September and October are traditional the most volatile months of the year. History shows us the largest one day percentage drop in history was 31 years ago, known as Black Monday, on October 19, 1987. On that day, stockbrokers in New York, London, Hong Kong, Berlin, Tokyo and just about any other city with an exchange stared at the figures running across their displays with a growing sense of dread. A financial strut had buckled and the strain brought world markets tumbling down. However, markets did not stay down for very long, by the end of '87 the downdraft was completely wiped away.

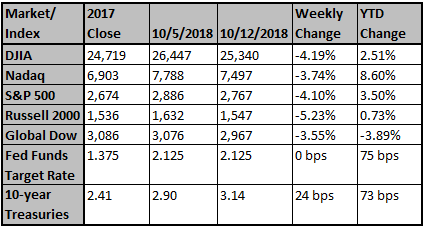

Despite Friday’s Technology-led relief rally, the two-day decline mid-week was the worst since February 2018. For the week, the Russell 2000® Index fell 5.24%, followed by the Dow Jones Industrial Average (-4.19%), the S&P 500® Index (-4.11%) and the Nasdaq (‑3.74%). Technology, which has driven the markets’ gains over the past few years, fell as investors feared that higher interest rates would dampen the sector’s future growth. Last week’s declines, unlike the indiscriminate selling in February, were largely sector and stock specific. Notably, several market darlings entered bear market territory (20% or greater decline from a 52-week high) or correction (10+% decline) with losses for Facebook (-30%), Netflix (-23%) and Amazon (-16%). In comparison, the more moderately priced Apple (-9.3%), Microsoft (-9%) and Alphabet (-8.5%) avoided double digit declines. These stocks, with their previously reliable price appreciation trends, were the ‘easy trade’ for many investors; and, passive index investors rode the wave. Over the summer, though, indications of a rotation from Technology into value stocks emerged as some investors sensed that the growth momentum was unsustainable. A further concern: so far this year, 83% of the Technology IPOs are companies which have never been profitable.

On the international stage, the U.S. and China are showing some interest in a November meeting to discuss the basis on which trade negotiations might begin. Tariffs are an emerging topic in earnings reports and commentaries: Fastenal and PPG Industries stock prices declined following commentary on the negative impact of tariffs on revenues and earnings. The Chinese government has taken steps to stimulate economic growth with monetary easing and policy changes; for example, BMW received approval to take majority control of its joint venture with Brilliance Automotive. In Europe, Brexit negotiations are fast approaching a critical deadline. And, on Thursday, despite warnings from the European Union and the International Monetary Fund, the Italian legislature approved a budget which targets a 2.4% deficit in 2019; yields on Italian bonds have soared although, European banks outside of Italy, which have only modest holdings in Italian debt, do not face the same exposure they had with the Greek debt crisis.

Oil prices declined this week as U.S. oil inventories rose while both OPEC and Russia reported production increases. Inventories are often volatile this time of year as refineries rotate from summer to winter fuels, and reduce operations for routine maintenance. Looking ahead, the bias toward higher oil prices reflects several issues including the loss, as of the November 1st embargo, of Iranian oil production; a steeper-than-projected production declines in U.S. fracking activity; and the overall lack of new oil production to offset natural depletion.

The recent spike in interest rates has unsettled the markets even though the economy remains healthy and inflation remains moderate. Perhaps investors, companies and consumers are transitioning to the new paradigm of a normal interest rate environment. On Friday, JP Morgan, Citigroup and Wells Fargo reported double digit earnings increases. Citigroup CFO John Gerspach echoed other bank executives in commenting, “The U.S. economy is performing very, very well . . . Now, the market is going to have to react to somewhat of a return to a more normal short-term rate structure.” That is, higher interest rates are a natural result of accelerating economic growth. Short-term, the markets may remain volatile; but, the markets should recover from the recent downturn, and investors will begin to identify companies well positioned to prosper.

We read a great piece over the weekend in the wall street journal, and we thought we would share it with everyone. This article is timely and keeps the markets and our economy in perspective. Written by former Fed Chair Alan Greenspan and Adrian Wooldridge, the article points out the great run we have had as a nation, some of the obstacles we had to overcome, and it also gives a little insight as to where they think we are. Here is a quote from the article we found interesting:

“Some economists think that the U.S. is mired in a swamp of low growth. We prefer to think that it is trapped in an iron cage of its own making. Out-of-control entitlements and ill-considered regulations are condemning the economy to perform well below its potential. Swamps by their nature are very difficult to escape. Cages can be opened, provided that you have the right keys—and are willing to turn them.”

Source: Strategas and Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Related News

How to Fix the Great American Growth Machine

1. THE SATURDAY ESSAY How to Fix the Great American Growth Machine. The U.S. economy is losing its historic capacity for 'creative destruction.' A few key reforms are essential to keep it on top. By Alan Greenspan and Adrian Woolridge Imagine that a version of the World Economic Forum was held in Dav...

Bob Doll's Market Commentary

We have been following our friend Bob Doll since he was the head of Merrill Lynch Investments more than a decade ago. We agree with his timely comments and thoughts on where we are at today. You can listen to his comments by clicking on the link below: Bob Doll's Market Commentary Sincerely, Fort...

Last Week's Headlines: 10/15/2018

1. The consumer Price Index for All Ubran Consumers (CPI-U) increased 0.1 percent in September on a seasonlly adjusted basis after rising 0.2 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.3 percent brefore seasonal adjus...