With another week’s worth of data in the books, the U.S. economy looks ok. Inflation is not a problem. We continue to believe that any (eventual) inflation pop due to tariffs should be “transitory” with monetary policy restrictive. The consumer still has some momentum. Yes, there are some impaired U.S. sectors (eg, housing), but this is not new news. Manufacturing – which has been weak – may be starting to recover for the first time in over two years.

There have been considerable shocks (trade) and cushions (fiscal, regulatory) to economic growth & inflation in 2025. We are probably set up for several additional choppy months ahead. Some of the shocks due to political uncertainty are ongoing (as exemplified by the odd Fed construction tour in D.C. last week). To cut through the noise, our base case remains that the U.S. economy will make it through the recent volatility without a recession, since corporate profit growth is still positive y/y.

True, growth in the private sector is slowing. Some of this shift is related to reduced labor supply – ie, it’s structural not cyclical. That’s why the U.S. unemployment rate is not rising in 2025.

Looking ahead to 2026, the situation should improve. The recently passed U.S. tax bill should provide a boost to corporate capex. Deregulation should also support activity. There could be other supports if the Fed resumes rate cuts later this year, as we expect (cuts will affect the economy with a lag). Each week that goes by with “good enough” data (eg, initial jobless claims at 217,000 last week) gets us closer to that point.

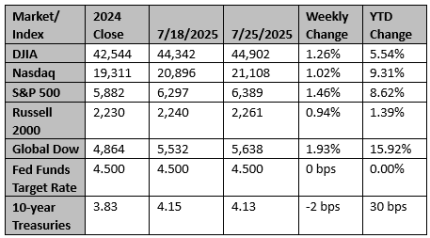

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Out-gunned Europe accepts least-worst US trade deal

In the end, Europe found it lacked the leverage to pull Donald Trump's America into a trade pact on its terms and so has signed up to a deal it can just about stomach - albeit one that is clearly skewed in the U.S.'s favour.

Reuters

US, China hold new talks on tariff truce, easing path for Trump-Xi meeting

Top U.S. and Chinese economic officials resumed talks in Stockholm on Monday to resolve longstanding economic disputes at the centre of a trade war between the world's top two economies, aiming to extend a truce by three months.

Reuters