The big discussion last week among investors was about the deficit and the impact on bond yields of the One Big Beautiful Bill (OBBB). A long-tail Treasury auction threw gasoline on this debate, which was already combustible. It has been noted that once net interest costs exceed 14 percent of tax revenue, bond markets pay attention to US fiscal policy. Interest costs are currently at 18 percent of tax revenue.

Adding to this pressure is that Treasury will need to flood the market with debt issuance once the debt ceiling is raised with the passage of the tax legislation. And because of the deficit, at some point, Treasury will need to increase long-term bond issuance, which has been on hold for some time. The Senate is talking about more tax cuts. These are headwinds for the Treasury market.

However, we notice investors are overestimating the deficit impact of the legislation by only incorporating the tax portion and failing to incorporate tariffs. The deficit impact is often cited at $3.7 trillion over 10 years. This is the tax component, but fails to include the $1.5 trillion of spending cuts. The net cost we see is $2.3 trillion over 10 years. This is just slightly higher than the $2.1 trillion in tariff revenue expected from Trump’s trade fight.

In other words, tariffs have largely backstopped the tax cuts, and can view this as net austerity relative to the current policy mix with more spinach (tariffs) than candy (new tax cuts).

FAILURE TO INCLUDE TARIFF REVENUE MAKES ANY DEFICIT ANALYSIS OF OBBB INCOMPLETE

Since Trump is enacting tariffs by executive order and Congress is not passing any tariffs, any revenue from the new tariffs is not included in the current budget baseline or the scoring of OBBB. There is always a chance of Trump removing some tariffs, but it feels like the 10 percent universal, 30 percent China, and sectoral tariffs are what is likely to remain in force (pharma and semis have not been enacted yet).

We have estimates, but simply took the Tax Foundation estimates of tariff revenue and compared them to the net scoring of OBBB. The deficit impact is negligible over 10 years, and the short-run deficit effect is smaller. Neither of these estimates assumes growth effects.

Source: Strategas

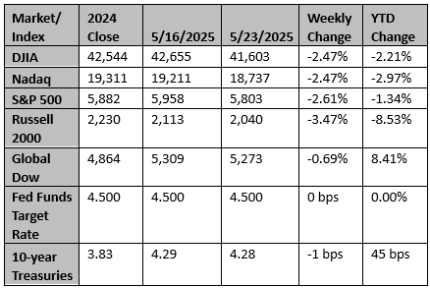

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Chinese savers decry falling deposit rates but still won't spend more

After Chinese banks reduced deposit rates last week, Miro Chen launched a social media poll: "When interest rates fall, do you save or spend?"

Reuters

Exclusive: Japan to consider trimming super-long bond issuance, sources say

Japan will consider trimming issuance of super-long bonds in the wake of recent sharp rises in yields for the notes, two sources told Reuters on Tuesday, as policymakers seek to soothe market concerns over worsening government finances.

Reuters