US Energy Policy Failure

It has been four months since Russia’s invasion of Ukraine. The White House’s failure to recognize that the Russian attack signified a need to focus on energy security over climate change has kept the price of energy elevated, raised recession risks, provided the funding for Putin’s military, reduced support for Ukraine, and eroded backing for Congressional Democrats.

Now panic is setting in at the White House as the domestic political environment crumbles and Russia moves closer to having complete control over Eastern Ukraine. The urge to do “something” is building and the good options have become scarcer. Over the weekend President Biden talked about a gasoline tax suspension. Our sense is that the White House is looking to a pre-July 4th announcement that calls for a gasoline tax cut paid for with a windfall profits tax on oil companies. This is a political proposal that will not make it through Congress while energy costs remain elevated.

Adding to this is that oil companies are expected to meet with the Secretary of Energy on Thursday. The Biden Administration seems like it is leaning towards the use of the Defense Production Act to get the companies to refine more oil and/or to restrict crude and LNG exports. Against this backdrop, the Administration remains more focused on getting a reconciliation bill with renewable energy tax credits. The policy is unlikely to meaningfully provide consumer relief unless Build Back Smaller fails and the Senate center puts a deal together like the bipartisan infrastructure bill that passed in 2021.

AN ENERGY POLICY FAILURE IN THE U.S.

- Russia Is Slowly Taking Over Ukraine As The West Failed To Boost Its Fossil Fuel Infrastructure: Russia attacked Ukraine on February 24th. The rise in energy prices was predictable. Still, Democrats made no attempt to boost fossil fuels in the short run to mitigate the effect of rising prices. Instead, the Biden Administration continues to push clean energy while remaining dependent on other nations for oil, which has not come through. The net effect is that energy and food prices have increased, central banks are being forced to raise interest rates furiously, and voter support for the effort in Ukraine is declining. Russia now controls 30% of eastern Ukraine and has the momentum to keep pushing forward as higher commodity prices reduce voter support for the war in the West.

- The Failure To Keep Energy Prices Low Is Now Leading To Potential New Policy Errors: Panic is setting in at the White House and could lead to more policy errors. The Administration is issuing veiled threats to oil companies in an effort to get more supply. While difficult to understand what the Administration intends to do, invoking national security suggests that the White House is looking at possibly suspending crude and LNG exports. A more controversial read of Biden’s letter to the companies suggests that he will invoke the Defense Production Act to increase refining capacity or impose price controls.

- State Gasoline Tax Cuts Are Feeding Through To US Consumers: Some vulnerable Democratic senators want to cut the gasoline tax ahead of the midterms as a way to provide direct relief to consumers. Speaker Pelosi has opposed this measure, arguing the tax cut will feed through to the oil companies. While we are not big fans of cutting the gas tax, both Penn Wharton and our colleague Chris McGrath have found Speaker Pelosi’s assertion has not come to fruition among the states that cut gasoline taxes this year. In fact, in the states that cut gasoline taxes, a majority of the savings went directly to consumers.

- Biden Continues To Focus On Renewable Energy Tax Credits: Despite higher energy costs, Democrats are worried that if they lose the House this year, they will not have the chance to pass long-term renewable energy tax credits until 2025 or 2027. As such, a laser focus remains on passing long-term green energy tax credits as part of reconciliation before September 30th. Because this is budget reconciliation, all of the tax credits need to be paid for with tax increases and/or spending cuts while growth has slowed.

- Republican Energy Policy Seeks To Boost An All-Of-The-Above Approach, But Passage Is Not Guaranteed: The 2022 midterm election is shaping up to be an energy election, and energy policy will be the focal point of midterm campaigns. Republicans’ energy policy is focused on an all-of-the-above approach that calls for increasing domestic production, including on federal lands, and export of fossil fuels - setting up a clash with the White House if the GOP takes control of Congress. Democrats have a number of Senators who will be facing tough re-elections in 2024 and may be open to some bipartisan negotiations. But legislation a year from now does little to mitigate the effects of Russia-Ukraine and still faces the perils of getting legislation passed in divided government.

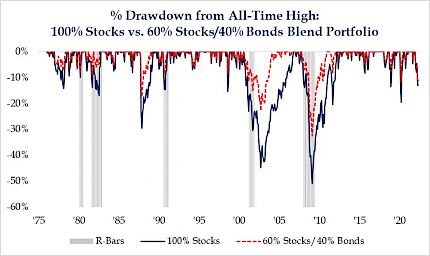

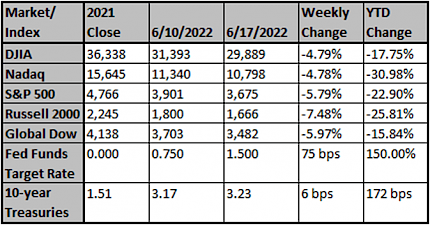

Bonds Not Hedging Stocks During This Bear Market

One of the biggest changes in this sell-off compared to previous sell-offs over the last 40 years is that a portfolio of entirely stocks has the same drawdown as a portfolio of 60% stocks and 40% bonds. We’ve noted for some time how the correlation between the two was breaking down, but now investors, who believed they were in less risky investments, will realize bonds have not been “safe”.

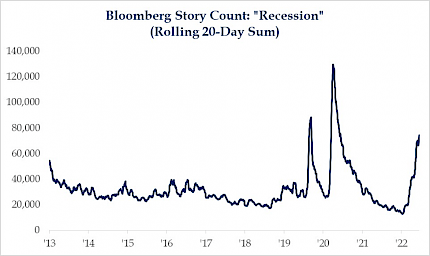

Mentions of “Recession” Are Beginning To Mount

We’ve shown the below chart from time to time and it continues to show that the mentions of “Recession” in news articles are accelerating. With inflation running north of 8%, gas prices above $5 a gallon, and mortgage rates near 6% the consumer is stressed and future indicators of economic activity are slowing. As a result, our Chief Economist Don Rissmiller raised our U.S. recession odds from 40% to 50%.

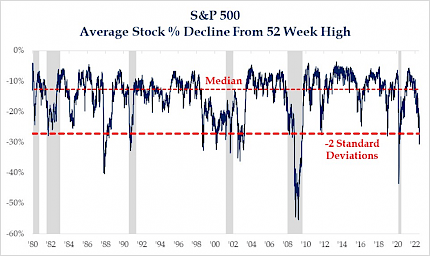

Average S&P 500 Stock Now Down -31%

The below chart remains one of the most requested from clients and after yesterday’s sell-off the average stock is now down -31% from its 52 week high. This certainly is an outlier reading and historically has shown to be a decent time to put money to work. However, we continue to believe the bear market is not yet over. After all unemployment remains historically low, the Fed’s balance sheet decline has just begun, and earnings estimates have yet to be revised lower.

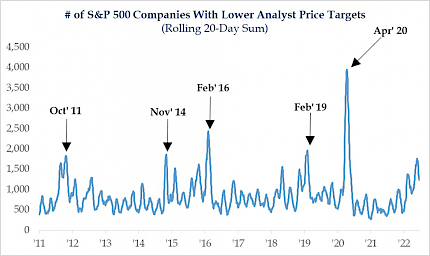

Expect Another Wave Of Lower Price Targets

Despite the broad market sell-off and the rather orderly uptick in lower analyst price targets on stocks, we believe there is likely going to be another wave of downgrades. The reason being is that thus far earnings estimates have largely remained unchanged and price targets have been reduced because of lower expected multiples. With the 10-year treasury now higher, the rate used to discount future earnings should result in lower estimates all else being equal. Add a recession to the mix and it becomes more apparent. This is likely coming during the 2Q reporting season.

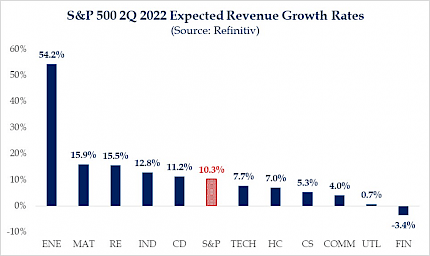

2Q Revenue Growth Expected To Be 10.3%

Sales growth for the S&P 500 during the second quarter is expected to remain north of 10%, led by the energy sector at 54%. The slowest growing sector is expected to be the financials at -3.4%. To the extent to which energy continues to contribute a large portion, aggregate sales growth will continue to look stronger than it actually is.

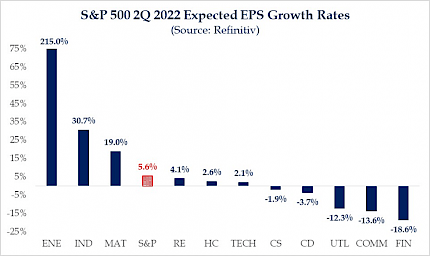

Earnings Growth Now Expected To Be Low Single Digits For 2Q

Earnings growth for the 2nd quarter is estimated to be 5.6% which is below the level of sales growth, telling us that analysts are expecting more downward pressure on margins. Ex. Energy earnings are even worse as growth would be negative. The only other sectors expected to see growth above the overall index are industrials (airlines) and materials. While the 2nd quarter earnings bar is low due to decline estimates, full-year 2022 estimates have remained unchanged.

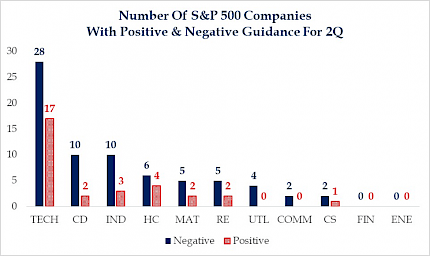

Guidance Will Be Pivotal Going Forward

According to FactSet, 103 companies have issued EPS guidance for 2Q’22, with 72 having issued negative guidance and 31 issuing positive. This is the highest number of S&P 500 companies issuing negative EPS guidance for a quarter since 4Q’19, when 73 issued negative guidance. The percentage of companies issuing negative guidance for 2Q is 70%, which is above the 5-year average of 60% and above the 10-year average of 67%. With economic growth slowing, negative guidance will likely pick up during this reporting season.

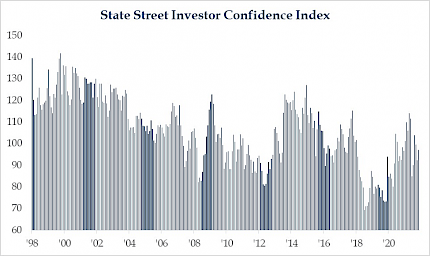

Investor Confidence Above 2018 and 2020 Levels

The State Street Investor Confidence measure has been trending lower for several months but remains well ahead of levels seen during both the 2018 sell-off and 2020 shutdowns. With the measure intending to show investors' willingness to hold risk assets, we believe the market could see further declines. After all, the Fed has further to go with tightening, layoff announcements are beginning to broaden out, and margins are being pressured.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Biden Near Decision on Backing Federal Gas-Tax Holiday

Any suspension in the federal gas tax of 18.4 cents a gallon would require action from Congress. So far, Democratic-led efforts to temporarily pause collecting the tax have failed to gain...

The Wall Street Journal

Recession Probability Soars as Inflation Worsens

Economists have sharply raised the probability of a recession, now putting it at a level usually seen only on the brink of or during recessions.

The Wall Street Journal

Dow Futures Surge as Wall Street Rebounds From Last Week'...

Lifting sentiment Tuesday were comments from President Joe Biden, who said a U.S. recession isn't 'inevitable.'

Barrons