Many clients ask us why we manage our portfolios the way we do. Our management style is that of active managers, meaning we will overweight or underweight the companies represented by the S&P 500 index, considering certain fundamentals.

These fundamentals include free cash flow, price-to-earnings ratio (PE Ratio), and increasing shareholder value like increases in dividends or stock buybacks that favor the shareholder. On the other hand, passive investing is investing in the indexes as they are and letting the market rebalance the index.

Many indexes become overweighted with companies with poor fundamentals and can expose the investor to more risk than they want. That is not to say these companies are not good just because their fundamentals seem stretched. It just means they are more volatile to the upside and the downside.

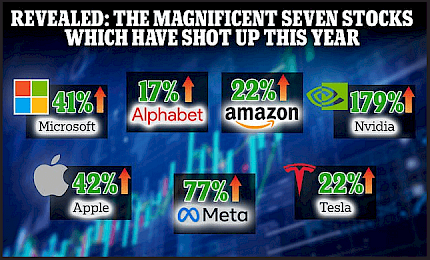

Take the so-called Mag 7 stocks. As of March 2025, the Magnificent Seven represented 32% of the S&P 500, up from 12.3% in 2015. From 2015 to 2024, these seven companies achieved a 697.6% return, outperforming the S&P 500. In 2025, the Magnificent Seven experienced a larger downturn than the S&P 500, declining 13.2% YTD.

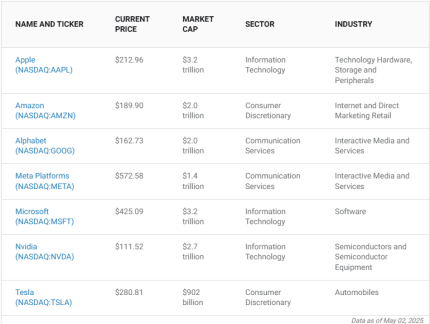

The "Magnificent Seven" is a group of seven of the largest and most influential technology-focused companies. This group includes:

As these companies continue to outperform the index's average holding, they become a larger percentage of the index, making it more volatile when the market is selling off. They tend to sell off quicker than the average holding in the index because of their stretched valuations and inherent volatility on an individual basis.

In other words, these seven companies lead the index up in good times and down in bad times because of their disproportional weighting. There is a place for these companies in our client's portfolios; we have many of them in your portfolio. We do not have them at the significant weighting the S&P 500 has them, so our portfolios are not like the tail wagging the dog. We capture a nice upside when the market is good but do not give away the farm when the market goes down like it has recently.

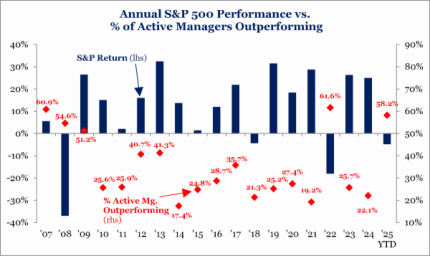

Active managers in the large-cap core space continue to hold on to their outperformance, with 58% beating the S&P 500. That marks the second-highest reading since the COVID-19 pandemic and ranks third overall in 2007. The more the Mag 7 lags the broader market, the greater the likelihood that active management will continue outperforming. However, active managers are likely to underperform if market leadership quickly reverts to the names that have driven returns over the past 10– 15 years.

Source: Strategas

Our clients are mostly retirees, people looking to retire in the next five years, and successful business owners who have most of their net worth in their business. Because of this, our goal is to capture asymmetrical performance in our client’s portfolios. Asymmetrical performance means gains are disproportionately larger than losses, leading to a favorable risk/reward profile.

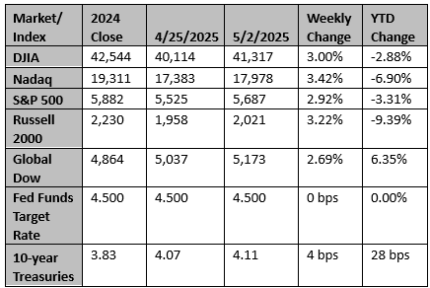

Thus, the large market swings experienced by the indexes, as we saw in April, were reduced. Allowing our clients to be more comfortably invested than having 100% exposure to the market’s volatility.

We are okay with the tradeoff of underperforming in good markets and outperforming in bad markets because asymmetrical performance produces more predictable, lower volatility portfolios. To ensure we are on the right track with our client’s portfolios, we combine financial planning with the portfolio’s management.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed policymakers expected to keep rates steady as tariffs roil outlook

The Federal Reserve will doubtless leave interest rates unchanged on Wednesday, but the meeting may be the last where the outcome is so cut and dry with President Donald Trump's tariffs casting a shadow of uncertainty over the economic outlook.

Reuters

US stock futures fall after Trump's new tariffs at start of Fed-decision week

U.S. stock index futures fell on Monday after President Donald Trump reignited concerns about the effects of a global trade war by introducing new tariffs, while markets awaited the Federal Reserve's monetary policy decision this week.

Reuters