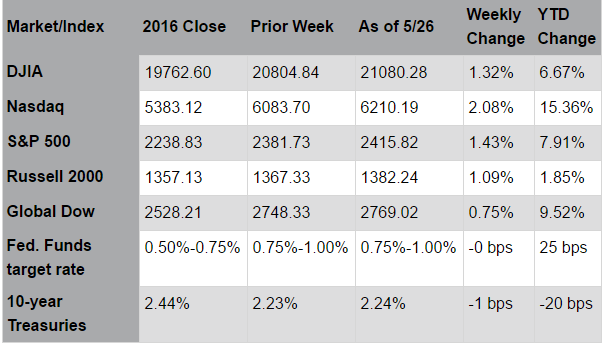

Markets rallied last week; Technology stocks continued to lead the way, with the NASDAQ outpacing all other indices for the week as well as year-to-date. The notable exception, though, was the Energy sector which declined despite an extension of OPEC’s production freeze agreement (more on this below). Political headlines have mostly followed President Trump on his first overseas trip to Saudi Arabia, Israel, the Vatican, Belgium and Italy. The momentary reprieve from the domestic spotlight allowed investors to refocus on generally encouraging economic and corporate data. The estimate for first quarter GDP growth was increased to 1.2%, from the initial 0.7%, on stronger consumer spending and business equipment purchases. And, the preliminary reading for the Purchasing Manager’s Index of manufacturing and services activity rose from 52.7 in April to a better-than-expected 53.9 in May (readings above 50 indicate expansion). Economic conditions in other major developed markets are also improving; as such, investors are apparently reallocating assets to Europe and Japan to participate in growth opportunities as their economies accelerate. We added to our international exposure a few weeks ago and are now overweighting the sector. The value of the dollar reflects, in part, this transfer of funds; the dollar, which had risen roughly 30% from 2014 through 2016, has retreated approximately 5% in 2017. Further declines would effectively raise the costs of imported goods; the associated impact on inflation could, in turn, justify higher interest rates. These topics may well be discussed at the Federal Reserve meeting on June 13‑14.

As widely expected, OPEC agreed on Thursday to extend its production cuts through March 2018. The news fell flat, though; following the announcement, crude oil prices declined 5% and energy-related stocks sold off. Investors may have been disappointed that the group did not unveil a more aggressive policy, such as deeper cuts, a longer time frame for the agreement, or an explicit price objective. Perhaps more likely, the market was dominated by traders looking to turn a quick profit by “buying the rumor, and selling the news.” Meanwhile, U.S. crude oil inventories have declined for seven consecutive weeks; domestic supply should begin to fall more rapidly as peak driving season approaches. OPEC’s pact indicates ongoing cooperation among major oil producers, including Russia, and strong adherence to the terms of the agreement. Notably, U.S. shale producers are not party to the deal; indeed, OPEC is facing the harsh reality that the economics of shale oil will effectively govern their price and output objectives. The wide-ranging benefits for the U.S. economy of this “new world order” should include meaningful opportunities in areas such as manufacturing, transportation, petrochemicals and refineries, as well as crude oil and liquefied natural gas (LNG) exports. The emergence of U.S. shale as a permanent fixture in the world oil markets will have broad-ranging geopolitical and economic impacts for decades to come.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week's Headlines

- The second estimate of the first-quarter GDP was a bit more positive than April's preliminary estimate. The gross domestic product increased at an annual rate of 1.2% compared to the preliminary estimate of only a 0.7% annual rate of growth. The fourth-quarter GDP grew at an annual rate of 2.1%. Accounting for the increase in the annual growth rate were increases in business investment and consumer spending, while the decreases in state and local government were smaller than previously estimated. Gross domestic income (the sum of income less costs in the production of GDP) increased 0.9% in the first quarter, in contrast to a 1.4% decrease in the fourth quarter.

- Continuing a trend of less than robust economic news for April, new orders for manufactured durable goods decreased $1.6 billion, or 0.7%, following four consecutive monthly increases, including March's 2.3% gain. Shipments decreased 0.3%, led by a 0.5% drop in shipments of transportation equipment. On the positive side, unfilled orders and inventories both increased.

- New home sales fell precipitously in April, according to the Census Bureau. Sales of new single-family homes were 11.4% below the March rate of sales, and only 0.5% above the April 2016 rate. The median sales price of new houses sold in April was $309,200 ($318,700 in March). The average sales price was $368,300 ($385,400 in March). With the number of sales falling, the inventory of new homes for sale rose 16.3%, representing a supply of 5.7 months at the current sales rate. By comparison, the supply of homes for sale in March was 4.9 months.

- Sales of existing homes were also off in April — slipping 2.3% compared to March. Low supply held down sales as the median number of days a home was on the market fell to a new low of 29 days, according to the National Association of Realtors®. Despite the decline, existing home sales are still 1.6% above their pace a year ago. The median existing-home price for all housing types in April was $244,800 ($236,400 in March), up 6% from April 2016 ($230,900). April's price increase marks the 62nd straight month of year-over-year gains. Total housing inventory at the end of April climbed 7.2% to 1.93 million existing homes available for sale, but is still 9% lower than a year ago (2.12 million) and has fallen year-over-year for 23 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.6 months a year ago.

- According to the advanced international trade report from the Census Bureau, exports fell in April while imports increased, pushing the international trade deficit higher for the month. The trade deficit was $67.6 billion in April, an increase of $2.5 billion from March. Exports of goods for April were $125.9 billion, $1.1 billion less than March exports. Imports of goods for April were $193.4 billion, $1.4 billion more than March imports.

- Consumer sentiment in May remained at the same high level as April. Consumers were not quite as enthusiastic about current economic conditions, but were optimistic about the economy moving forward.

- In the week ended May 20, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 1,000 from the previous week's unrevised level. The advance seasonally adjusted insured unemployment rate remained at 1.4% for the sixth consecutive week. For the week ended May 13, there were 1,923,000 receiving unemployment benefits, an increase of 24,000 from the previous week's revised level.

Eye on the Week Ahead

Memorial Day week unofficially kicks off the summer, which is typically a slower time for market activity. However, two important economic reports for May are out this week. Personal income and outlays looks at consumer income, spending, and price changes for consumer products and services. It is one of the main indicators of inflationary trends relied upon by the Fed. Also coming out this week is the May employment report. New hires kicked up in April following a weak March, although increases in average hourly earnings have only marginally surpassed the rate of inflation.