As the dust settles after a volatile first five months of the year, investors are biased to buy risk assets. Record or near-record highs are frequently recorded in various markets, including equities, credit, real estate, gold, etc. There is no shortage of investor liquidity.

Summary

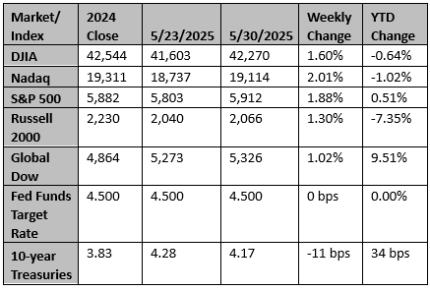

Equities increased (S&P 500 1.90%) last week, offsetting some of the prior week's loss. Highlights included lots of tariff crosscurrents and NVIDIA'S earnings. Best Sectors were real estate (2.75%) and technology (2.36%), underperformers included energy (-0.43%) and materials (0.90%).

Key Takeaways

- Durable goods orders fell 6.3% in April after four months of gains. This weakness suggests softer shipments in the coming months, which will negatively impact GDP growth.

- Consumer confidence surged to 98.0 in May, a significant jump from April's five-year low.

- As reflected in numbers 1 and 2 above, "hard" data is slowly deteriorating (durable goods) and "soft" data is slowly improving (consumer confidence).

- Business tax refunds to small businesses are becoming a large, unrecognized source of stimulus in 2Q, running at a $225 billion annualized rate.

- Fed minutes reflect the risks of both higher unemployment and inflation. Such a scenario could pit the Fed's goals of stable prices and maximum employment against one another.

- The net cost of the "Big Beautiful Bill" is estimated at nearly $2.4 trillion over 10 years. This is slightly higher than the $2.1 trillion in tax revenue expected from Trump's trade fight. In other words, tariffs may largely offset the tax cuts.

- With all the back and forth on the "Big Beautiful Bill" and DOGE, it can be reinforced the assertion that the direct way to seriously address the debt/deficit problem is via entitlement cuts.

- Trump's threat to impose a 50% tariff on the EU re-awakened trade fears. Walking that threat back and the EU accelerating talks have repaired that temporary fear.

- The courts ruled unfavorably on the legality of President's Trump's tariffs. The ruling has been appealed and adds to the uncertainty around tariffs. Although the administration will attempt other options to impose the tariffs, if not successful, that will lessen both the growth-dampener and inflation-enhancer impacts.

- Full-year EPS estimates for the S&P 500 continue to drift lower, now sitting at $262 implying a 7% growth rate. Downward revisions thus far largely reflect the direct impacts of the tariffs.

Source: Bob Doll CIO/CEO Crossmark Investments

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Corporate America is well prepared for the coming storm

Headwinds from tariffs, bond yields and 'stagflation' are gathering force, but corporate America could not be in better shape to face the economic storm that may be building.

Reuters

Fed's Waller still open to cutting interest rates later this year

Federal Reserve Governor Christopher Waller said on Monday that interest rate cuts remain possible later this year even with the Trump administration's tariffs likely to push up price pressures temporarily.

Reuters