Investors are proceeding into the second half of 2022 with caution after the worst first six months to a year in decades. Risk-off sentiment was seen in most areas of the market, fueled by soaring inflation and the Fed's aggressive monetary policy to fears of slowing growth and increased borrowing costs. A much hoped for "soft landing" also hit some turbulence, with Fed Chair Jay Powell remarking this week "there is no guarantee that we can do that and it's obviously something that's going to be quite challenging."

Perfect storm: The S&P 500 has plunged 21% since January, losing more than $9T in market capitalization and suffering its worst first half of a year since 1970, while the Nasdaq Composite and Dow Jones fell 16% and 30%, respectively. The 10-year Treasury yield climbed from 1.50% to around 3.00%, and Bitcoin has tumbled nearly 56% YTD to under $20,000. One of the only pockets of the market that gained in the first half was commodities, with crude oil going from $75 to well over $100 a barrel and U.S. gas prices nearly tripling before falling back in recent weeks.

Heading into the second half of the year, many are worried that central bank actions could push the global economy into a downward spiral. The latest reading from the Atlanta Fed's GDPNow tracker is now in negative territory, predicting Q2 real GDP growth of -1.0% as of June 30, down from +0.3% on June 27. If that print comes to fruition, it would mark two straight quarters of negative real GDP growth (-1.6% in Q1) making it a technical recession.

More volatility ahead? Earnings season, which kicks off later this month, could present the next market volatility risk, though you never know when buy-the-dip institutional managers and retail investors will step in and gain control of the markets.

What really started this current inflationary cycle… Let's look at one of the factors:

Our economy has changed in many ways since the 1970s and early 1980s when we last saw inflation like we do today. Back then, life was much simpler than it is today in many ways. Let's look at one way life has changed in regards to our buying habits. Up until the mid 2000s when we needed to shop, we would hop in the station wagon and head down to the local K-Mart or Sears store and fill the car with all the goods we needed on a seasonal basis. Back to School, Holiday season, and summer vacation to mention a few. Browsing the Sears catalog and ordering the item to be picked up at your local Sears store was a nice convenience.

Now think of today’s shopping habits and the amount of Fossil Fuels it takes to deliver a roll of toilet paper to your front door? We no longer make shopping lists and make one trip for our goods. Now we simply go online and order what we need to be delivered and voila, it magically shows up at our home. To see a UPS truck in any neighborhood back in the 1980s was a rare sight indeed. Today, you probably see a UPS, Fed Ex, or Amazon Truck in your neighborhood at least once an hour. As an example just yesterday I had three items delivered to my house from three different companies and it took two UPS deliveries at different times to deliver my items.

Not a really efficient way of sourcing goods when you look at it through an energy consumption lens. So rising energy prices touch every facet of our lives well more than they did just a few decades ago. Is it any wonder that the Green agenda of the current administration has set off a domino effect that has ended up with fuel prices at an all-time high and inflation out of control? When you consider how energy touches our lives today Vs a few decades ago, how could any reasonable person come up with any other conclusion?

With all the challenges the world economy is facing in the advent of the massive COVID Disruptions we have seen over the last two years, we did not need any additional challenges. The one sure way we can address these challenges is to admit the current policies on Energy are wrong and go back to where we were just a few years ago. Think of it this way, when you are driving your car and you realize you made a wrong turn you have two choices. You can wait until your GPS redirects you and possibly go many miles out of your way (and burn more energy), or you can stop the car, back it up and get back on track with minimal interruption (and energy burned).

It is time for our country to admit we missed the turn and we are going in the wrong direction, back up the car to get back on track. The longer this takes us to do the more economic pain we will face as a country with continuing high gas prices and inflation.

QUANTITIVE TIGHTENING AND ITS IMPLICATIONS FOR ASSET PRICES AND INFLATION

It has been claimed that the first casualty in any war is the truth. In the fullness of time historians of future generations will be charged with determining whether this maxim was accurate when it came to the all-out war waged by policymakers against COVID-19. Certainly, in addition to the tragic loss of life due to the virus, there have been other public casualties, not the least of which has been a weakening of our social fabric and deepening distrust of once-venerated institutions. We take at face value the idea that policymakers have been acting with good intentions and in good faith. Still, public trust requires both proper motivation and competence. We fear that the hyperpartisan nature of our current national discourse in the context of higher inflation will make it difficult, in the end, for the Fed to retain its political independence, risking the worst of both worlds – lower asset prices and persistently high inflation.

No further ink needs to be spilled on these pages about how our central bank absolutely whiffed on the idea that the inflation we started to see last year was transitory. Thankfully, there is little doubt now that both the Administration and the Fed recognize the need to tighten monetary policy to address the potential for persistently high inflation. The question now is the pace and the manner in which such tightening can and will occur. To the extent to which lags in policy are long and variable, we are skeptical that the current inflationary pressures in wages and rents will subside quickly or on their own. Our environmental policies and goals are similarly likely to continue to drive up the prices of oil and industrial metals without a change in course. A resolution of supply chain issues will no doubt bring down the rate of inflation on some goods, like autos, but it is difficult to see a 36% increase in the level of M2 in a two-year period not having a long-lasting impact on the general price level.

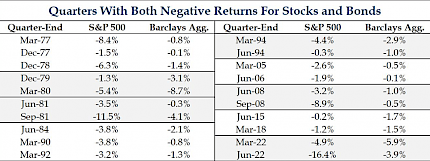

Stocks And Bonds Both Negative Again In 2Q

Of the 186 quarters since 1976, a negative quarterly return for both stocks and bonds has occurred just 20 times including the second quarter of 2022. Furthermore, over the same period, there are just five instances where both stocks and bonds are negative for two consecutive quarters. Recessions have been associated with three of the previous four periods and the jury is still out on the latest instance.

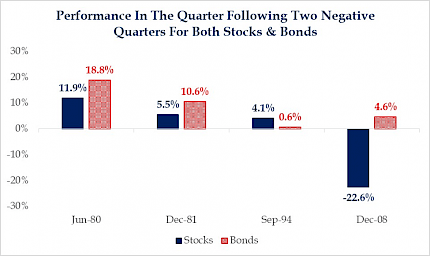

Bonds Historically Rally In The Quarter Following Two Negative Quarters

In the quarter following two negative return quarters for both stocks and bonds, equities were positive during three of the four instances while bonds were positive in all four. The one instance where equities continued to decline was during the financial crisis. While it’s difficult to say what will happen in the coming quarter a bounce is certainly possible, although we still believe the bear market is going to last longer.

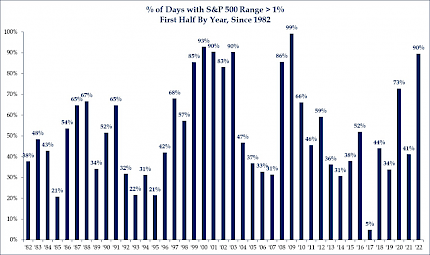

S&P 500 Sees Its Most Volatile Half Since 2009

My colleague, Todd Sohn, passed this data along showing that during the first half of the year 90% of trading days had an intraday range greater than 1% range. This is the highest level since 2009 when 99% of the trading days saw ranges greater than 1%. We see no reason for volatility to subside in the second half.

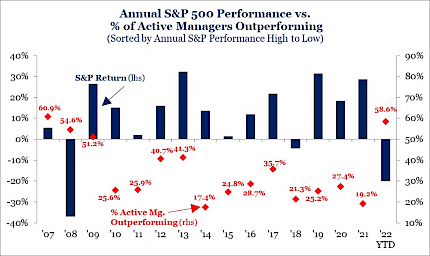

Active Managers Are Having A Strong Year

With the S&P 500 down -20% since the beginning of the year, active managers are having their best year since 2007 with 59% outperforming and the average fund declining -18.5%. These data are focused on large cap core managers and it is a welcome sign for an industry that had a challenging time thanks to easy monetary policy. The extent to which that is changing should become a better environment for stock selection.

What’s Old is New Again: The Case for Active Management Builds Under the Headwind of Tighter Financial Conditions

One of the frustrating challenges presented by the QE era was its broad support for passive, flows-driven price appreciation. The rising tide ultimately emphasized larger (and mega-cap) names and the securities of post-GFC franchises with – shall we say – spurious business models over operators with battle tested durability, as well as granular security selection. Along the way, this led too many portfolio managers to note the sense of hopelessness they felt in attempting to ply their trade the old fashioned way. Jumping on the liquidity train almost seemed the only way. As Jason Trennert from Strategas wrote in his Apr’13 WSJ op-ed, paraphrasing Lady Thatcher, There Is No Alternative. But, it seems, that what’s old is new again.

The Fed’s pivot to normalizing monetary policy and the increased likelihood that inflation conditions are likely to force them into an overly restrictive policy framework, while topically painful, actually provides an accommodative backdrop for active management. In addition to traditional fundamental analysis, the overhang of global macro considerations also supports the mapping of the characteristics of macro thematic trends to aid in the process of security selection through the prism of quantitative factors.

In looking at a Quantitative Factor Review, we highlight the distinct factor performance profile seen during previous policy rate tightening cycles. On the negative side of the ledger, “risk-on” – high beta, high short interest, high leverage, etc. – are the primary factors to avoid, consistently underperforming the broader market during tightening cycles. On the positive side, and while not altogether surprising – Quality factors dominate – the securities populating the relevant quintiles might have low P/E ratios, higher free cash flow, and solid balance sheets. These are the companies paying dividends that can actually go up and have been buying their own stock back as a way of enhancing shareholder value.

The tide has changed and so must the way portfolios are managed. There is still a place for passive investments in an actively managed portfolio. But for now, active management is back and looks to be the new normal.

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com