Last week the Federal Reserve held its FOMC meeting and came out with an announcement we already knew. Outside the supply chain disruptions being caused by the global economies reopening, our economy is running hot. This announcement was subtle on Wednesday when Fed Chairman Powell made his meeting wrap up commentary but seemed to garner more attention when comments were made on Friday by one FOMC Member that rates would be raised sooner than expected.

One fundamental question to ask yourself is, with our economy currently expanding at an annualized rate well north of the best normal growth rates we have seen over the last 50 years, why would we not expect the Fed to tighten monetary policy in response to avoid overheating the economy and possible inflation. To think the Federal reserve would do something other than that, would go against all economic policy we have followed since Regan broke the hyperinflation in the early 1980s. This time it is a little different and rates will only rise once the Federal Reserve announces a change in its bond purchases.

The Federal Reserve is currently buying $120 Billion per month in US Treasury and Mortgage backed bonds. The same tightening strategy they used back when we were coming out of the Great Financial Crisis back in 2010 and 2011. Just like then, the Federal Reserve will have to announce that they are reducing their bond buying so bond markets can start to price in real demand in bonds and start to normalize interest rates before the Fed announces its first rate hike.

The Fed has said it would reduce bond buying in 2022 and then raise rates in late 2023, but we believe they will not be able to hold off that long. We think the Fed will actually announce a change in its bond purchases by early fall of 2021 and will more than likely start to raise rates in 2022. If they continue to deny the real current economy we will surely be looking at an overheated economy and inflation will be more of a problem than we would like. Hopefully, politics will not get in the way of making sound economic policy decisions.

We have currently positioned our portfolios to do well in a good economy and rising interest rate environment. We have reduced our exposure to interest rate sensitive sectors of the markets and overweighted higher dividend paying equities which should assist us in reducing portfolio volatility during a rising interest rate cycle.

The Atlanta Fed’s tracking estimate for U.S. 2Q real GDP is at 10.3% q/q annualized. As we’ve noted previously: imagine what it could be if we did not have labor disincentives, homebuilders backed up, chip shortages affecting autos, remaining hesitancy with vaccine rollouts, schools partially closed, and skill mismatches.

U.S. industrial production (still) looks like it’s catching up to the recent demand boost, up +0.8% m/m in May. Capacity utilization is at 75.2%. Housing starts rose 3.6% m/m. The NY Fed mfg index for June also showed continued evidence of bottlenecks, consistent with recent price pressures (eg, the U.S. PPI up +0.8% m/m in May). The Philly Fed index was similar.

The recovery is not complete (eg, initial jobless claims at 412,000 last week), so there’s not a rush to tighten policy. But discussing an end to emergency easing is now necessary. Trend improvements in the timely data give us confidence, even if there are obstructed pathways & remaining global virus variant concerns (eg, China, U.K. delays).

True, there has been some weaker data. Given the elevated level after 2021 stimulus checks, it’s tough to call U.S. retail sales weak. Still, the m/m change was negative, down -1.3% in May with sales ex autos & gas down -0.8%.

Yet many FOMC members appear more confident that the U.S. economy is progressing toward its goals. The pandemic was noted as a risk but was dropped from last week’s statement as an item that was causing tremendous hardship. The Fed dots (forecasts for future fed funds) rose from the zero bound in 2023, but Fed Chair Powell noted that there is a large amount of uncertainty out 2 years.

Powell seemed more dovish in last week’s press conference vs. the relatively hawkish committee projections. He opened the door to a discussion on QE tapering (Reducing Bond Purchases) but noted that the U.S. is still not at the “substantial further progress” standard that would allow policy normalization. Powell called this the “talking about talking about meeting”.

There remained expectations that a very strong labor market is coming. In the meantime, growth is being driven by 1) increased hours from those willing/able to work and 2) increased output-per-hour. Productivity has improved, so GDP looks set to return to prior peak levels well before jobs.

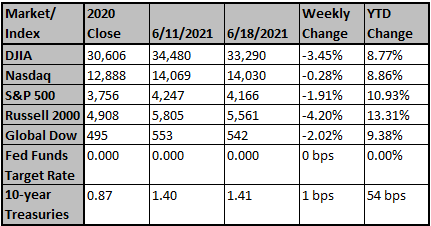

The Fed’s call remained that U.S. inflation will be transitory. Lumber, used cars, airfares & hotels were mentioned as imbalanced areas as the economy re-opens. The Fed is attempting to look through price volatility here. Despite some d/d volatility, 10-year Treasury yields ended last week at 1.44%.

In contrast, WTI oil prices were up to $72 last week.

Bottom line: Because of a variety of factors including child care, unemployment incentives, changed perspectives of what's important, necessity (i.e. wages are higher and net worth has increased potentially eliminating the need for some to work) etc. we have not achieved substantial progress yet in the U.S. labor market (the Fed’s goal), but it is difficult to argue we have not seen some progress. Stimulus-boosted demand is still outpacing supply. Prices are rising. The Fed has called current price moves transitory. Investors thus far have been willing to give the Fed the benefit of the doubt. Labor is always a lagging indicator and we will have a clearer picture of the labor market once the unemployment benefits normalize in September and the free market starts working again.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Chip Shortages Are Starting to Hit Consumers

Semiconductor companies say they face higher costs that they are passing on to customers in some cases.

Wall Street Journal

Jun 21, 2021

Delta looks to hire more than 1,000 pilots by next summ...

Citing an internal memo, Reuters and Bloomberg News separately reported Delta is looking to raise its number of pilots by about 8%, anticipating a recovery in air travel over the next yea...

marketwatch

Jun 22, 2021

Port Delays in Shenzhen, China, Snarl Global Trade

The Shenzhen port's capacity to handle containers plummeted early this month, and state-controlled media said on Monday that full recovery might require the rest of June.

New York Times

Jun 21, 2021

Fed's Williams emphasizes flexibility in the central bank...

The New York Fed president panned Wall Street's efforts to put an equation on the Fed's average inflation approach.

New York Times

Jun 21, 2021