With all the uncertainty going on in the world, we have found more stability in looking at the reported economic data. One of the data points that we believe is crucial is personal income. We have shared many times over the years that the US economy is a consumer led economy; roughly 70% is driven by consumption. The most recent report of personal income shows that it increased 0.9% in September (+1.6% including revisions to prior months), which beat consensus expectations (again). Consensus expectations were looking for an increase of 0.4%. More importantly than September's data, over the last year personal income is up 6.2%.

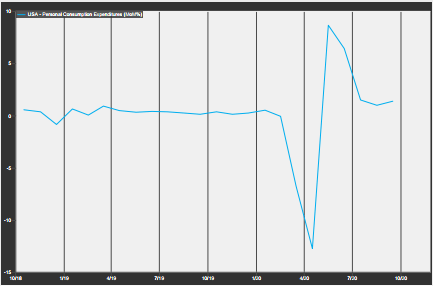

Personal income is so important because it is a leading indicator of consumption; if income falls, we normally see a drop in consumption. We also like to track consumer confidence because in order for increasing incomes to create economic growth, we also need to see increased consumption. Generally, we expect to see higher consumption when consumer confidence is high. However, this year has been an anomaly in that consumer confidence (while up 18% off its bottom) is still down 24% from its pre-Covid levels, but personal consumption is up. The chart below shows personal consumption expenditures over the last two years, and though we saw a precipitous drop in consumption in March and April, it has since rebounded. We attribute some of the delinking between consumer confidence and spending to the Fed's monetary policy. Interest rates have gotten so low that we are seeing a lot of real estate purchases.

Source: FactSet

Unlike the real estate purchases leading up to the Financial Crisis of 2008, these purchases are being fully underwritten. Borrowers are having to pass stringent credit and income requirements, and they are most often taking out long-term fixed-rate mortgages. This behavior may well be a base for continuing economic growth as housing costs are locked in at relatively low levels due to the low interest rates. As wages rise and housing costs remain relatively low, consumers will be able to direct future wage increases to savings, investments, and the consumption of other goods and services.

Perhaps more importantly than the rise in personal income is the source of the increase. Private sector wages and salaries increased 1% in September and are up over 10% from where they bottomed out in April 2020. Although wages are not yet back to their pre-Covid highs (they down 3% from February's highs), they are continuing to make steady progress forward. Equally, and perhaps more importantly, personal income continued to increase even though government payments continued to fall in September.

We also want to highlight that the recovery in spending is broadly based. In September:

- Spending on autos increased by 6%

- Spending on clothing and footwear increased by 7.3%

- Spending on movie theaters was up 137%

- Spending on railway transportation was up 36%

- Spending on rental cars was up 12%

- Home sales are up 22% from a year ago

The big question is, can this continue? We believe the answer is yes because there is still "dry powder" available; the savings rate continues to be elevated, and in September measured in at over 14%. When we couple the current savings rate and the growth in personal incomes, we see evidence that the current economic recovery can keep pushing forward.

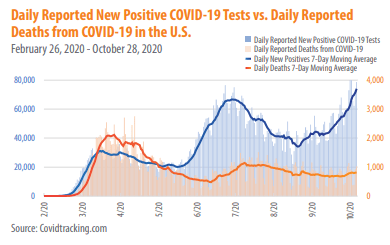

Because the re-opening of the economy will depend significantly on what is happening with Covid-19, we are also tracking the Covid-19 data. Covidtracking.com reported (as of 10/28/20) that although there has been a dramatic climb in the number of new Covid-19 infections, the death rate has not increased as dramatically.

While it is impossible to know all the reasons why the death rate has held far steadier than the rate of infection, we can think of a number of plausible explanations:

- Now that we know more about the virus, those who are at the most risk are likely doing a much better job of quarantining themselves from the virus.

- The medical community has worked tirelessly on treatment options, and they have learned a great deal in a short period of time about the best ways to treat Covid patients, and they are delivering better outcomes.

- Because we are doing much more testing now, we may simply be more accurately aware of how many cases of Covid there actually are. We have heard numerous scientists and doctors report there may be as many as 10x the number of Covid cases that we know about. The more broadly testing is done, the more actual cases of Covid will be accurately reflected in the number of positive tests.

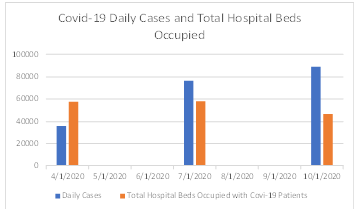

Taking data from CovidTracking.com again, we see that despite the steady rise in daily cases of Covid-19, the demand for hospital beds from April through October 29, 2020, has been relatively steady, and has in fact decreased from the levels seen in April and July.

And though the US is nearing "traditional" hospital bed capacity in various areas, throughout the pandemic, we have seen evidence that the US has significant resources to open "surge" centers throughout the country to help handle the additional needs. In March, NY Governor Cuomo issued an order to increase hospital bed capacity and plans were laid out to add over 16,000 hospital beds.1 In April, CA Governor Newsom ordered CA to use its surge capacity to create an additional 50,000 hospital beds (a 67% increase).2 The Texas Medical System in Houston reported that if they hit capacity, they had resources to add an additional 66% through surge capacity.3 Governor Ducey in AZ reported that his state had ample surge capacity to meet the projected demand. 3

Further, we have seen a willingness of states with excess resources to lend support to those who need it. We have also seen military medical support as needed to offer staffing to run the surge capacity beds in various parts of the country. With CA and NY being among the hardest hit when the pandemic first started, we saw military hospital ships dispatched to offer support. Fortunately, much of the surge capacity and support has not been required, but we believe it is important to recognize that many of the current headlines are focusing on the current traditional hospital capacity, reacting as if that were the end of the line. Thankfully, the accurate (and under-reported) story is that when we have seen various medical systems reaching capacity, we have seen quick responses to provide surge capacity so that medical services can be provided as needed.

So while we cannot know with certainty "why" the death rate has held so steady and "why" the demand for hospital beds has not surged like the number of new cases, there are some things we do know.

We do know that given the number of patients in the hospital with Covid-19 currently (46,095 nationally), there is dramatically more capacity than what is now required. Again, CA alone issued a plan to add 50,000 new hospital beds, NY's initial plan was to lay out an additional 16,000 + hospital beds. Texas, AZ, FL, and many other states all issued plans to dramatically increase their available hospital beds. If the total number of in-patients nationally were to double, California's anticipated increase in surge beds alone would be enough to handle the capacity.

We understand it is not practical to move thousands of patients to CA, we are simply stating that there is a significant amount of evidence that the US has the broad ability to add surge beds where needed to help care for the sick, should the need arise.

Looking at the data, we believe there is strong evidence that we are unlikely to return to the level of lockdowns seen in March and April. We are equally convinced we are likely to see smaller regional responses to flatten out the number of new Covid cases in areas where they are not able to flatten the curve any other way. But because we expect these measures to be focused, we do not expect dramatic reductions in the country's economic activity like what was seen in March and April.

Please call us with any questions.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

- 1. "https://www.bloomberg.com/graphics/2020-new-york-coronavirus-outbreak-how-many-hospital-beds/

- 2. https://www.gov.ca.gov/2020/04/06/governor-newsom-announces-progress-in-expanding-hospital-capacity-to-fight-coming-surge-in-covid-19-cases/

- 3. https://www.reuters.com/article/us-health-coronavirus-hospitals/hard-hit-u-s-states-surge-hospital-intensive-care-beds-as-icu-wards-fill-up-idUSKBN23X2E0