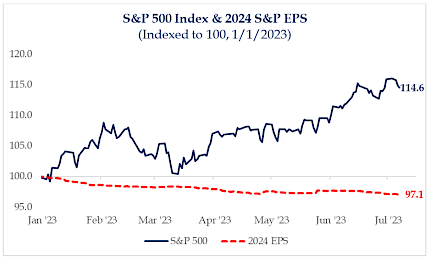

Expectations for 2024 S&P 500 operating earnings have fallen from $253 at the start of the year to $246 today. While this is only a modest decline, it means that the S&P 500’s entire +14.6% price gain year-to-date has been due to multiple expansion. This may have been easier to understand when 10-year Treasury yields plumbed their 2023 depths of roughly 3.3% in early April, but it is harder to justify now as the 10-year broke decidedly above 4% last week. A combination of slower expected earnings growth and higher long-term interest rates is not consistent with multiple expansion or the continued outperformance of long-duration stocks. A slowdown in the economy in the second half of the year may ease the pressure on the long end of the curve but we believe it’s important to remember that long-term Treasury yields are still negative in real terms. We also believe it’s important to remember that Treasury issuance is set to explode simply based on interest expense alone. Forward returns on stocks may be challenged in such an environment, especially when starting from an economic condition of near-full employment.

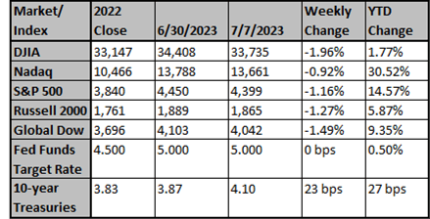

Equities advanced in Q2 (S&P 500 +8.7%), making the third straight up quarter. The NASDAQ was the standout (up 17%). Treasuries were weaker with ten-year yields rising 31 basis points to 3.81%. Crude fell nearly 7%, after losing 6% in Q1. A pickup in soft landing expectations, disinflation talk, better than expected Q1 earnings, the AI secular growth theme, and easing regional bank stresses were among the tailwinds. Bearish commentary included a more aggressive Fed and global tightening cycle, negative money growth, tightened lending standards, narrow breadth and valuation. Outperforming sectors included technology (+17.2%), consumer discretionary (+14.6%), and communication services (+13.1%). Sectors falling in Q2 included utilities (-2.5%), energy (-0.9%), and consumer staples (+0.5%).

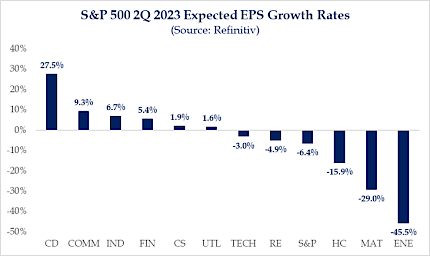

With 2Q Reporting Season Set to Begin, S&P Earnings Estimated to Decline -6.4%

The second quarter earnings season is officially set to kick off later this week with the banks, and as of today current estimates for the S&P 500 suggest a decline of -6.4%. Consumer discretionary is expected to see the strongest growth at 27.5%, while energy and materials are expected to be the laggards at -45.5% and -29.0% respectively.

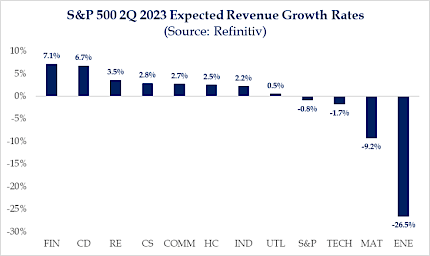

Revenues are Estimated to Contract -0.8%

From a revenue perspective, the overall S&P 500 is expected to see a decline of just above -1%. Similar to earnings, this revenue decline is expected to be led by energy and materials at -26.5% and -9.2%. On the contrary, the sectors expected to see the strongest revenue growth are financials at 7.1% followed by consumer discretionary at 6.7%. Keep in mind banks tightened lending standards significantly during the quarter.

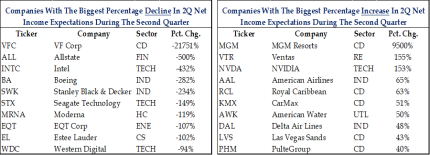

Largest Increases In 2Q Estimates Linked To Discretionary Spending

When looking at net income changes by company for the second quarter, we can see that many of the biggest increases are for companies that are most reliant on discretionary spending, which suggests to us that consumers continue to spend. Perhaps, another contributing factor to these increases is the return of business travelers. On the flipside, those companies with the biggest revisions lower vary across industries. Between traditional retail, insurance and energy it’s challenging to decipher a common theme among them.

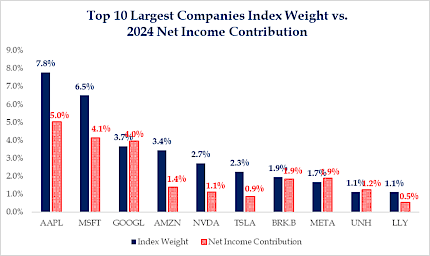

Top 10 Companies Are Roughly 30% Of The Index But Just 20% Of The Earnings

Looking at the index weight and earnings contribution of the 10 largest companies in the S&P 500 shows that not all companies carry their weight in earnings. Apple, Microsoft, Amazon, Nvidia & Tesla are expected to contribute to earnings significantly less than their current index weights in 2024. Alphabet, Berkshire, Meta & United Healthcare are all expected to contribute more to earnings than their current index weights. Eli Lilly is currently estimated to be just below as well. Overall, the companies currently comprise about 30% of the overall index and are expected to contribute just 22% of the earnings in 2024. Something may have to give at the top.

Conclusions:

- We expect a mild recession to commence between Labor Day and year-end.

- The weakest GDP quarters are ahead of us.

- The resilient labor market is beginning to show some cracks.

- Inflation remains a significant problem and isn't falling fast enough.

- Fed is likely to follow a higher-for-longer path.

- Corporate profit estimates remain too high.

- Sentiment has moved from bearish to bullish.

- Valuation levels are high (given inflation and interest rates).

- Stock risk/reward is unfavorable.

- Domestic and geopolitical risks are multiple.

What to Do?

- Expect choppy markets (buy dips/trim rallies).

- Own some bonds.

- Diversify across asset classes and geographies (more non-U.S.).

- Focus on free cash flow and high predictability in earnings.

- Own high quality value and less expensive growth.

- Consider an absolute return strategy to complement market exposures.

- At the moment, one has to choose between fighting the Fed and fighting the tape - accordingly, avoid extreme positions.

Source: TBD

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed is close to end of rate hiking cycle, central bank officials say

The Federal Reserve will likely need to raise interest rates further to bring down inflation that is still too high, but the end to its current monetary policy tightening cycle is getting close, several U.S. central bank officials said on Monday.

Reuters

Fed's Barr lays out plan to order more capital for large U.S. banks

The Federal Reserve's top regulatory official laid out a sweeping plan to increase capital requirements for the nation's largest banks, saying recent bank failures underlined the need for regulators to bolster resilience in the system.

Reuters

US wholesale inventories revised up in boost to second-quarter GDP

U.S. wholesale inventories were unchanged in May after declining for two straight months, suggesting inventory investment could support economic growth in the second quarter

Reuters