Historically, the movement in stock prices has had a stronger relationship with inflation and long-term interest rates than it has with the unemployment rate. Still, we are left with a simple question – can a new and durable economic cycle and market cycle begin when the economy is already starting at full employment?

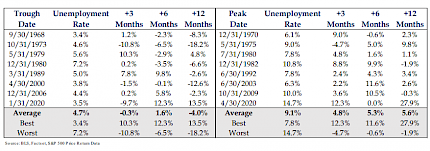

As the table below indicates, forward stock returns are better coming off peak unemployment rates rather than troughs. Still, forward returns off trough unemployment can be decent provided that the recession that may follow is mild.

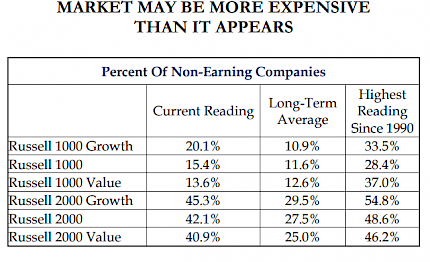

As it says in the Good Book, we know not the time or the hour. While it may be a foolish consistency, we are continuing to play the odds of a recession and all that entails over the next year. To the extent to which the case for this economic scenario is well-known, the pain trade is undoubtedly higher. But as Strategas’ Chief Economist has noted, there are “cracks” emerging in the economy – not the least of which is a slow but steady increase in unemployment claims and, as noted on page three, an increase in corporate bankruptcies in the absence of the “kindness of strangers.” To the extent to which more than 40% of the companies in the Russell 2000 have not earned a profit in the last 12 months and the profitable companies still trade at ~23x trailing earnings, we would be hesitant to claim that a recession is fully priced in to stock prices.

Our Current Sector Weights and Why

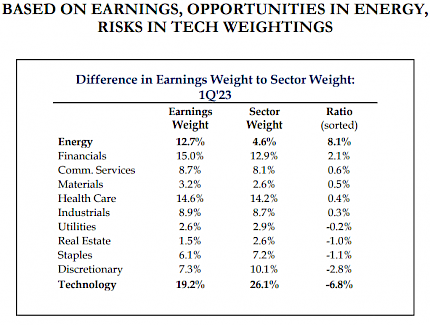

Overweight: Energy, Materials, Healthcare, Staples

Neutral Weight: Industrials, Utilities

Underweight: Financials, Real Estate, Discretionary, Technology, Communications

Energy – We are Overweight Energy due to their strict stewardship of capital and our view that the sector remains undercapitalized. Rationale: Capex growth, while rising, remains suppressed relative to historical records. On the back of higher crude prices versus prior years, the sector has enjoyed significant free cash flow generation (though this is moderating). Risks: A global recession would impact demand. A breakdown in OPEC+ agreements could stress energy markets. Concentration risk remains pronounced with XOM+CVX composing almost half of the sector.

Materials – We are Overweight Materials given our view that like Energy, the sector is undercapitalized. Rationale: If electric vehicles remain the lodestar of the renewable energy movement, commodity prices (copper specifically) should benefit given their associated elevated demand. Commodities are at secular lows relative to stocks. Risks: A recession would hamper economic activity. A strengthening U.S. dollar would hurt global revenue.

Health Care – We are Overweight Health Care given the defensive attributes the sector provides with the risk of an elevated recession and heightened market volatility. Rationale: Fundamentally, the sector is in good shape with ACA growth +12% last year and +35% over the past two years. Congress prevented $750bn in Medicare cuts from coming into effect in CY’23. Higher taxes also appear unlikely. Risks: The sector would likely lag in the event of a cyclical upswing. Congress failed to fix the R&D tax credit as part of the omnibus spending bill. As a result, companies will have to amortize their R&D expenses over 5 years, and this cash tax increase is eating into cash flow of companies in tech, health care, and defense.

Staples – We are Overweight Staples as a defensive hedge against recession risk. Rationale: Sector has seemingly maintained pricing power as inflation has started to moderate. The sector has a track record of outperforming in the nascent stages of a recession / economic slowdown. Consumers will still rely on staple goods regardless of economic backdrop. Risks: Staples industries tend to underperform in rising interest rate environments. Sector’s dividend yield relative to fixed income yields is leading to a competition for capital to securities with less capital risk.

Industrials – We are Neutral Weight the Industrials sector given the elevated risk of a U.S. recession and low likelihood of a Fed soft landing. Rationale: US Dollar strength possibly impairing global revenue sources, but weakening US Dollar could change this trend. Margins are impaired due to elevated inflation, increasing costs of goods and labor. Risks: Industrials are a likely beneficiary of a cyclical upswing, a potential outcome if a recession is avoided. Debt ceiling debates risk limits to defense spending.

Utilities – We are Neutral Weight Utilities given the increasingly difficult environment of yield competition impacting the shares. Rationale: The sector’s dividend yield is facing heightened competition from the fixed income asset class. The sector does have some defensive hedge properties in the wake of a recession, but also faces fundamental struggles like volatile natural gas prices and rising leverage. Risks: A further push higher in yields could hurt the relative performance of Utilities. A cyclical upswing or “risk-on” rally would likely leave Utilities shares behind.

Financials – We are Underweight the Financials given the ongoing bank crisis and consequential underperformance from the money centers and regional banks. Rationale: The bank crisis has raised the odds of the U.S. recession, and the equities trade poorly. Estimates likely need further downward revision to reflect weakness in loan books. Risks: The banking crisis is contained, and the banks recover quickly, leading to outperformance. Banks valuations serve as attractive entry point for investors.

Real Estate – We are Underweight Real Estate given the persistent ambiguity concerning Commercial R/E valuations and broad sector underperformance. Rationale: Return to office continues its jagged recovery to pre-pandemic office occupancy levels and has consequently negatively impacted commercial property valuations. Globally, real estate companies trade in a similarly poor fashion. Risks: A fall in yields could make the interest and dividend income from Real Estate more attractive. Cloud-based infrastructure is not going away, will need to build and housed. Elevated mortgage rates could be tailwind for apartment REITs (rent vs. buy).

Discretionary – We are Underweight Discretionary shares given the outsized concentration risk from AMZN and TSLA, as well the heightened odds of a U.S. recession. Rationale: The sector is heavily influenced by AMZN and TSLA, two names that struggled in the higher interest rate environment. More broadly, a recession would hamper consumer spending habits and likely result in more restrained activity. Risks: Wage gains may prove to be sticky, and with inflation rolling over, may give the consumer increased confidence to spend. A soft landing or avoidance of a recession could lead to a cyclical bid in the market. Durable outperformance from AMZN and TSLA in this environment is a negative.

Technology – We are Underweight Technology given the difficult operating environment for long duration equities and their lofty valuations. Rationale: Technology is home to a large portion of the Growth contingent, a style that we believe will struggle in an operating environment of higher interest rates and elevated inflation. Too much growth has been pulled forward, likely leading to less-than-average revenue growth going forward. Risks: Concentration risk is a theme within Technology, with AAPL and MSFT heavyweights in both the sector and overall S&P 500. A persistently narrow market led by AAPL and MSFT would be a negative for our sector underweight. If the cyclical highs for yields are in, growth could see a more sustainable bid. Semis will benefit from the CHIPS and Science Act.

Communications – We are Underweight due to our bearishness on the Growth style, in which META and GOOGL are heavyweights in both Growth and the Communications sector overall. Rationale: The concentration risk associated with META and GOOGL has weighed negatively on the sector. Mounting pressure from higher interest rates and a deteriorating economic environment are likely headwinds and could severely impact advertising spending. Risks: Durable outperformance from META & GOOGL would buoy the overall sector. Valuations remain elevated and unattractive given the interest rate and inflation environment. The structural trend of digital content and advertising seems poised to continue. An “arms race” is likely to persist for some time.

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Futures rise as focus shifts to inflation data, Fed meet

June 12 (Reuters) - U.S. stock index futures rose on Monday ahead of inflation data and the Federal Reserve's interest rate decision this week, while Biogen shares gained in premarket trading after the U.S. FDA panel backed its Alzheimer's drug. Investors are on the watch for the U.S.

Reuters

UBS CEO says around 10% of Credit Suisse employees have left the bank

ZURICH, June 12 (Reuters) - UBS's (UBSG.S) Chief Executive Sergio Ermotti said around 10% of Credit Suisse (CSGN.S) staff have already left the company before its takeover by his bank. "It's true that around 10% of the workforce have already left in the last few months before the takeover," Ermotti told Swiss broadcaster SRF in an interview.

Reuters

Healed from the pandemic, U.S. job market may face fresh wounds from the Fed

U.S. Federal Reserve officials, who hoped to return the job market to its 2019, best-in-a-generation status after the pandemic, may be on the verge of success as the economy passes key milestones for labor participation and nears a return to pre-pandemic trend levels of employment.

Reuters