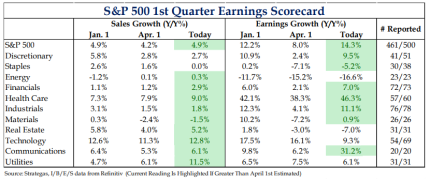

With the first quarter earnings season nearly complete, earnings growth surprised to the upside, coming in at approximately 14%, well above the 8% expected at the start of the season. Revenue growth also exceeded expectations, coming in just under 5%.

Despite concerns about tariffs during the quarter, corporate profits continued to advance. This marks the third time in the past four quarters that earnings have grown double-digit, suggesting that corporations remain in solid shape overall, even amid persistently low confidence levels.

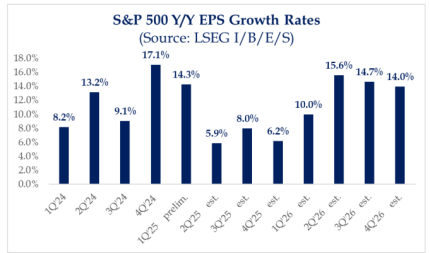

Consensus Expecting 2Q To Be Trough Earnings Growth This Year.

Earnings growth expectations for the second quarter have slowed to 5.9%, coinciding with the period when tariffs officially took effect. That said, it wouldn’t be a surprise to see another round of upside surprises when companies begin reporting.

For one, despite the announcement of tariff delays, there have been very few upward revisions to earnings estimates, suggesting that expectations may be too low. While only halfway through the quarter, there’s been no clear sign that economic activity has reached a standstill.

Downward Revisions in the U.S. Halted, International Now Moving Lower

The downward earnings revision trend in the U.S. has finally seen a reprieve, with revisions turning up slightly. However, the same cannot be said for the MSCI EAFE and Emerging Markets. While many investors call for a sustained period of outperformance from international markets, it's believed that such a trend ultimately needs to be supported by improving fundamentals.

Unfortunately, the next twelve months’ EPS estimates for both EAFE and EM have turned lower. While this isn't entirely unexpected, it does not represent the kind of fundamental improvement needed to support the bullish case for international equities.

Sector Valuations Have Bounced Back Towards Peak Levels

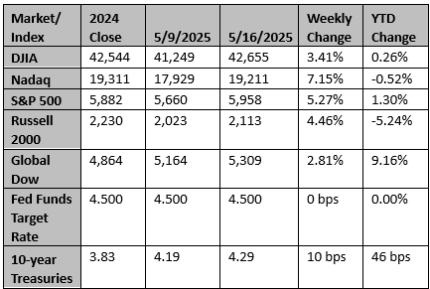

With the market now back to even, valuations have returned to levels near the peaks seen at the end of 2024. Technology is once again trading at 27x forward earnings, with the Consumer Discretionary sector exceeding those levels. Discretionary is one area where earnings estimates may prove to be too low, given that it's expected to bear the brunt of tariff-related impacts.

Notably, the Health Care sector remains relatively inexpensive, which has sparked increased investor interest. However, it's continued to be believed the sector faces a secular headwind, as government spending on healthcare trends lower.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Wall Street stocks finish flat with sentiment weakened by Moody's downgrade

U.S. stocks finished near the unchanged mark on Monday with market sentiment weakened by the downgrade of the federal government's perfect sovereign credit rating owing to its huge debt profile.

Reuters

UK strikes EU trade and defence reset in 'new era' for relations

Britain agreed the most significant reset of defence and trade ties with the European Union since Brexit after Donald Trump's upending of the global order pushed the two sides to move on from their acrimonious divorce.

Reuters