for a fifth consecutive quarter, an outcome that’s somewhat unusual at this stage of the economic cycle. The impact of AI-driven capex is clearly showing up in the numbers. The strongest growth rates are concentrated in the Technology, Communications, and Industrials sectors, reflecting this investment. On the top-line side, revenue trends are also healthy, with sales growth estimates currently running at 8.6%.

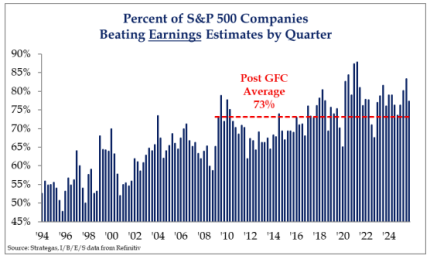

Percentage Of Companies Beating Estimates Starting To Dip

Compared with the previous two quarters, the share of companies surpassing estimates has edged lower this reporting season. During the reporting season, 77% of companies have beaten expectations, down from 83% in the third quarter and 80% in the second. Although the current figure remains above the post-GFC average of 73%, the modest pullback suggests that expectations have risen and are becoming incrementally more challenging to exceed.

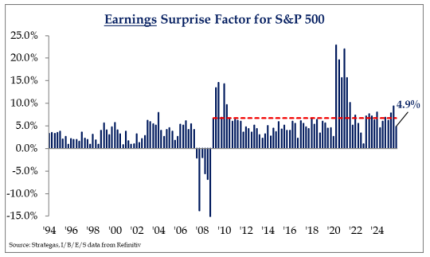

Earnings Surprise Ratio Falls To 4.9%

Another subtle indication that expectations may be becoming somewhat frothy is the earnings surprise ratio, the degree to which overall earnings are exceeding estimates, fell to 4.9%. While the dynamics of earnings season are well understood, companies are finding it incrementally more challenging to clear the bar. This points to the possibility that estimates have moved too far too fast, with projected growth rates of 13–15% unlikely to be sustained indefinitely. As several one-time growth catalysts expected to support 2026 begin to fade by mid-year, concerns around second-half growth are likely to come more clearly into focus.

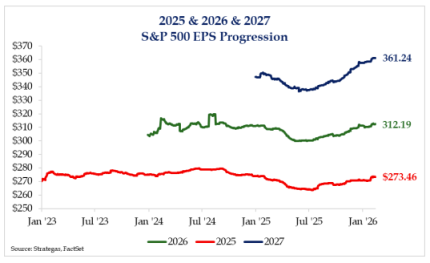

EPS Expectations For Mid-Teens Growth To Continue

While it may seem premature to focus on 2027, particularly with much of 2026 still ahead of us, it’s important to begin considering what catalysts can realistically sustain the mid-teens earnings growth rates the market appears to be pricing in. As temporary tailwinds such as tax refunds, the FIFA World Cup, and the 250th anniversary of the United States fade, the durability of growth becomes less clear. Capital expenditure is expected to remain supportive, but the second half of the year will likely need to demonstrate tangible productivity gains from that investment to justify continued optimism. We are already seeing early signs of this shift in market leadership. Companies that were rewarded last year for elevated spending are no longer receiving the same benefit of the doubt, suggesting investors are becoming more focused on returns and execution rather than investment alone.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Warner Bros rejects revised Paramount bid, but remains open to a final offer

Warner Bros Discovery on Tuesday rejected Paramount Skydance's latest $30-a-share hostile bid, but gave the Hollywood studio seven days to come up with a "best and final" offer for the owner of HBO Max and the "Harry Potter" franchise.

Reuters

Warsh may want a smaller Fed balance sheet, but that's hard to achieve

Kevin Warsh, nominated to lead the Federal Reserve, may want a smaller central bank balance sheet, but he's unlikely to get it absent major tinkering with the financial system, and even then, it might not be possible.

Reuters