Key Takeaways

- In the absence of the usual monthly payroll report, the September ADP report contracted by 32k jobs, missing expectations and extending the trend of weakening employment.

- The September Dallas Fed Manufacturing Survey missed expectations, confirming weak growth and employment momentum.

- Consumer confidence fell again (from 97.8 to 94.2), reconfirming weakening labor signals.

- It is hard to justify the resumption of a Fed rate-cutting cycle when the economic expansion is durable and growth is above potential, labor market remains tight, and while inflation remains above target.

- The bank regulatory economy is trending in the most positive direction in nearly 20 years.

- Q3 earnings will likely come in strong as tariffs have proved to be less of a factor, the U.S. economy remains resilient, and USD weakness has supported large multi-national firms.

- High valuations and extreme market concentration have prompted comparisons to the dot.com bubble, but key differences exist. Unlike the late 1990s, today's growth stocks are delivering robust double-digit growth, strong margins, and good cash-flow generation.

- With three quarters now complete, fewer than 30% of active large cap managers are outperforming, a sharp decline from earlier in the year when more than half were ahead of their benchmarks. A key driver of this shift has been the renewed dominance of the Mag 7.

- The Russell 2000 small cap index is outperforming the S&P 600, another small cap index. (The S&P 600 requires companies to demonstrate positive earnings before being included, while nearly 40% of R2000 companies are producing losses.)

- The average government shutdown length is eight days, but our guess is this one will last longer. Markets are generally mostly unaffected by shutdowns.

Source: Bob Doll Crossmark Investments CEO

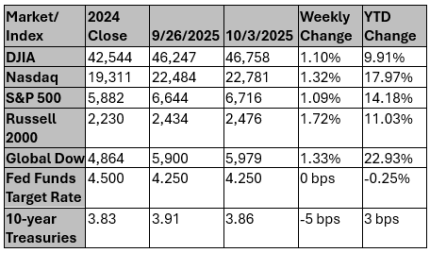

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Canada's Carney makes second White House visit to talk trade

Canada's Prime Minister Mark Carney is making his second visit to the White House in five months on Tuesday under increasing pressure to address U.S. tariffs on steel, autos and other goods that are hurting Canada's economy.

Reuters

NY Fed finds rising worry about state of job market in September

Americans grew more worried about the future of the job market in September, while at the same time bumping up projections for the future path of near-term inflation, a report from the Federal Reserve Bank of New York said on Tuesday.

Reuters