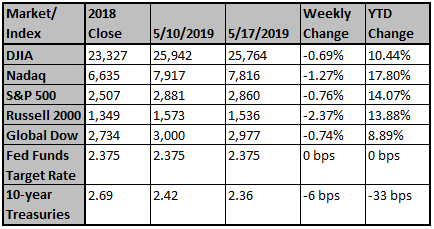

Trade dominated market sentiment as investors reacted to the breakdown in U.S./China trade negotiations and the potential economic impact. Trading volumes suggest that many investors chose to sit on the sidelines amidst the uncertainty. Last Monday, the Dow Jones Industrial Average fell 617 points (-2.38%) then reversed course leading all indices at the end of the week with a decline of 0.69%, followed by the S&P 500® (-0.76%), Nasdaq (-1.27%) and Russell 2000® (2.37%). President Trump indicated that he believes the U.S. economy can withstand higher tariffs and is necessary to achieve greater concessions from China. This represented a reversal of prior comments believing a trade agreement was imminent. It was reported that trade discussions will continue in China the last week of May but there has been no official confirmation. In addition to the breakdown in negotiations, the U.S. issued a ban on the purchase of equipment and products from Chinese telecommunications company Huawei which increases the complexity of trade discussions.

Most people think this is a simple tit for tat dispute but for China it is much more. We sometimes forget China is still a developing nation economically. Even though China is the second largest economy in the world they still have many challenges. One challenge that is facing China imminently is the fact that the trade war will hurt them much more than the U.S. Let’s assume the U.S placed 25% tariffs on all goods exported from China to the U.S and China did the same on all products from the U.S to China. The net effect would be that the U.S economy would be down by approximately .50% on annual GDP. However, China would have a hit of an estimated 4.5% to its GDP. The other fear China should have is a changing supply chain. If China were to raise its tariff’s on the U.S for a long period of time, U.S companies would look to move manufacturing from China to other favorable countries like South Korea, Vietnam or even come back to the U.S. This would cut China out completely and jeopardize their longer term economic prosperity.

In all of this China Trade/Tariff drama, I have not heard one thing about the fact that the US corporate tax rate is now one of the lower corporate tax rates in the world at 21%! Trump said before he jumped on Marine One that he really wants American companies to come home and make their products here in the USA (no tariffs here). This is what the China Trade/Tariff is all about and nobody is talking about it! Trump has set the stage for a corporate boom in the USA with corporate tax rates now at 21% (below the global average of 23%). Don’t forget, money goes where it is best treated and the USA is the best/strongest country in the world.

There is no clarity at this time as to resumption of trade negotiations. Presidents Trump and Xi will meet next month for the G7 meeting and it is expected that they may discuss the current impasse. The impact of higher tariffs cannot be applied across all companies in a uniform manner. Many companies have multiple sources of production which can be adjusted to minimize the impact of tariffs. Other companies rely heavily on China for parts and assembly such as Apple. Many smaller companies in the U.S. generally do not rely as much on Chinese products and services and may be favorably positioned in comparison to some of their competitors.

On a brighter note, President Trump deferred the imposition of auto tariffs for six months to give more time to negotiate with Japan and Europe. There was also an announcement on Friday that the U.S., Canada and Mexico have reached an agreement to remove the steel tariffs imposed last year.

The preliminary May reading of consumer confidence came in at 102.4 which is the highest level in fifteen years.

Despite both positive and negative reports surrounding trade agreements it is evident that the process can change very dramatically in a short period of time. Short-term investors try to take advantage of these shifts in sentiment as reflected in the extreme swings in the market this week. Longer-term investors are more likely to move more cautiously to avoid over reacting to changing markets. In politics there is an often used expression, “It’s the economy stupid.” Indeed, leaders of both countries will be monitoring economic and political sentiment as they contemplate their next move.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest News

Last Week's Headlines: 5/20/2019

1. U.S. import prices advanced 0.2 percent in April, the U.S. Bureau of Labor Statistics reported today, after increasing 0.6 percent in March. The April advance was driven by higher fuel prices, which more than offset decreasing prices for nonfuel imports. Prices for U.S. exports rose 0.2 percen...

US breaks record for dividends as investor payouts surge

Global dividends reached a first-quarter record of $263.3 billion, rising 7.8% despite concerns about the world economy, according to new reach Monday.

Google may have just hit the 'kill switch' on Huawei's gl...

Google has suspended business activity involving the transfer of hardware, software and key technical services with Huawei.

Apple's iPhone Could Cost 3% More to Produce Due to China...

And the company's profits could plummet.