Albert Einstein once said the most powerful force in the universe is compounding. Compounding can be easily explained, but most people do not understand It and why it matters. The basis of compounding is that as forces become larger, compounding starts to gain speed. A penny a day doubled is 100% compounding daily and in the first few days if doesn’t seem like much. Day one 1 penny, day two 2 pennies, day three 4 pennies and so on. Not until day 15 does this start to become meaningful when you are compounding $163.84. By day 30 you have compounded to more than $5 million dollars and day 31 you have more than $10.6 million.

That is why compounding is so important to your investments and debt management. At some point the compounding becomes so great there is no way to stop it. This is the main reason for the wealth gap that so many are talking about these days. The answer to this problem is easy. If you have no savings and are living paycheck to pay check you have no investments to compound for your future use. And to make matters worse if you have debt compounding aggressively works against you. However, if you have no debt and have put money away on a regular basis you will have a tailwind with compounding and your net worth will grow over time and the larger it grows the faster it will add up. Politicians on both side of the isle will say the Government can somehow control this wealth divide but it’s not that easy.

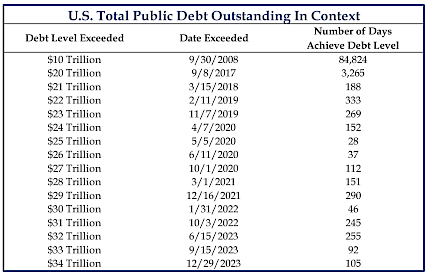

As many Americans know when you get too far into debt it is next to impossible to get out from under that debt, especially if you continue to spend money you do not have, this debt can add up quickly because of the compound interest charges on the debt. Take this observation along those lines and how do you think this will work out?

Your typical American public company may not have the ability to print its own currency or employ nuclear weapons, but it does have something the federal government doesn’t – namely, money. While Uncle Sam sports a total debt to revenue ratio of 7.5:1, the S&P 500’s debt is less than 0.5:1. What’s more, it appears that corporate America is taking advantage of the Treasury’s suspension of long-term debt issuance to refinance itself long - $208 billion in corporate debt has been issued thus far in 2024, the highest level since 1990.

The paucity of longer-dated government debt is leading to extremely tight spreads for investment grade paper. In essence, corporations are “crowding in” to the bond market while they have the chance. One could be forgiven for coming to the conclusion that the Treasury Department’s refunding schedule has been anything but “regular and predictable,” making big interest rate bets at a time when the nation’s debt has been growing by about $1 trillion every six months over the last six years. For context, it took roughly 232 years for the U.S. to amass its first $10 trillion in debt, nine years to amass its second $10 trillion, and a mere five years to amass its third. The last trillion was tacked on in less than four months.

Now you must ask yourself one fundamental question. With unemployment at 3.7%, the CY23 deficit came in at 7.7% of GDP, a level that would be more consistent historically with an unemployment rate closer to 8%. Multi-trillion-dollar deficits at a time of full employment have brought the issue of Treasury supply to the forefront for markets.

For this reason, accurately tracking deficits becomes more important as an indicator of Treasury’s financing needs. The Treasury refunding meeting, three months ago, estimated the FY24 deficit at $1.8 trillion. This may be a bit optimistic, but it will take a few months to play out. The current budget deficit stands at $2.1 trillion and has been increasing each month. Moreover, January’s quarterly tax season, which has typically been a good signpost for April Tax Day collections, has been weaker than anticipated thus far. This raises the risk that April could further disappoint, and the deficit could once again overshoot expectations, exacerbating Treasury supply concerns.

Further, Congressional fiscal policy actions on taxes, Ukraine, and discretionary spending could easily exceed $300bn of new spending this year, which isn’t baked into any official debt issuance forecasts. Taken together, we could be setting up for another overshoot of the deficit, which will keep the bond market on edge and Treasury supply front of mind.

With this as the backdrop in Washington and Corporations running to refinance their current low interest rate debt that is set to mature In the next few years, do you think Corporate America believes the Fed will be able to lower long term interest rates in the next year or so. If they did believe the Fed can lower rates, they would be waiting to refinance the debt they are holding after the rate cuts began. But they are not waiting and are happy to refinance at current rates.

If you are a little confused here, you are not alone. Common sense would tell you that the Fed cannot lower interest rates to stimulate an economy that does not need stimulating and if the economy continues to be primed by government spending with money the government does not have to spend, it creates more debt it cannot afford to pay for. The prospects of having a soft landing become less and less and so do the chance of lowering interest rates. We are of the belief that you cannot lower interest rates until the economy really needs to be primed to turn GDP positive. As long as government spending accounts for more than .5 % of annual GDP, it is hard to see a recession on the short term horizon.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist First Trust

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Futures muted ahead of Fed decision, tech earnings this week

U.S. main index futures were subdued at the start of a week packed with major events including the Federal Reserve's rate decision and big-ticket tech earnings that could set the tone for Wall Street after a recent record-breaking rally.

Reuters

Pharma industry to get US government price cut proposals by Thursday

Pharmaceutical companies are due to receive by Thursday the U.S. government's opening proposal for discounts it is seeking on 10 high-cost medicines, an important step in the Medicare health program's first ever price negotiations.

Reuters