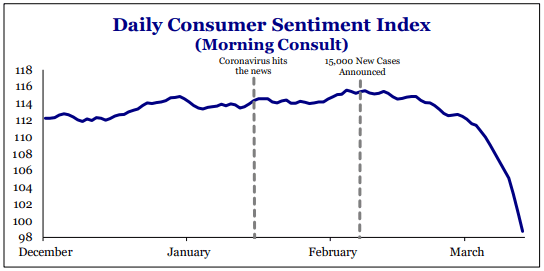

Estimates for 2Q GDP growth are ratcheting down and a 10 percent contraction is not far off from the consensus. Initial unemployment claims could reach 1 million next week. If policymakers get this wrong, contagion can easily spread, despite the temporary nature of the coronavirus. In that context, Congress is rushing to get a $1 trillion plus stimulus passed in the coming days. Senate Republicans released their plan last night. There are large differences between the goals of the two parties, but the negotiation process will start today. House Democrats have their own ideas of what to include. We break the Senate Republican plan into four categories: 1) Tax refunds for individuals; 2) Aid to small businesses, which sets up a loan forgiveness plan for small businesses to retain employees and pay their rent/mortgage; 3) Funds to build up the health care infrastructure; and 4) Guaranteed loan facilities to backstop large companies suffering from a collapse in demand. This should help with liquidity in the short term. As part of the corporate backstop, however, the Treasury Secretary is authorized to inject capital into companies and participate in the gains of the company through warrants, stock options, common or preferred stock, or other appropriate equity instruments. President Trump endorsed this idea yesterday. The government is set to become a distressed investor. We anticipate a loud chorus to argue that the stimulus won’t work. But our read of the plan suggests that the underlying goal is to make the initial surge of unemployment temporary, prevent more layoffs, and allow for a quick resumption of hiring as the US economy restarts.

DIRECT AID FOR SMALL BUSINESSES TO COVER PAYROLL EXPENSES AND RENT

Unemployment is about to go higher. Small businesses, suffering from a collapse of revenue, are laying off workers. The Senate Republican plan tries to make this effect temporary, akin to a natural disaster, rather than a permanent increase in unemployment. In fact, the legislation provides for 100 percent guaranteed loans through December 31st to enhance liquidity. But most importantly, the proposal provides for loan forgiveness in the amount equal to payroll costs and debt obligations like rent for the entire second quarter. The amount of loan forgiveness is reduced proportionately by the number of employees laid off (So keep paying your employees). A read-through of this proposal is that federal taxpayers will pay for small businesses to maintain their payrolls through the entire second quarter as the US economy shuts down. Implicitly, if the virus fades in the summer, there will be less need for small businesses to reduce their payrolls and others can hire workers back.

Small Business Provisions:

- Provides small business interruption loans from March 1 through December 31, 2020 for businesses of 500 employees or less and for nonprofits.

- Increases the maximum 7(a) loan amount to $10mn through December 31.

- Expands allowable uses of the loans to include payroll support (including paid sick leave), employee salaries, mortgage payments, and any other debt obligations.

- Provides delegated authority to all current 7(a) lenders and to lenders that join the program, and requires lenders to determine eligibility based on whether the business was operational on March 1 and had paid employees.

- Waives both borrower and lender fees for 7(a) loans.

- Provides 100% government guarantee of the loans through December 31, and allows complete deferment of loan payments for not more than one year.

- Increases the maximum loan for an SBA Express loan from $350k to $1mn through December 31, after which the maximum will be $500k.

- Allows borrowers to be eligible for loan forgiveness in an amount equal to the payroll cost and costs related to debt obligations for the period of March 1 through June 30, but the amount eligible will be reduced proportionally by the number of employees laid off during this period. Provides for no prepayment penalties before December 31.

TAX RELIEF FOR INDIVIDUALS COULD PROVIDE A TEMPORARY BOOST DURING THE VIRUS WAITING PERIOD

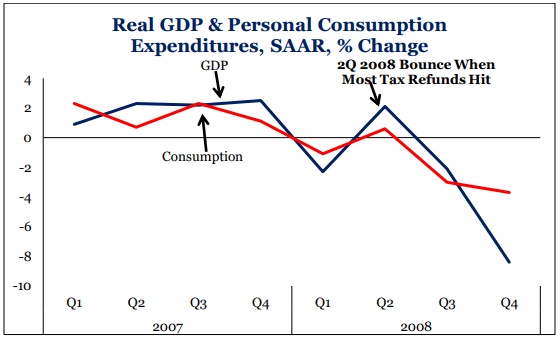

The mitigation strategies of dealing with the virus are leading to a collapse in consumer demand. As such, Congress is looking to boost incomes of Americans as the waiting period takes hold. We rank order tax cuts based on the economic bang for the buck as: 1) Income tax rate cuts; 2) Payroll tax cuts; and 3) Tax refunds. The Senate plan has chosen the lowest of the three choices, which is more of a function of political expediency than seeking economic efficiency. More specifically, the Senate plan proposes tax rebates of $1,200 per individual and of $500 per child. But there is a catch. Estimates suggest that 65 million people with lower tax liabilities will not receive the full rebate. Additionally, the checks phase out at $75,000 in income for individuals and $150,000 for those filing jointly (based on 2018 tax returns). The payment will be completely phased out for those with income of $99,000 per individual and $198,000 for joint filers. It’s hard to see how this current proposal makes it through the final product. The slicing and dicing of the rebates by income and children will slow the process down of getting the checks out. There will also be a push to make sure taxpayers with lower tax liabilities get a bigger check. The most efficient way to get the money into the economy is to give everyone the same amount. If policymakers are truly concerned about the wealthy not getting a check, a tax can be placed on the refund in next year’s tax filing season. Still, despite the program design issues, the delivery of $500bn of tax refunds in 2Q could help. The chart below shows GDP and consumption in 2008 when the tax refunds hit. The delivery of the checks coincided with the only positive quarter for growth and consumption during 2008. At the very least, the checks will restock household balance sheets to help consumers when the US economy restarts.

INDIVIDUAL TAX PROVISION SUMMARY

Individual Tax Provisions

- Recovery checks of up to $1,200 per individual and of $500 per child. The checks phase out at $75,000 in income for individuals and $150,000 for those filing jointly (based on 2018 tax returns). The payment will be completely phased out for those with income of $99,000 for an individual and $198,000 for joint filers. Taxpayers with little or no tax liability, but at least $2,500 of qualifying income (earned income, Social Security retirement benefits, certain veteran pension and compensation benefits), will be eligible for a minimum rebate check of $600 per individual.

- Extends the tax filing deadline from April 15 to July 15. Allows for the postponement of estimated tax payments due from the date of enactment until October 15, 2020.

- Waives the 10% early withdrawal penalty for distributions up to $100k from qualified retirement accounts for coronavirus-related purposes. Income attributable to those distributions would be subject to tax over 3 years and the taxpayer may recontribute the funds within 3 years without regard to that year’s cap on contributions. Provides flexibility for loans from certain retirement plans for coronavirus-related relief.

- Allows for the deduction of up to $300 of cash charitable contributions regardless of whether the taxpayer itemizes their deductions. Increases the limitations on deductions for charitable contributions by individuals who itemize and for corporations (suspending the 50% of AGI limitation for individuals for 2020, increasing the limitation for corporations from 10% to 25% of taxable income, and increasing the limitation on deductions for contributions of food inventory from 15% to 25%).

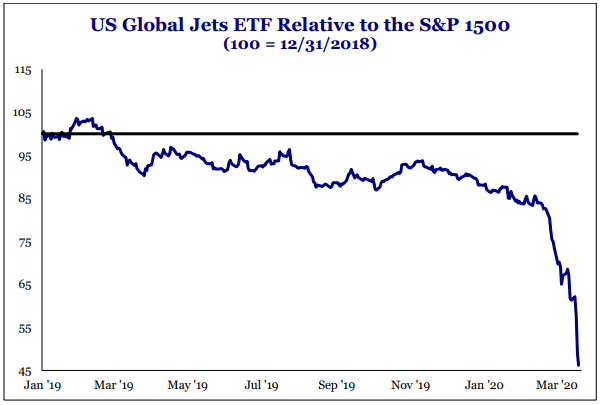

NEW FACILITY TO PROVIDE GUARANTEED LOANS AND CORPORATE TAX CHANGES TO BOOST LIQUIDITY

The next leg of the legislation is to provide liquidity to firms that need it through collateralized loans and loan guarantees. More specifically, the legislation provides $208bn for Treasury’s Exchange Stabilization Fund. The purpose of this facility is to provide collateralized loans and loan guarantees for industries. The legislation sets forth $50bn for passenger air carriers, $8bn for cargo air carriers, and up to $150bn for other companies. The legislation specifically prohibits the funds being used for grants and/or direct aid. There are restrictions on compensation and golden parachutes. Our sense is that the final legislation will likely increase the size of the non-airline facility and impose more restrictions on buybacks and possibly dividends as a condition of receiving the aid. Taxes are also a part of the effort to increase liquidity. Airlines are not getting any direct aid, but the legislation eliminates taxes for commercial aviation. All employers will be able to defer their current payroll taxes. Additionally, the legislation makes several corporate tax changes to help with liquidity for firms with no profits such as expanding net operating losses, accelerating corporate AMT credits for refunds, and increasing the amount of net interest that can be deducted. The legislation also fixes the expensing provision from 2017’s tax reform to include restaurants and hotels. Our sense is that Democrats will oppose most of these corporate tax changes.

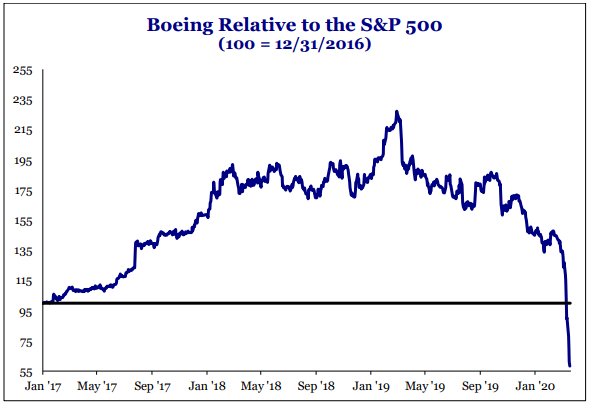

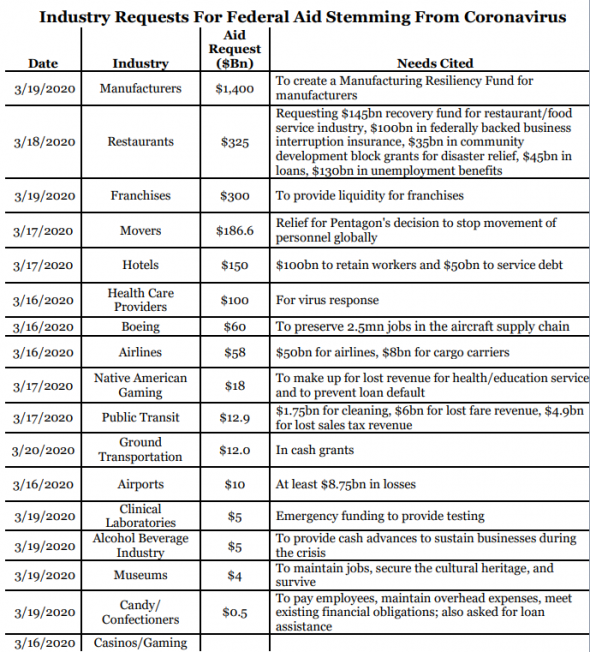

THE FEDERAL GOVERNMENT IS ABOUT TO BECOME A DISTRESSED INVESTOR

The Treasury Secretary is authorized to inject capital into companies and participate in the gains of the company through warrants, stock options, common or preferred stock, or other appropriate equity instruments. President Trump endorsed this idea yesterday. The reason this language was included is because the number of industry aid requests being sent to policymakers is staggering. Yet, direct aid is not politically feasible and the federal government is likely to become a distressed investor. Boeing, which we would consider to be at the top of the food chain, is the largest US exporter and has a supply chain employing roughly 2.5 million people. The company is “Too Big To Fail” and failure to act by the federal government would lead to a surge in the number of unemployed Americans. Yet, there is little appetite on Capitol Hill for Boeing to receive direct taxpayer aid. That leaves few options for policymakers other than a direct stake in the company. While Boeing won’t fail, a partnership with the federal government is not likely to benefit shareholders. In a flashback to 2008 with the banks, we would not be surprised if policymakers are looking for a private sector actor with a large balance sheet to do this work for them. But absent private actors stepping in, we anticipate the government will need to be active based on the aid requests from companies.

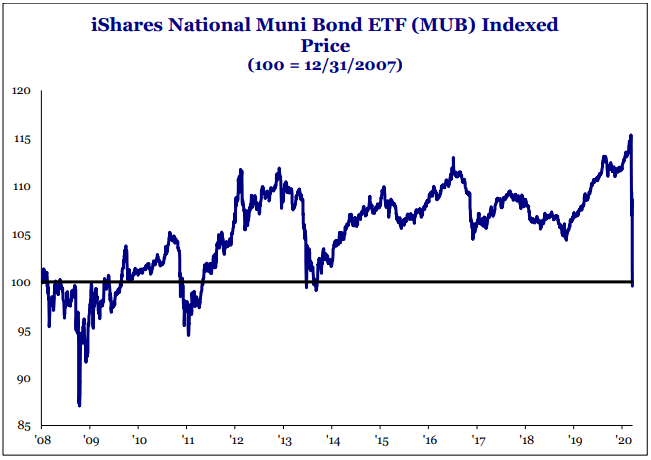

WE ANTICIPATE THAT STATE & LOCAL AID WILL BE PART OF ANY FINAL STIMULUS PACKAGE

By all reports, the municipal bond market is a mess right now. State tax revenues are about to get crushed. Our sense is that the federal government will plug those gaps as it did in 2003 and 2009. The federal government always backstops states after natural disasters. Additionally, we expect the House legislation to authorize the Fed to purchase municipal bonds. We are not fully convinced that the all members of the Fed want to purchase corporate and municipal bonds, but political pressure is building given the mess in the municipal bond market.

Source: Dan Clifton, Strategas

Please call or email us with any questions

Sincerely,

Fortem Financial

www.fortemfin.com

(760) 206-8500