In today’s Investment Strategy Note, we discuss the undeniably strong profit trends, begin to consider the narrative heading into 2026, and address the two near-term risks we continue to observe.

Profit Growth Continues To Trend Higher

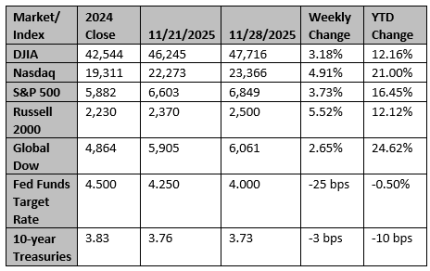

With the third quarter reporting season nearly wrapped up, the fundamental backdrop for equities remains supportive as we move toward 2026. As of the end of November, the subsequent twelve-month earnings growth stands at 12.5%, the highest level since January. South Korean export data, which historically shows a 0.7 correlation with the S&P 500 NTM EPS, was released last night and also points to continued strength in S&P earnings. That’s particularly encouraging for the technology sector.

If there’s one area of fundamental risk, it’s the continued concentration within the index. The top 10 companies now account for approximately one-third of total net income, meaning a miss from any major large-cap contributors could materially affect the overall earnings outlook. For now, though, growth remains robust with just one month left in 2025.

Understanding the 2026 Narrative As We Sit Here Today

With many investors now shifting their focus to the 2026 outlook, today’s narrative largely centers on two themes: continued AI-related capital expenditures, albeit at a slower pace, and the potential for an economic reacceleration supported by fiscal stimulus and Federal Reserve policy. While AI Capex growth will naturally moderate after such outsized investment levels, a key question is whether companies that issue debt to fund this spending will continue to receive the exact valuation multiples they enjoyed earlier in the cycle.

As for the prospect of an economic reacceleration, much of the story begins with the current holiday shopping season. We are closely monitoring daily credit card spending data, and each incremental softening makes a rebound in growth harder to envision. The encouraging news is that spending over the holiday weekend remained solid. The question now is whether consumer momentum can be sustained through the end of the year.

Crypto Deleveraging Continuing To Weigh On Risk Sentiment

Seeing the market rally last week and watching our basket of companies with levered single-stock ETFs begin to turn higher was an encouraging near-term sign. That said, with crypto deleveraging resuming this morning, we remain patient before becoming more optimistic about risk. For now, we continue to take a more risk-aware stance.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Asia's factories stumble as US trade deals fail to revive demand

In China, the world's largest manufacturer, factory activity slipped back into contraction. Japan, South Korea and Taiwan also reported declines in activity.

Reuters

AI helps drive record $11.8 billion in Black Friday online spending

Although U.S. consumers spent more this Black Friday compared to last year, price increases hampered online demand, according to Salesforce.

Reuters