The loss of momentum in U.S. payroll job growth has been a concern. The FOMC statement noted last week that "job gains have slowed, and the unemployment rate has edged up but remains low" and followed that up with "the Committee … judges that downside risks to employment have risen." However, initial claims falling to 231,000 (240,000 on the 4-week average) were reassuring last week. Factoring out recent noisy readings due to fraud in TX, claims indicate economy-wide firing remains limited.

U.S. real GDP tracking estimates remain positive in 3Q (eg, the Atlanta Fed measure).

Other U.S. data have been adequate to push back on "stagflation" concerns. Nominal retail sales were a solid +0.6% month over month (M/M) in Aug, with sales ex autos & the control group +0.7% m/m. July sales were revised up. Industrial production rose +0.1% m/m in Aug, though July was revised lower to -0.4% m/m. Regional Fed surveys on balance look like they are muddling through in September.

True, there are still some weaker interest-rate-sensitive parts of the U.S. economy. Housing starts declined 8.5% m/m in August, and single-unit permits were also weak. The National Association of Home Builders housing market index remained depressed in September.

But, as we've noted previously, as long as corporate profits are growing year over year (y/y) (so far, so good), the economy tends to avoid big trouble. The wealth effect buoying upper-income U.S. consumers – asset owners benefitting from corporate profits – has been a key cushion. Other supports include surging tech capex spending (AI-related), steady healthcare employment gains (likely taking care of an aging population), and gig jobs supporting the lower income cohorts (multiple jobholders rose m/m in the Aug employment report). That's a narrow list & an odd mix of factors, but it's been working.

Within the tech sector, there is evidence of productivity increasing, with production trending up but computer manufacturing employment trending down. Broader productivity gains would be welcome in an economy close to full employment.

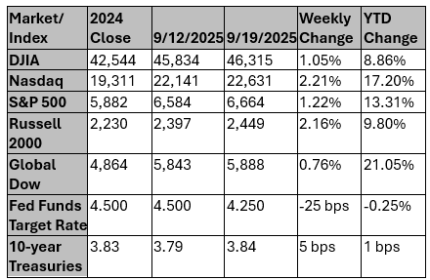

Still, until U.S. economic growth becomes more broad-based, it seems critical that govt policymakers keep U.S. financial conditions from tightening much. The FOMC – spooked by concerns about jobs – took steps last week to help, cutting its policy rate by -25bp to a 4.0-4.25% range. Recently appointed Governor Miran dissented in favor of a larger -50bp reduction, but no other objections were noted. The Fed's dot plot indicated two more rate cuts were possible before the year's end. This trajectory may have allowed the decision to proceed without additional dissents.

Bottom line: There are some parts of the economy working, but it's a narrow list (tech, healthcare, gig jobs).

Some of the shocks due to political uncertainty are ongoing (e.g., tariffs on/off and uncertainty over FOMC composition). Looking ahead to 2026, the situation should improve. The recently passed U.S. tax bill should boost, more broadly, to corporate capex. Deregulation should also support activity. Fortunately, credit conditions still look benign. There remains time to correct this; part of this process is the Fed moving policy rates toward neutral.

A key question remains: how low is the fed funds rate going (where is neutral?). A ~1 % real (inflation-adjusted) rate should be a good longer-term target. Mortgage refis have already started to increase, so rates do matter.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Powell, Miran among slew of Fed officials speaking this week as policy shifts

U.S. Federal Reserve officials this week are set to accelerate the debate over whether to cut interest rates again in just over five weeks with at least a dozen policymakers speaking, including Chair Jerome Powell and new Governor Stephen Miran continuing a heavy public schedule just days into his new role.

Reuters

Stocks take a breath, dollar falls after Trump visa crackdown and ahead of Fed commentary

MSCI's global stock index was edging higher and the dollar fell along with Treasury yields as investors digested U.S. President Donald Trump's latest visa restrictions and waited for economic data and commentary from Federal Reserve officials.

Reuters