I came across an interesting article that discusses the disjointed market we have seen thus far in 2023. We believe fundamentals will drive this market as we progress through the year and believe our portfolios are positioned to reduce volatility as we proceed forward. We are overweight good high dividend paying value stocks at this time which are trading at a discount to the overall market.

Mysterious Ways: Growth vs. Value Debate

by Liz Ann Sonders, Kevin Gordon of Charles Schwab, 5/3/23

Despite some rougher days recently, large-cap, growth-oriented sectors like Communication Services and Technology are still the best-performers this year—up 24.5% and 22%, respectively, through the end of April. Since both tend to get a disproportionate share of attention, and given they house the largest stocks in the S&P 500 (Apple, Microsoft, and Alphabet), it's worth looking at the "health" of both sectors.

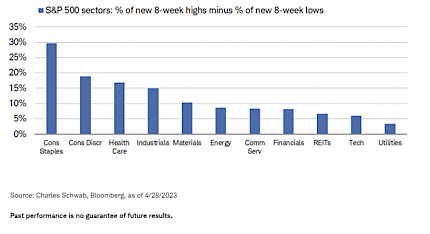

Unfortunately, it's not a clean bill. As shown in the chart below, Tech and Communication Services rank poorly when it comes to the percentage of their members reaching a new eight-week high relative to the percentage reaching a new eight-week low. Conversely, a traditional defensive sector, Consumer Staples has much healthier breadth among its members.

A Stronger Defensive Line

While defensive plays have been strengthening—with Utilities and Consumer Staples up 1.8% and 3.4%, respectively, in April—mega-cap heavyweights are still hanging in there. Indeed, Communication Services finished up 3.6% in April, but here's the catch: excluding the two largest stocks in the index (Meta and Alphabet), the sector would have declined slightly.

That speaks to a broader issue that has plagued the market this year, which we highlighted in a previous report. The concentration in outperformance up the cap spectrum has been one of the growing risks for the market and hasn't abated. To be sure, some of the kneejerk reactions by investors in jumping into well-capitalized, large-cap names are justified; given still-looming stress in the banking sector and higher interest rate pressures for small companies. When the generals are on the front lines but the soldiers are lagging behind, battles are harder to win.

The (Equal Weight) Tech Wreck

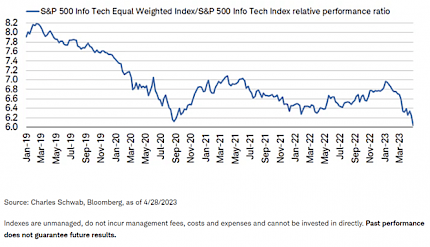

Homing in specifically on the ever-popular Tech sector, it represents the posterchild for the buildup in concentration risk this year. As shown in the chart below, the equal weighted version of the S&P 500 Information Technology sector has fallen to its lowest price relative to the cap weighted version in several years—undercutting the September 2020 low (which was the peak in relative performance for the "big 5" relative to the rest of the S&P 500).

All Else is Not Equal

Prior instances of underperformance for the equal weight index—mid-to-late 2020 and late 2021—preceded reversals in the ratio, but it's worth noting certain differences. The reversal from late 2020 into early 2021 didn't precede anything sinister for the market, as the "average" stock was reclaiming its pandemic losses, courtesy of the broad reopening of the economy. As we all remember, 2021 wasn't a bad level for the market in general. Yet, the underperformance in late 2021 preceded a much different set of circumstances in 2022, a full-blown bear market that dealt a large hit to the large-cap behemoths.

One can't be certain as to which scenario today's declining ratio is predicting, but it's worth noting that—unlike in 2020—we are no longer relying on a few companies (i.e., the mega caps in Tech or Communication Services) to carry out our everyday lives. If participation down the cap spectrum doesn't show signs of strengthening, it would likely be suggestive of a worsening economic outlook, thus presenting a risk to stocks more broadly.

The Growth and Value Conundrum

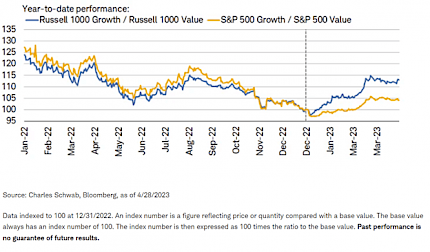

Another area in which leadership dynamics have become difficult to parse through is the growth and value universe. One might look at the aforementioned outperformance of large-cap "growth" sectors like Tech and Communication Services, and expect growth-labeled indexes to reflect similar strength. That simply isn't the case across all indexes, though. As shown below, the Russell 1000 Growth Index has outpaced the Russell 1000 Value Index by a solid margin this year (nearly 15%). Yet, S&P 500 Growth's gain relative to that of S&P 500 Value has been much weaker at 4%.

Russell is the Stronger Quarterback

As we wrote in early March, much of the divergence in performance can be attributed to the mid-December rebalance for the S&P indexes. Russell doesn't rebalance its indexes until June, so for now, there remain glaring differences in how the benchmarks are constructed. There are times, like last December, when rebalancing has dramatic results. On December 18, the day before S&P did its rebalancing, all eight of the "mega-cap 8" (Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVIDIA and Tesla) were in the S&P Pure Growth Index. On December 19, following the rebalancing, only one of the eight (Apple) remained. On December 18, Tech represented more than 37% of the S&P Pure Growth Index; while on December 19, it had dropped to only 13%.

Also of note, the S&P Pure Growth index does not contain any stocks that overlap into their value indexes; while the S&P Pure Value index does not contain any stocks that overlap into their growth indexes. However, there are many stocks that coexist in the regular S&P Growth and Value indexes. In fact, of the seven stocks among the "mega-cap 8" that left the S&P Pure Growth index as of December 19, two of them (Amazon and Microsoft) now overlap in both the S&P Growth and S&P Value indexes.

A Quilt of a Different Style

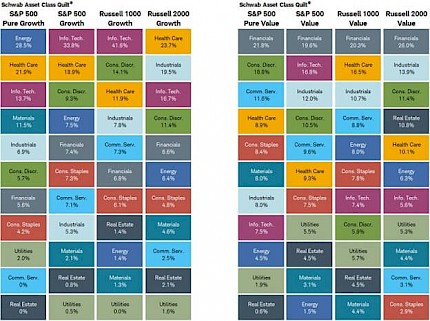

Shown below is a style index version of our quilt charts, which typically show performance among asset classes or sectors. This time, each percentage represents the weight of each sector in the index listed at the top. Given the recent focus on the Tech sector, take a look at its weightings in various indexes:

- 13.7% in S&P 500 Pure Growth (third place)

- 33.8% in S&P 500 Growth, a bit of a distance from 41.6% in Russell 1000 Growth

- 16.8% in S&P 500 Value (second place)

It's Not What You Think

This speaks to the essence of the growth vs. value debate. We think there are three ways to think about growth and value:

- There are the growth- and value-labeled indexes (and their at-times stark weighting differences, like today).

- There are the pre-conceived notions of what are growth stocks and what are value stocks.

- There are the actual factors (or characteristics) of growth and value.

Conventional wisdom might suggests that Tech should automatically be associated with growth—and that the stocks generally only live in growth indexes. However, that is clearly not the case in S&P 500 Pure Growth, which now has Energy as the heaviest weight, followed by Health Care; leaving Tech in third place. Conversely, a value-oriented investor wanting to shun Tech might look to S&P 500 Value as an obvious choice, but Tech is now the second largest sector in that index.

Not Your Parents' Growth and Value

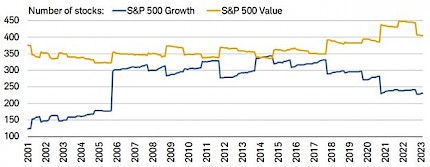

Another way to look at shifts in the growth and value landscape over time is to compare how many stocks are in the indexes with how many actually exhibit growth and value factors. As shown below, the number of stocks in the S&P 500 Growth index has steadily declined from a peak about a decade ago, but remains high relative to the inception of the index to two decades ago. Conversely, the number of stocks in the S&P 500 Value index, while off the peak, is still quite high relative to history.

Less Growth, More Value

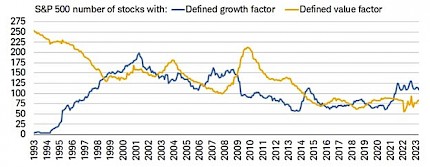

The story changes when screening for the number of stocks that have true characteristics of growth and value. This is by no means an exhaustive screen, as there are many ways to characterize and define each style, but for now we'll stick with simple definitions (shown in the footnote of the following chart) for each. Within the overall S&P 500 index, the number of stocks with a defined growth factor has remained unchanged for more than a decade; while the number of stocks with a defined value factor has declined more dramatically.

A Shrinking Pool of Growth and Value

Again, this emphasizes the importance of taking a factor-based approach when it comes to growth and value. There are times (like today) when huge differences in indexes and factors can lead to dramatically different performance dynamics.

In Sum

We find that growth vs. value debates are generally approached too simplistically; which can lead investors astray. We remain focused on factor-based analysis and screening; especially when it comes to looking for stocks that have actual growth characteristics and/or stocks that have actual value characteristics. We also suggest investors remove their blinders and be open-minded when it comes to screening for stocks across growth and value factors. It's particularly important in today's market environment; during which we continue to emphasize "quality." Almost by definition, high quality tends to manifest itself in a blend of growth and value factors; including positive earnings revisions/surprises, dividend growth, strong balance sheets, ample interest coverage, and lower volatility, among others.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

US Consumers' Inflation Expectations Mixed in April, NY Fed Report Shows

(Reuters) - U.S. consumers said last month they expected slightly lower inflation in a year's time, the New York Federal Reserve said in a report that also showed the bank stresses that kicked off in March weren't weighing heavily on the moods of Americans.

U.S. News

Biden seeks debt ceiling talks, as U.S. faces possible June 1 default

President Biden invited House Speaker Kevin McCarthy (R-Calif.) and other congressional leaders to the White House next week to discuss the debt ceiling, as Washington scrambled Monday to respond to news that the government could default on its obligations as soon as June 1.

The Washington Post

Oil prices inch up as recession fears begin to fade

SINGAPORE, May 8 (Reuters) - Oil prices rose slightly in early Asian trade on Monday as fears of a recession in the U.S., which drove prices down for three straight weeks for the first time since November, began to recede. Brent crude futures were up 6 cents at $75.36 a barrel at 0022 GMT.

Reuters