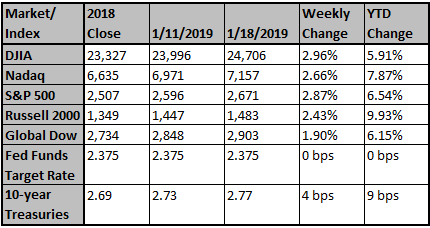

The equity markets recovery continued last week led by a 2.96% gain in the Dow Jones Industrial Average followed by the S&P 500® Index (2.87%), Nasdaq (2.66%) and Russell 2000® Index (2.43%). Corporate earnings season began last week with major financial institutions including Citigroup, JPMorgan, Bank of America, and Goldman Sachs; each posted earnings that exceeded analysts’ expectations despite low trading revenues related to December’s severe volatility. The companies believe that economic conditions remain favorable with no signs of imminent recession. Schlumberger, one of the largest energy services companies, reported revenues which exceeded expectations and; more importantly, the company stated that it expects a gradual recovery in oil prices, and that spending on exploration and production (E&P) is beginning to normalize. The Transportation sector is considered a barometer of economic growth; here, companies surprised with better-than-expected revenue and earnings. Trucking companies JB Hunt, Knight Transportation, and railroad company Kansas City Southern, commented on positive outlooks for both shipping volumes and pricing.

Trade negotiations between the U.S. and China will resume on January 30th; last week, though, the markets reacted positively to unconfirmed reports of potential offers during the latest round of negotiations. The recovery in oil prices continues as the outlook for a trade agreement, and a more optimistic assessment of economic growth, would rebalance supply and demand. The British Parliament’s vote last week to reject the negotiated Brexit Plan creates uncertainty in the run-up to March 29, the date on which the United Kingdom (UK) is scheduled to leave the European Union (EU). The way forward is unclear: the UK parliament could vote to cancel its “leave” decision and remain an EU member; the UK could extend the deadline and/or issue another referendum; or the EU members could vote to delay to process. Some fear that another ballot might lead to a “hard Brexit,” a leave decision with no agreements with the EU.

The four-week rally in all of the major indices reflects a renewal of investor confidence. Those who abandoned the market during December’s severely oversold conditions are now reentering the market to avoid missing the recovery. Not surprisingly, the preliminary University of Michigan Consumer Sentiment fell 7% in December; the late month report reflected the market selloff, and volatility due to trade, monetary policy and energy concerns. Now, the 28-day government shutdown is creating problems for companies in need of government approvals for various initiatives. Over time, the disruption will likely weigh on market sentiment. The reports last week, while limited, indicate that investors overreacted in December. The selloff, though, may have motivated policymakers toward resolution to some of the markets’ underlying worries. Upcoming earnings reports should provide important insight into the health of the economy and influence market momentum.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest News

Last Weeks Headlines: 1/22/2019

1. Business activity grew slightly in New York State, according to firms responding to the January 2019 Empire State Manufacturing Survey. The headline general business conditions index fell eight points to 3.9, its lowest level in well over a year. New orders increased at a slower pace than in r...